[ad_1]

- Bitcoin has remained under the $60,000 value vary.

- Accumulation has elevated after months of distribution.

Bitcoin [BTC] has been persistently buying and selling under the $60,000 mark, and up to date information indicated that numerous entities have began accumulating it throughout this value consolidation section.

This strategic accumulation prompt that some traders considered the present value vary as a positive entry level. Regardless of this accumulation, there was a noticeable lower in pockets exercise throughout the identical interval.

Bitcoin enters the buildup section

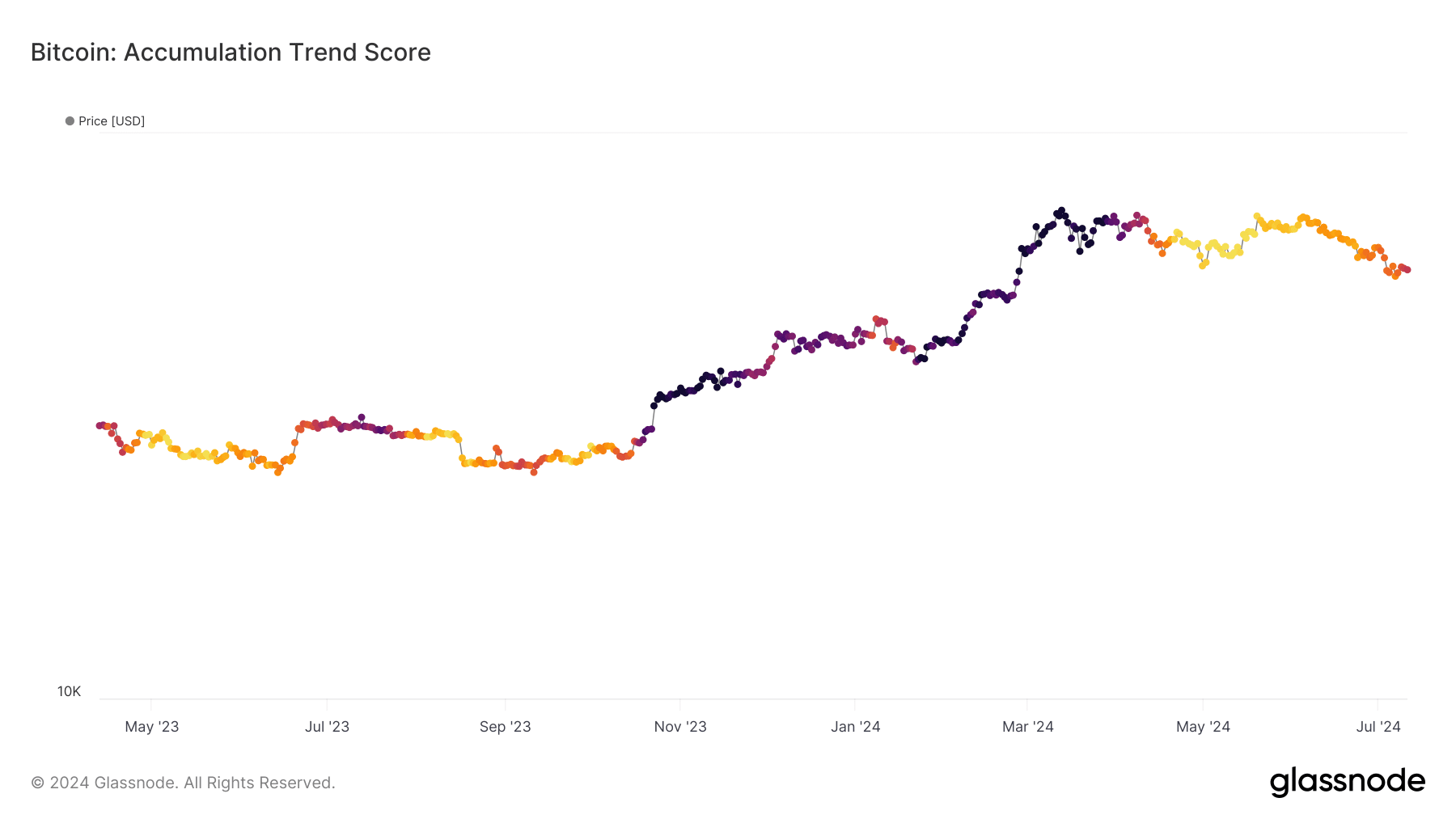

AMBCrypto’s evaluation of Bitcoin’s development rating from Glassnode indicated a notable reversal in market habits.

The development rating, at 0.4 at press time, marked a major shift, suggesting that entities have begun accumulating BTC after a distribution interval.

This improve within the development rating, whereas not but at 1, signaled a motion in direction of extra aggressive accumulation. Additionally, this was the primary time since April that the development rating has reached this degree.

