[ad_1]

Arthur Hayes, the co-founder of crypto trade BitMEX, has lately supplied a complete evaluation in his newest essay, “Zoom Out,” drawing compelling parallels between the financial upheavals of the Nineteen Thirties-Nineteen Seventies and in the present day’s monetary panorama, particularly specializing in the implications for the Bitcoin and crypto bull run. His in-depth examination means that historic financial patterns, when correctly understood, can present a blueprint for understanding the potential revival of the Bitcoin and crypto bull run.

Understanding Monetary Cycles

Hayes begins his evaluation by exploring the key financial cycles ranging from the Nice Despair, via the mid-Twentieth century financial booms, and into the stagnant Nineteen Seventies. He categorizes these transformations into what he phrases “Native” and “International” cycles, central to understanding the broader macroeconomic forces at play.

Native Cycles are characterised by intense nationwide focus the place financial protectionism and monetary repression are prevalent. These cycles usually come up from governmental responses to extreme financial crises that prioritize nationwide restoration over international cooperation, sometimes resulting in inflationary outcomes as a result of devaluation of fiat currencies and elevated authorities spending.

Associated Studying

International Cycles, in distinction, are marked by intervals of financial liberalization, the place international commerce and funding are inspired, usually resulting in deflationary pressures as a consequence of elevated competitors and effectivity in international markets.

Hayes rigorously examines every cycle’s affect on asset lessons, noting that in Native cycles, non-fiat belongings like gold have traditionally carried out effectively as a consequence of their nature as hedges in opposition to inflation and forex devaluation.

Hayes attracts a direct parallel between the creation of Bitcoin in 2009 and the financial setting of the Nineteen Thirties. Simply because the financial crises of the early Twentieth century led to transformative financial insurance policies, the monetary crash of 2008 and subsequent quantitative easing set the stage for the introduction of Bitcoin.

Why The Bitcoin Bull Run Will Resume

Hayes argues that Bitcoin’s emergence throughout what he identifies as a renewed Native cycle, characterised by the worldwide recession and vital central financial institution interventions, mirrors previous intervals the place conventional monetary programs have been underneath stress, and various belongings like gold rose to prominence.

Increasing on the analogy between gold within the Nineteen Thirties and Bitcoin in the present day, Hayes elucidates how gold served as a safe haven throughout occasions of financial uncertainty and rampant inflation. He posits that Bitcoin, with its decentralized and state-independent nature, is well-suited to serve an analogous objective in in the present day’s risky financial local weather.

Associated Studying

“Bitcoin operates outdoors the standard state programs, and its worth proposition turns into significantly evident in occasions of inflation and monetary repression,” Hayes notes. This characteristic of Bitcoin, he argues, makes it an indispensable asset for these looking for to protect wealth amidst forex devaluation and monetary instability.

Hayes factors out the numerous surge within the US price range deficit, projected to succeed in $1.915 trillion in fiscal 2024, as a contemporary indicator that parallels the fiscal expansions of previous Native cycles. This deficit, considerably greater than in earlier years, marking the best degree outdoors the COVID-19 era, is attributed to elevated authorities spending akin to historic intervals of government-induced financial stimuli.

Hayes makes use of these fiscal indicators to counsel that simply as previous Native cycles led to elevated valuation for non-state belongings, the present fiscal and financial insurance policies are more likely to improve the enchantment and worth of Bitcoin.

“Why am I assured that Bitcoin will regain its mojo? Why am I assured that we’re within the midst of a brand new mega-local, nation-state first, inflationary cycle?” Hayes asks rhetorically in his essay. He believes that the identical dynamics that drove the worth of belongings like gold throughout previous financial upheavals are actually aligning to bolster the worth of Bitcoin.

He concludes, “I consider fiscal and financial situations are unfastened and can proceed to be unfastened, and due to this fact, hodl’ing crypto is one of the simplest ways to protect wealth. I’m assured that in the present day will rhyme with the Nineteen Thirties to Nineteen Seventies, and meaning, given I can nonetheless freely transfer from fiat to crypto, I ought to achieve this as a result of debasement via the growth and centralisation of credit score allocation via the banking system is coming.”

