[ad_1]

- BTC didn’t rally regardless of a dovish FOMC assembly on thirty first July.

- July Jobs report on Friday might add volatility and set the following BTC value path.

Bitcoin [BTC] decoupled from US equities after a dovish FOMC assembly on Wednesday, 1st August, sliding under $65k whereas shares hit file highs.

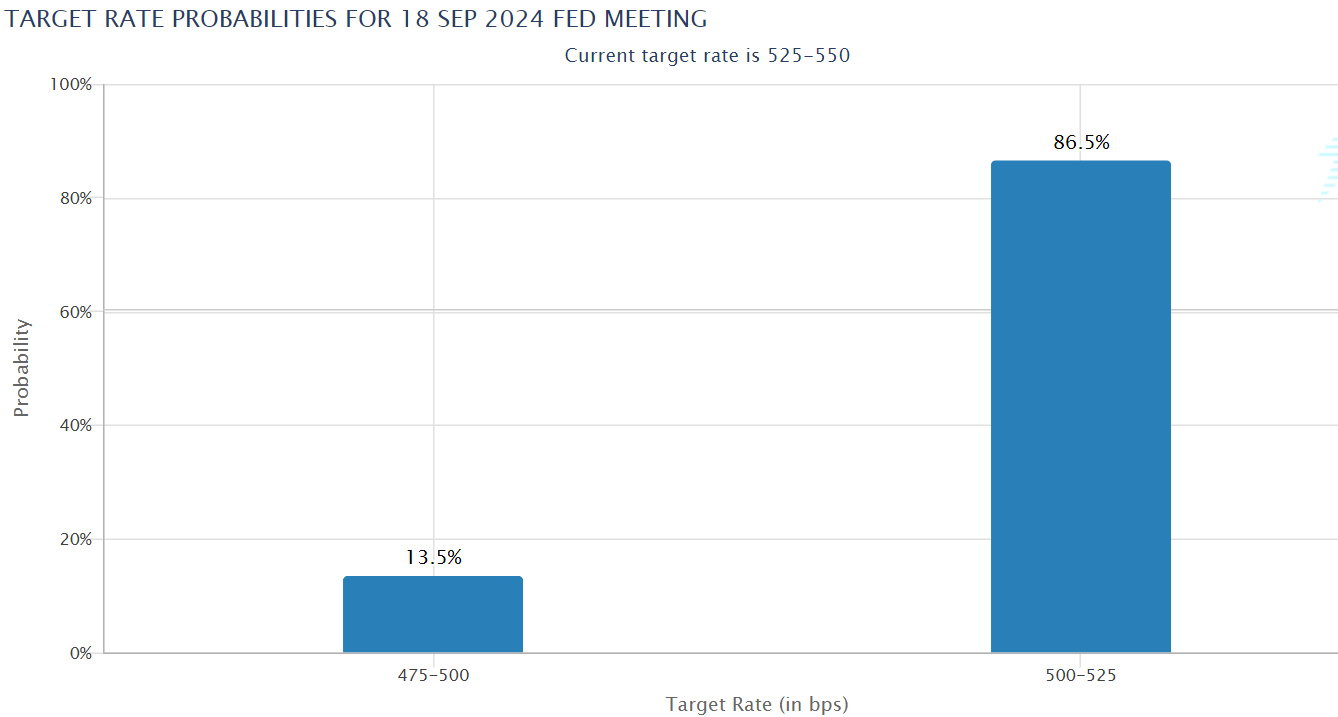

The Fed saved rates of interest unchanged as anticipated on the latest assembly, however chair Jerome Powell signaled a possible September price reduce.

As of press time, rate of interest merchants at the moment are pricing 86.5% odds of a September reduce, an general bullish cue that boosted US shares.

So, why didn’t Bitcoin observe the US equities rally, given the Fed’s dovish announcement?

Galaxy’s Mike Novogratz blames US authorities

Galaxy Digital’s Mike Novogratz agreed that the US authorities might be the market threat issue. He argued that the US might promote Bitcoin for political causes after Trump introduced that he would create a strategic reserve.

‘I agree it seems like somebody is leaning on $BTC. No thought, nevertheless it might be the US Marshall’s workplace. They report back to DOJ… I want they weren’t promoting.’

QCP Capital reinforced an identical market warning linked to the U.S. authorities’s movement of $2 billion of BTC final week.

‘The latest motion of 30k value of Silk Street BTC by the US authorities has launched uncertainty into the cryptocurrency market.’

In consequence, QCP Capital projected that BTC might stay constrained within the vary after failing to clear the $70k range-high.