The Accumulation Development Rating is especially insightful as a result of it not solely considers the quantity of BTC that entities are shopping for or promoting, but additionally the scale of the entities’ balances.

A rating approaching 1 implies that bigger entities are actively accumulating BTC, a bullish sign. Conversely, a rating close to 0 means that these entities are both distributing their holdings or abstaining from additional accumulation.

This upward motion within the development rating might doubtlessly point out rising confidence amongst bigger traders.

Such habits usually precedes broader market recoveries, as vital accumulation phases by giant holders can scale back market provide and assist set up stronger value help ranges.

Energetic Bitcoin addresses fall

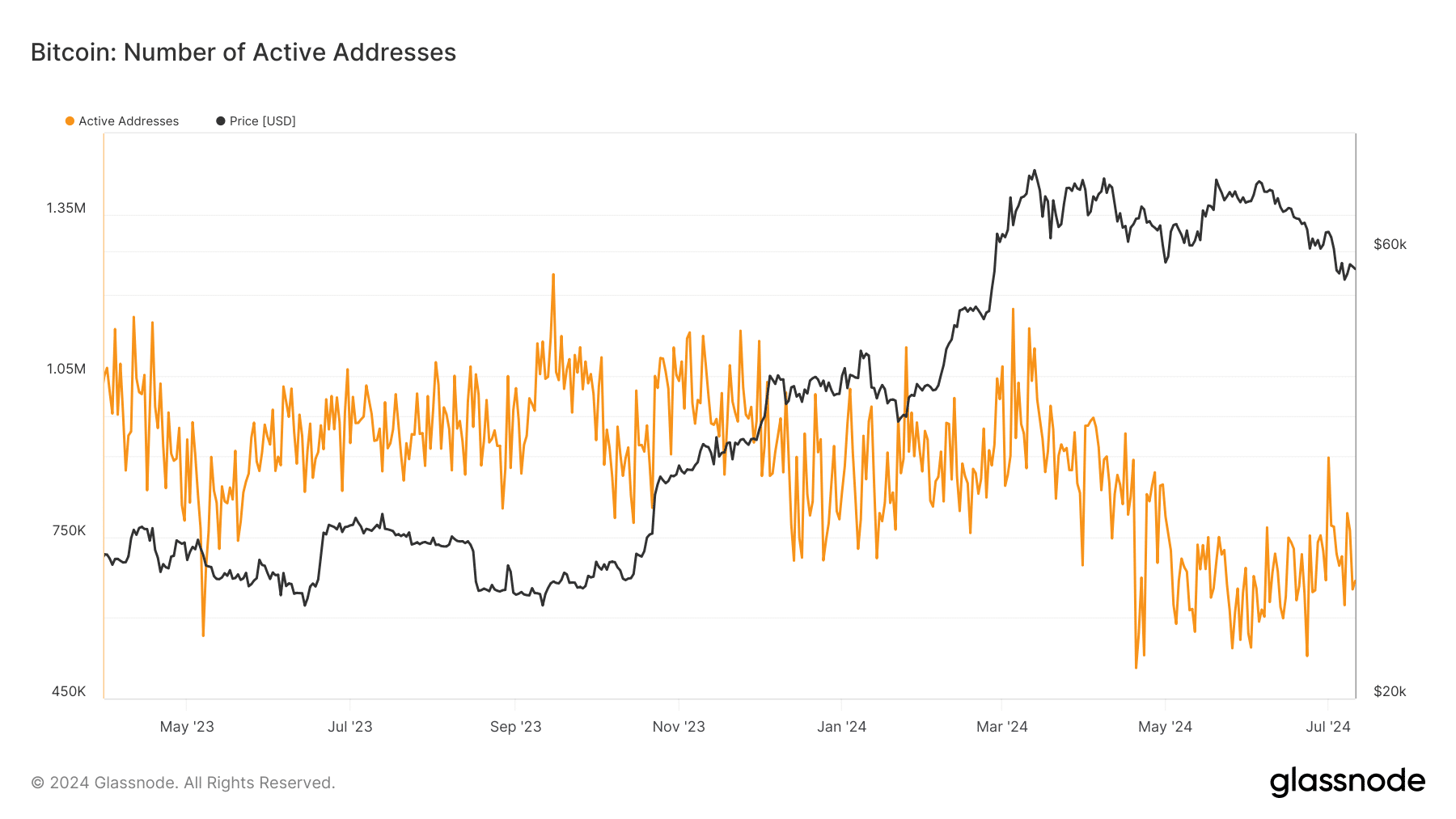

Whereas there’s a noticeable uptick in Bitcoin accumulation amongst bigger entities, the variety of each day lively Bitcoin addresses advised a unique story.