At press time, BTC traded at $62,649.

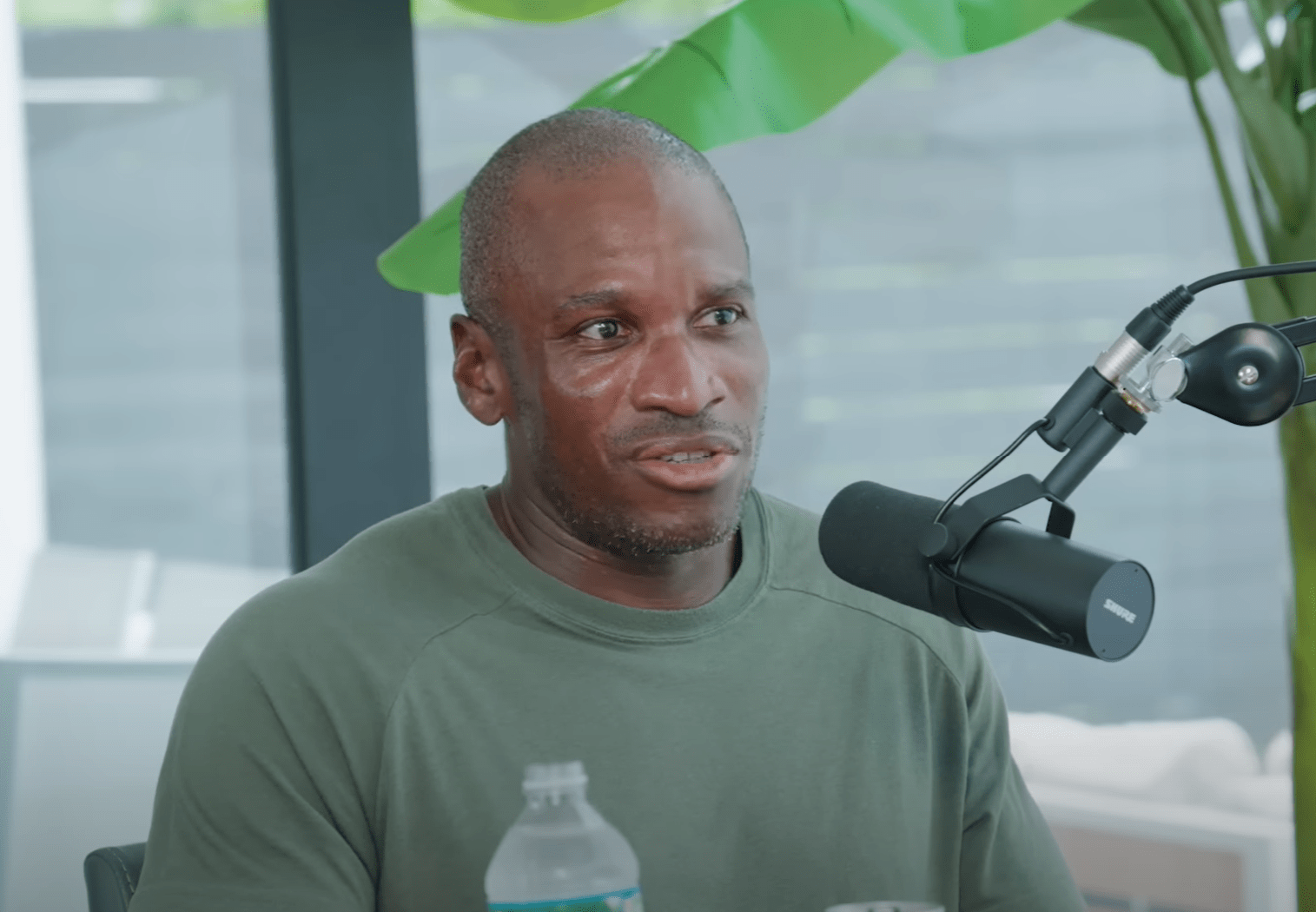

Featured picture from YouTube / What Bitcoin Did, chart from TradingView.com

[ad_2]

Source link