[ad_1]

- Inflows for Bitcoin ETFs grew suggesting a rising curiosity showcased in BTC.

- Revenues generated by miners remained optimistic earlier than the upcoming halving.

Bitcoin[BTC] climbed previous the $70,000 mark after staying stagnant at these ranges for fairly a while. Nevertheless, current curiosity in Bitcoin ETFs might assist BTC see inexperienced but once more.

A story of outflows and inflows

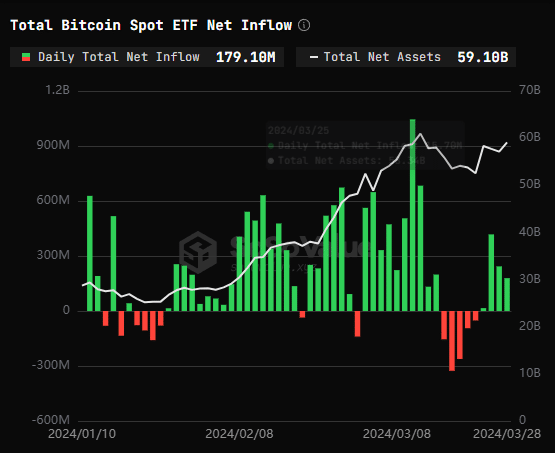

As per information from SoSoValue, the combination internet inflows into Bitcoin spot ETFs stood at $179 million on twenty eighth March.

Particularly, the Grayscale ETF GBTC witnessed an outflow of $104 million, whereas the BlackRock ETF IBIT skilled an influx of $95.12 million and the Constancy ETF FBTC noticed an influx of $68.09 million.

Consequently, the cumulative historic internet influx of those ETFs at present stood at $12.12 billion.

This surge in influx may indicate that retail curiosity in ETFs in conventional markets is on the rise. Excessive inflows may probably lead to a optimistic value motion for BTC sooner or later.

