[ad_1]

A giant change is brewing up on this planet of Bitcoin. Over time, US-based ETFs will change into the biggest holders of Bitcoin, surpassing even Satoshi Nakamoto, the mysterious founding father of the cryptocurrency. This growth actually additionally captures how institutional curiosity within the cryptocurrency area is rising.

Bloomberg senior ETF analyst Eric Balchunas stunned the crypto neighborhood with a farfetched prediction in relation to Bitcoin possession. Balchunas claims that if traits proceed, by the top of this yr, the world’s most elusive man, Satoshi Nakamoto, won’t be holding the biggest share of the cryptocurrency. This prediction assumes a dramatic change throughout the possession panorama of Bitcoin, with institutional actors gaining floor very quick.

Didn’t notice US ETFs are on monitor to go Satoshi in bitcoin held in October. BlackRock alone is already #3 and on tempo to be #1 late subsequent yr, and can possible keep there for a really very long time Ht @EdmondsonShaun pic.twitter.com/QGsO00zrxp

— Eric Balchunas (@EricBalchunas) August 12, 2024

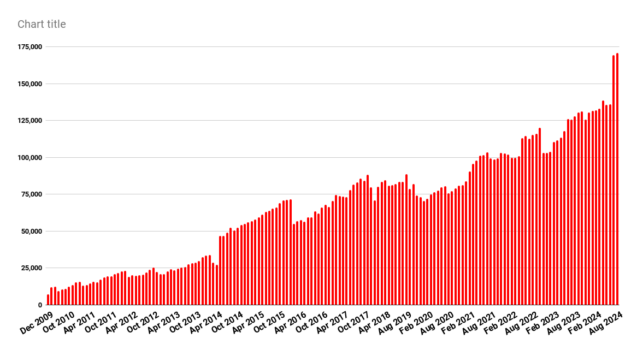

In that gentle, Bitcoin’s nameless creator doesn’t make the highest record, with solely about 1.1 million BTC mentioned to be in his/her/their possession. Nonetheless, US-based Bitcoin ETFs, presently managing about 909,700 BTC, are within the means of shortly catching up with this quantity, underpinning a brand new actuality of an inflow of conventional monetary establishments into the ecosystem.

As these ETFs proceed to realize recognition, Nakamoto’s dominance could possibly be surpassed, marking a shift in Bitcoin possession dynamics. This complete doesn’t account for Grayscale’s holdings, which would cut back the ETF depend to roughly 645,899 BTC.

Institutional Dominance

The quick rising focus of Bitcoin by US ETFs will be largely attributed to institutional gamers. BlackRock, the most important funding supervisor worldwide, has additionally advanced right into a heavyweight within the bitcoin area. With 347,767 BTC in its IBIT Bitcoin ETF, it’s now the third-biggest holding and, at this fee, prone to surpass all others earlier than the top of 2025.

Bitcoin market cap presently at $1.20 trillion. Chart: TradingView.com

Constancy’s Foray Into Crypto

The opposite finance big, Constancy, has additionally made some substantial headway within the cryptocurrency area. It’s presently holding 176,626 BTC, and its FBTC fund helps underscore rising institutional participation available in the market. Grayscale, one other well-liked digital forex asset supervisor, went a step additional within the institutionalization of the Bitcoin ecosystem by holding considerably 263,801 BTC.

The actual identification of Satoshi Nakamoto stays a thriller. Picture: Pixabay

Bitcoin: Timetable Estimate

In line with analysts, ETF holdings of Bitcoin might even surpass Nakamoto as early as October 2024. The timeline takes into consideration the present fee of accumulation and the projected development of the cryptocurrency market. After all, institutional curiosity in Bitcoin is barely going to develop within the coming years when gamers reminiscent of Constancy and BlackRock, who’re leaders on this discipline, have substantial investments channeled to the identical space.

That Bitcoin ETFs have grown to be the most important holders of the cryptocurrency is large information. It emphasizes how Bitcoin is changing into extra broadly accepted and the way institutional traders have gotten extra assured within the cryptocurrency sector. The extra confidence folks and organizations put into Bitcoin, the much less doubt we’ll have, and shortly, we might even see extra institutional cash flowing into the area.

What this implies for Bitcoin’s future—whether or not the dynamics of the crypto market will shift with institutional traders on the helm—stays unsure. Nonetheless, a brand new period within the Bitcoin world is starting, and it is going to be intriguing to see how all the pieces develops.

Featured picture from JPM & Companions, chart from TradingView

[ad_2]

Source link