[ad_1]

- Bitcoin miners’ reserves have moved up after weeks of decline

- BTC’s worth chart remained purple, whereas a number of indicators have been bearish too

Bitcoin [BTC] miners have at all times performed a vital function in deciding the trail BTC takes by way of its worth motion. Therefore, it’s price a selected development lately seen on the mining entrance, one that may presumably spur a hike within the crypto’s worth within the coming days.

Bitcoin miners are prepared to HODL

Crypto Dan, an analyst and writer at CryptoQuant, lately shared an analysis which underlined this very development. After the fourth BTC halving, mining rewards declined. In consequence, mining exercise fell and miners started promoting Bitcoin in OTC transactions to cowl mining operation prices. Nevertheless, in response to the evaluation, this development quickly modified,

“The present market might be seen as being within the strategy of digesting this sell-off, and luckily, the amount and variety of bitcoins miners are sending out of their wallets have been quickly reducing lately.”

This meant that promoting strain from miners diminished, which could create a scenario the place BTC might regain bullish momentum.

An fascinating, related decline in promoting strain from miners was seen in 2023 and 2024. On each events, a drop in promoting strain was adopted by large bull rallies. Due to this fact, because the second quarter of this 12 months is coming to an finish, BTC may start its bull rally in Q3.

Will miners provoke a rally?

Julio Moreno, a well-liked crypto-analyst, additionally shared a tweet highlighting one other fascinating improvement. As per the identical, BTC’s miner capitulation has reached ranges corresponding to December 2022 – A 7.6% drawdown.

In 2022, this incident indicated a market backside. If historical past repeats itself, then BTC may quickly flip bullish.

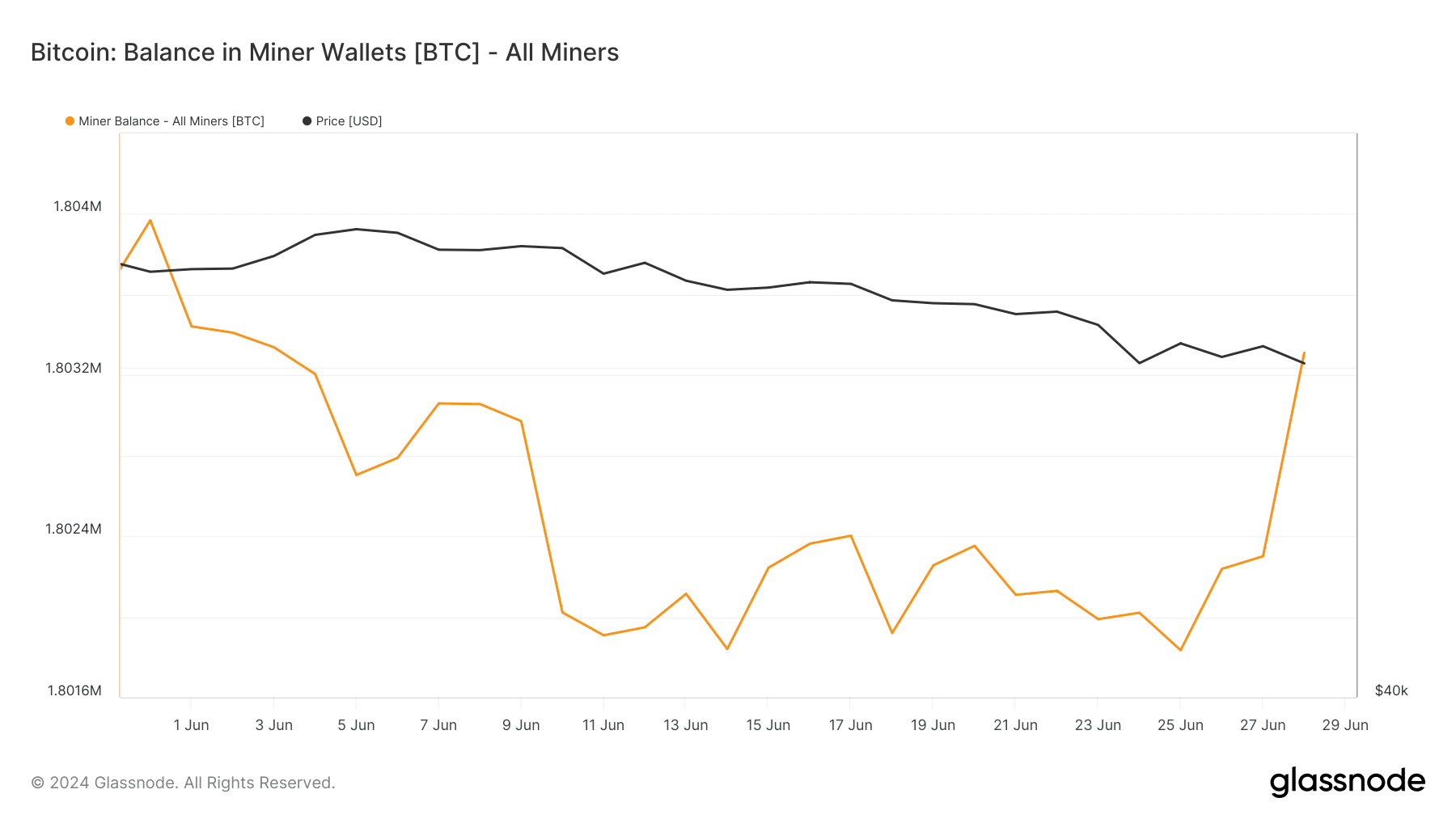

Moreover, our evaluation of Glassnode’s knowledge revealed that after a decline, BTC miners’ reserves began to rise, which means that miners have been shopping for BTC. Lastly, as per CryptoQuant, BTC’s internet deposit on exchanges appeared to be excessive, in comparison with the final seven days’ common – Indicating a hike in shopping for strain.

Nevertheless, at press time, BTC’s worth charts continued to flash purple. In keeping with CoinMarketCap, BTC was down by over 5% within the final seven days. On the time of writing, BTC was buying and selling at $60,920.48 with a market capitalization of over $1.19 trillion.

The Chaikin Cash Movement (CMF) registered a downtick. The MACD additionally displayed a bearish benefit available in the market, suggesting a sustained downtrend.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Nonetheless, the Relative Energy Index (RSI) regarded bullish because it went up. This may enable BTC to realize extra momentum within the coming days.

[ad_2]

Source link