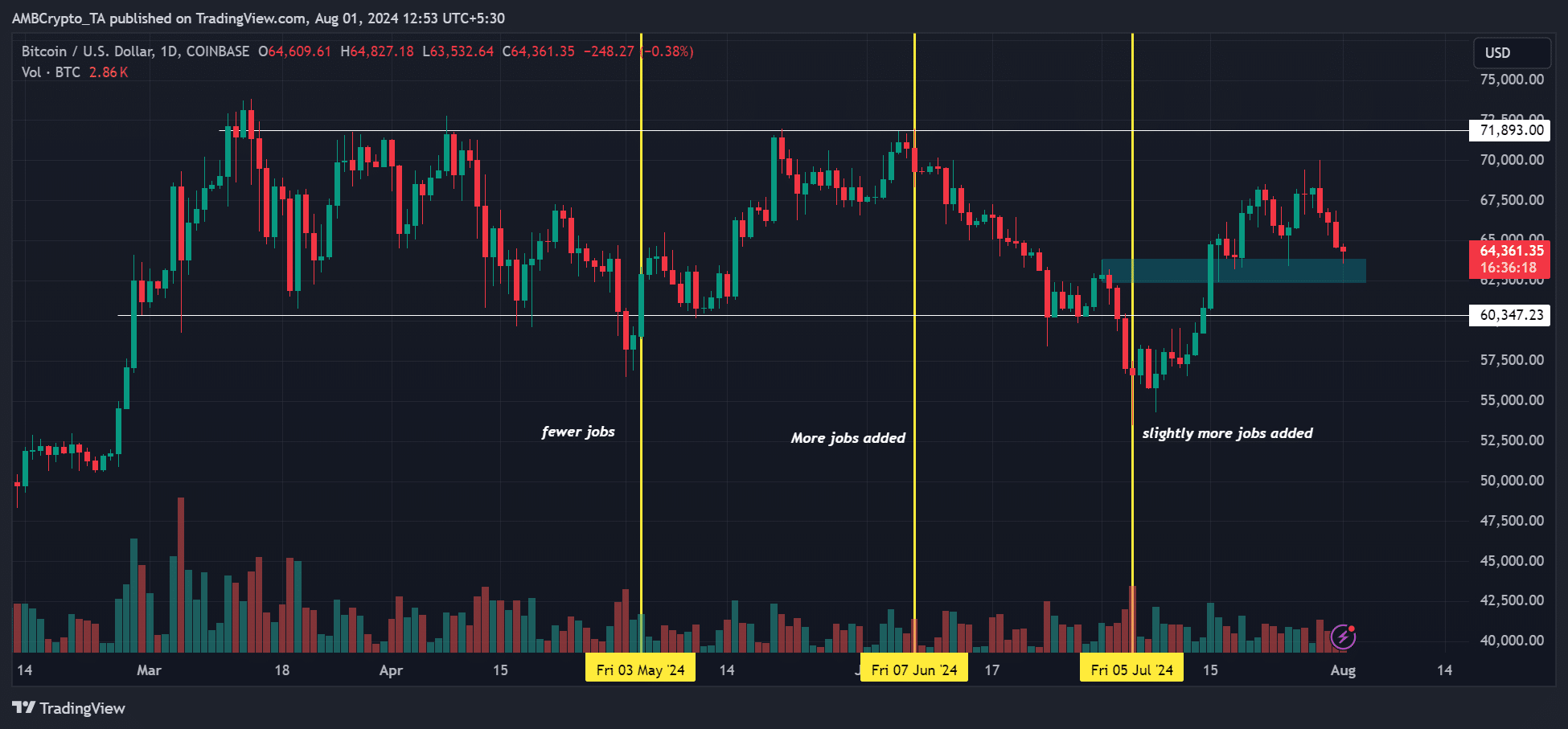

That mentioned, the following market mover might be the US July 2024 Jobs report, which might be launched on Friday (2nd August).

Based mostly on the previous jobs reviews, fewer added job eventualities corresponded to a rally for BTC, as they bolstered a cooling US labor market and supported the Fed’s possible reduce price risk.

Such a state of affairs occurred within the April Jobs report, launched on third Might, tipping BTC to rally about 6%.

Nonetheless, subsequent jobs reviews launched in June and July dragged BTC decrease after they confirmed enchancment in US labor markets.

So, a cooler Jobs report on Friday might increase BTC to reverse latest losses. Nonetheless, a warmer Jobs report, with extra job additions, might drag it even additional in the direction of the range-low.

Quinn Thompson of the crypto hedge fund Lekker Capital shared the identical outlook. Whereas acknowledging how essential Friday might be for markets, he maintained a optimistic outlook for H2 2024.

‘I stay positively inclined on the medium-term (2H 2024) macro outlook….I anticipate tomorrow’s FOMC/Friday’s NFP to be two an important occasions of the week.’

As of press time, BTC traded under $65k and will solely bounce again from the short-term help close to $65k, marked cyan, if Jobs’ report favors bulls.

So, macro elements and US politics nonetheless have an affect on BTC value, and it’s value monitoring these fronts for threat administration.

[ad_2]

Source link