In keeping with an evaluation of the lively addresses chart on Glassnode, there was a pointy decline in exercise lately.

Nonetheless, regardless of experiencing fluctuations, the variety of lively addresses has largely remained throughout the 600,000 vary. As of this writing, the quantity was round 669,000.

This decline in lively addresses amidst rising accumulation would possibly recommend a couple of potential eventualities. Firstly, bigger traders might be holding their BTC for the long run, decreasing transaction frequency.

Additionally, it might point out a cautious wider market, the place fewer people and entities are participating in transactions, probably ready for clearer alerts earlier than getting into or exiting positions.

BTC buying and selling under $60,000

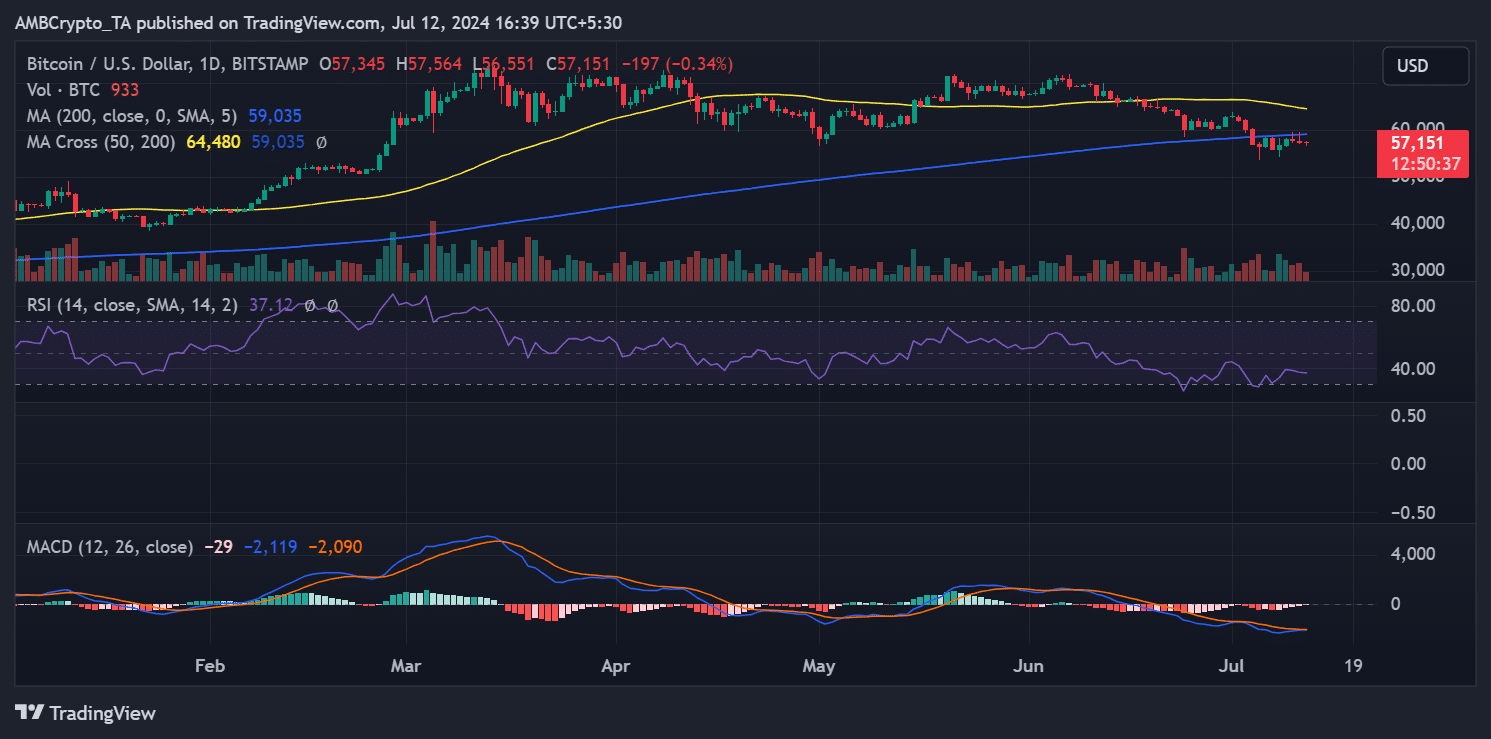

As of the newest information, Bitcoin was buying and selling at roughly $57,151, exhibiting a slight decline of lower than 1% on a each day timeframe. The value motion on the chart indicated that BTC was in a bearish development.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

This was evidenced by its place under the important thing transferring common (yellow and blue strains).

Bitcoin’s place, relative to the impartial line on the Relative Power Index (RSI) at press time, additional supported this bearish outlook.

[ad_2]

Source link