[ad_1]

- Hong Kong Bitcoin ETF reserves touched 4,941 BTC, value over $310 million.

- BTC was up by 4% within the final 24 hours, however a couple of metrics have been bearish.

Bitcoin [BTC] ETFs have remained a scorching subject of debate within the crypto area since their approval in January 2024.

Whereas the USA dominated the ETF sector at a world stage, new gamers have now began to enter. For instance, Australia and Hong Kong ETFs lately set data.

Bitcoin ETF: Australia, Hong Kong paved the way

To start with, Hong Kong’s Bitcoin ETFs have witnessed a considerable improve in flows over the previous couple of days. Exactly, BTC ETFs in Hong Kong registered a 28.6% improve from the earlier reserve.

The latest uptick pushed its BTC reserves to 4,941 BTC. In keeping with the AMBCrypto Converter, the entire Hong Kong BTC ETF reserves have been valued at over $310 million.

Like Hong Kong, Australia’s Monochrome Bitcoin ETF (IBTC) additionally made it to the headlines. Since its debut, it has obtained 83 BTC in inflow. This approached the 100 Bitcoin threshold by way of complete holdings.

Since there was a lot traction round BTC ETFs, AMBCrypto deliberate to have a greater have a look at what’s occurring. Our evaluation of Dune Analytics’ information revealed that BTC ETFs’ netflows have declined over the previous few weeks.

Nevertheless, it was attention-grabbing to notice that its web inflows remained larger, reflecting BTC’s demand and buyers’ confidence within the king of cryptos.

BTC turns bullish

Whereas all this occurred, Bitcoin bulls stepped up their recreation as its weekly and every day charts turned inexperienced. In keeping with CoinMarketCap, BTC was up by greater than 4% within the final 24 hours.

On the time of writing, BTC was buying and selling at $62,810.22 with a market capitalization of over $1.23 trillion.

Our have a look at Coinglass’ information revealed a bullish sign. Bitcoin’s Lengthy/Brief Ratio registered an enormous uptick at press time, reflecting extra lengthy positions available in the market than brief positions.

This urged that bullish sentiment across the coin was rising available in the market.

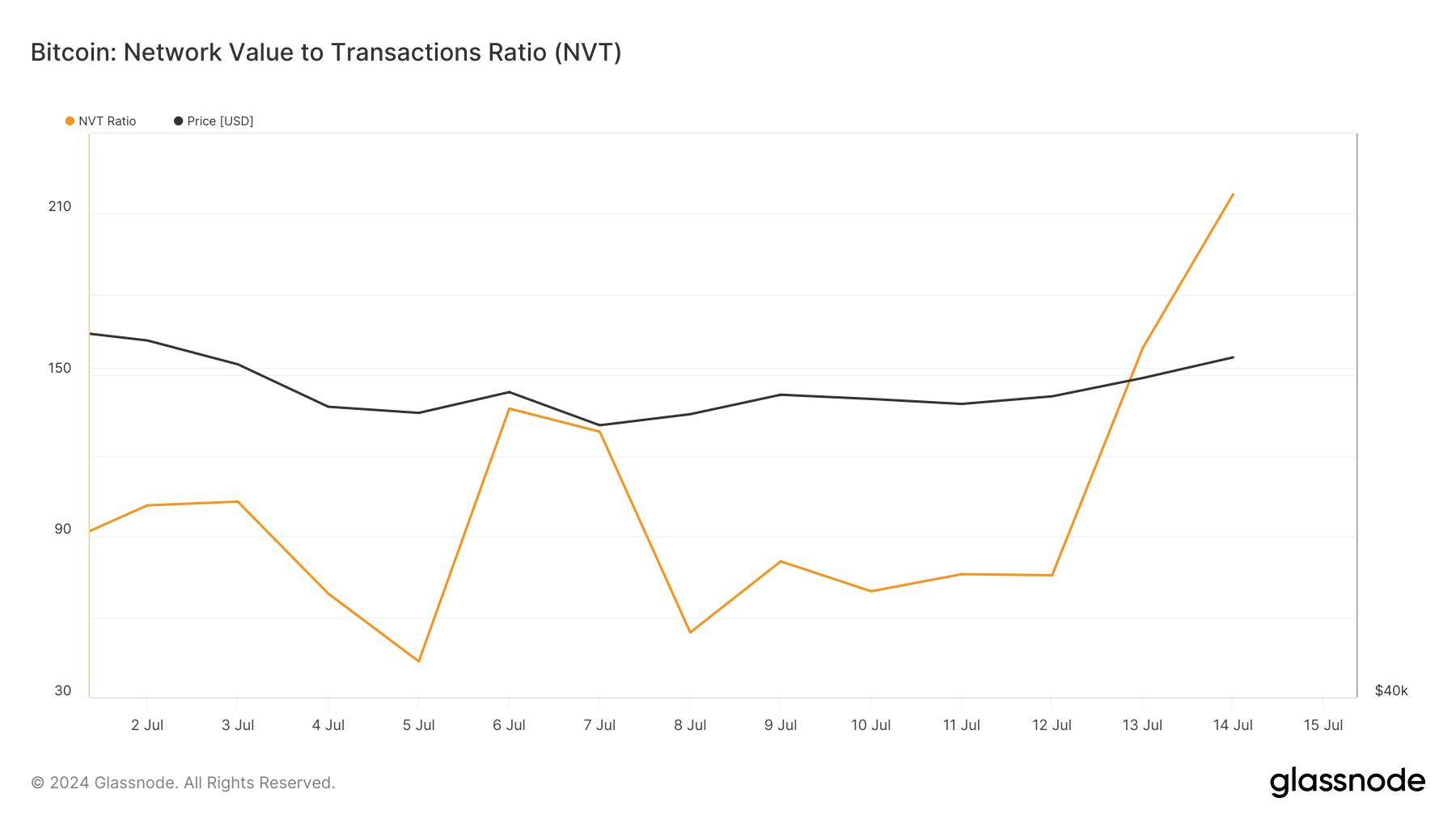

Nevertheless, not the whole lot was working in BTC’s favor. For instance, BTC’s NVT ratio registered a rise. Each time the metric rises, it means that an asset is overvalued, hinting at a potential worth correction.

Subsequently, AMBCrypto checked Hyblock Capital’s information to search for short-term help and resistance ranges.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

We discovered that if the bulls proceed to regulate the market, then it gained’t be shocking to see BTC touching $68k within the coming days.

Nevertheless, if a pattern reversal occurs, as urged by the NVT ratio, it’d drop to $56k as soon as once more.

[ad_2]

Source link