[ad_1]

- Bitfarms mined 189 BTC in June.

- The mining agency now holds over 900 BTCs.

A current earnings report from Bitfarms, a distinguished participant within the cryptocurrency mining sector, highlighted a marked enchancment in its monetary efficiency for June.

This optimistic improvement comes within the wake of a major company problem—an tried takeover—which the corporate efficiently managed to fend off.

Bitfarms ups its earnings

Bitfarms, a notable participant within the cryptocurrency mining sector, reported a rise in its Bitcoin [BTC] manufacturing for June, based on a press launch dated the first of July.

The agency efficiently mined 189 BTC in June, considerably enhancing from the 156 BTC mined in Might. Out of the June earnings, it offered 134 BTC for about $8.8 million.

Presently, the corporate holds 905 Bitcoin in its treasury, valued at round $57 million.

Regardless of the optimistic efficiency in June, a year-over-year comparability offered by Bitfarms revealed a major drop in productiveness. By this time in 2023, the corporate had collected 2,520 BTC.

Nevertheless, its earnings thus far in 2024 have decreased to 1,557 BTC, marking a decline of over 50%.

This discount in Bitcoin earnings isn’t solely as a result of adjustments in productiveness; a major issue has been the discount in BTC miner rewards, which has impacted the general yield for a lot of within the sector.

How Bitfarms emerged from a hostile takeover

In June, the cryptocurrency mining sector witnessed important company exercise involving Riot Platforms and Bitfarms. Riot Platforms made a considerable buyout supply to amass Bitfarms for $950 million.

Regardless of the sizeable supply, the acquisition try didn’t reach its entirety.

Nevertheless, Riot was capable of safe a 14.9% stake in Bitfarms. Efforts by Riot to extend its stake to fifteen% or extra had been thwarted, maintaining its affect slightly below a extra controlling curiosity.

Throughout the identical interval, Riot Platforms additionally aimed to extend its affect inside Bitfarms by trying to exchange three members of Bitfarms’ board of administrators.

This transfer was a part of Riot’s broader technique to doubtlessly steer Bitfarms extra instantly. Nevertheless, this effort additionally confronted resistance and in the end failed.

In response to those aggressive maneuvers by Riot, Bitfarms took strategic defensive measures by including a brand new member to its board.

This motion was probably aimed toward strengthening its governance and stopping additional takeover makes an attempt.

Miner income continues to say no

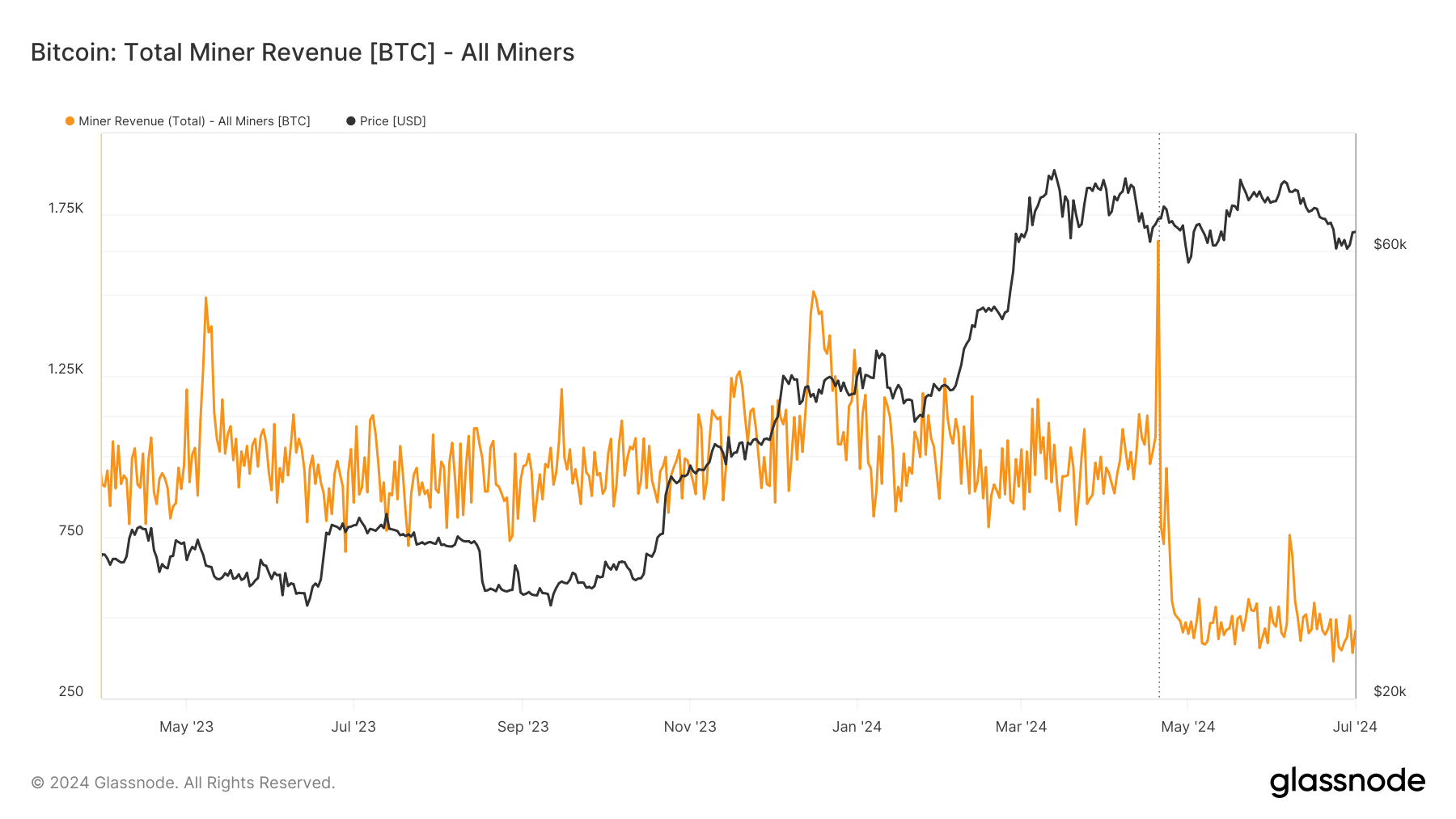

AMBCrypto’s evaluation of Bitcoin’s miner income, as reported by Glassnode, indicated a sustained lower following the Bitcoin halving occasion. This anticipated discount halves the reward for mining new Bitcoin blocks.

This occasion had a profound influence on the economics of Bitcoin mining.

Earlier than the halving, day by day income from mining operations hovered between 900 and 1,000 BTC. Put up-halving, this determine has considerably declined to round 400-500 BTC.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

As of this writing, the day by day income was round 456 BTC.

As demonstrated by the current monetary disclosures from Bitfarms, this decreased income stream from mining actions is a pattern that’s probably impacting miners throughout the trade.

[ad_2]

Source link