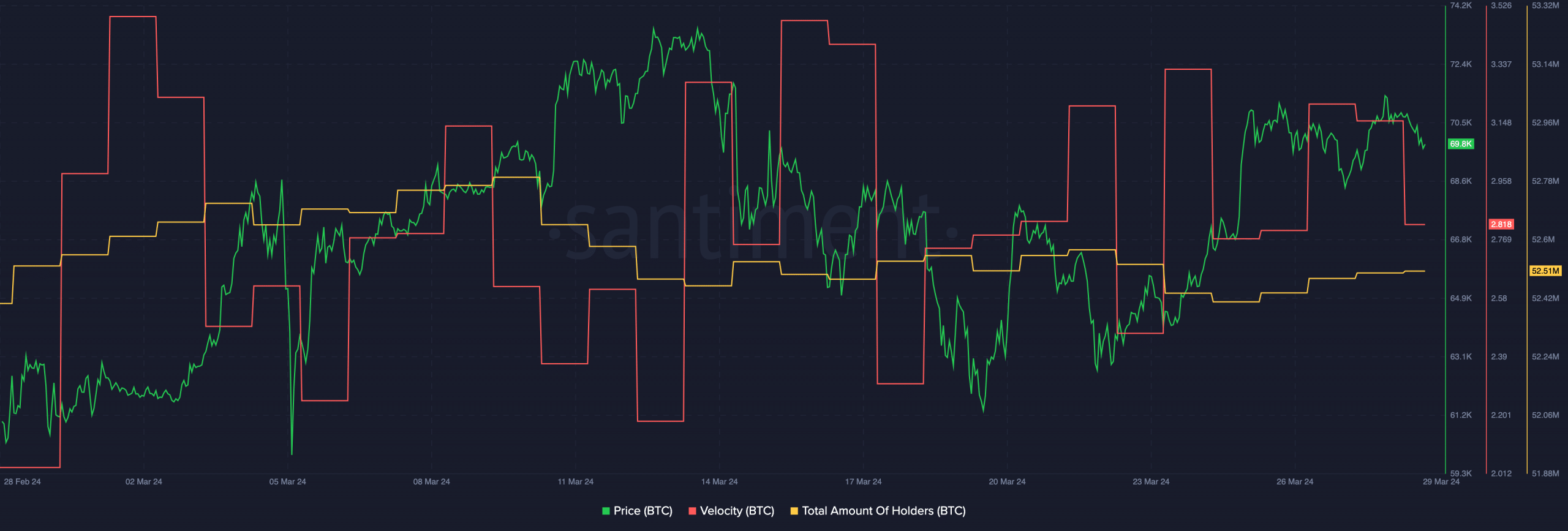

At press time, BTC was buying and selling at $69,864.20 and its value had declined by 0.81% within the final 24 hours.

Although curiosity in Bitcoin was rising within the Conventional Finance sector, the identical couldn’t be stated by way of the crypto house. The speed at which BTC was buying and selling had additionally fallen throughout this era. This meant that the frequency at which the king coin was buying and selling at had declined. The decline in velocity might point out that present addresses could also be dropping curiosity in BTC.

Moreover, the whole variety of holders accumulating BTC had additionally declined. These components may influence BTC’s value going ahead.

State of miners

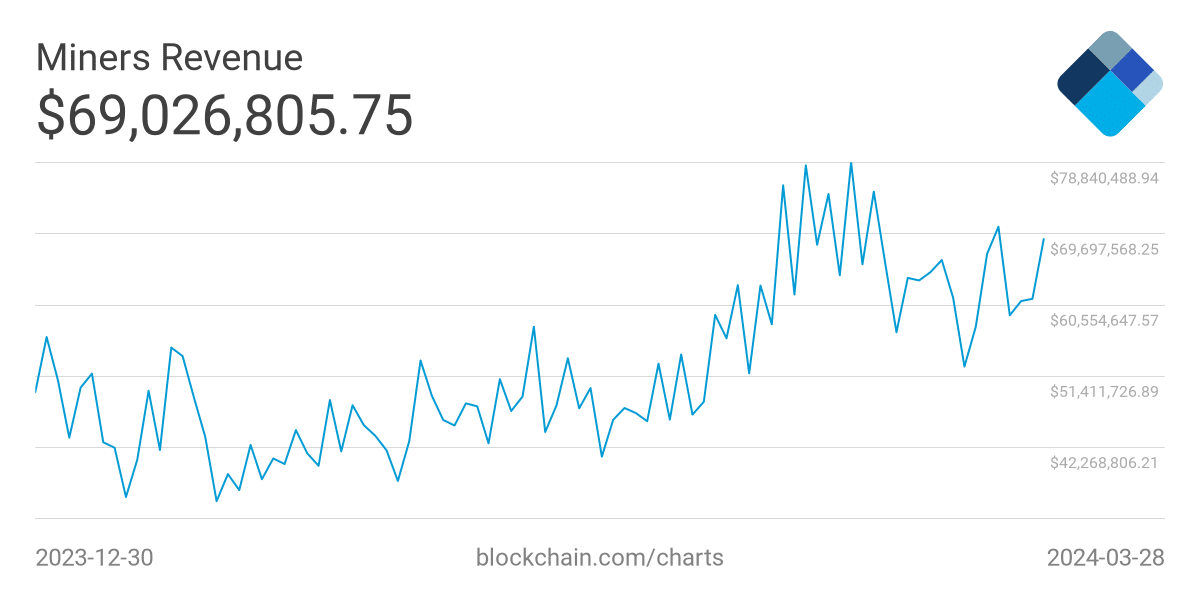

One other issue that would affect the value of Bitcoin can be the state of miners on the community. AMBCrypto’s evaluation of Blockhain.com’s information revealed that the income collected by miners had surged.

The surge in income implies that miners gained’t need to promote their BTC holdings to stay worthwhile.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

The general promoting strain for BTC may be decreased. Nevertheless, the upcoming halving may change the course for miners because the reward generated by miners would lower.

This might lead to many miners opting to promote their holdings. Although halvings have traditionally been a bullish occasion for Bitcoin, many holders must soak up the short-term sell-offs that would happen as a result of halving on the community.

[ad_2]

Source link