[ad_1]

- Final week’s crypto market rally led to a movement of funds into crypto-backed funding merchandise.

- Final week, Ethereum recorded its highest weekly inflows since March.

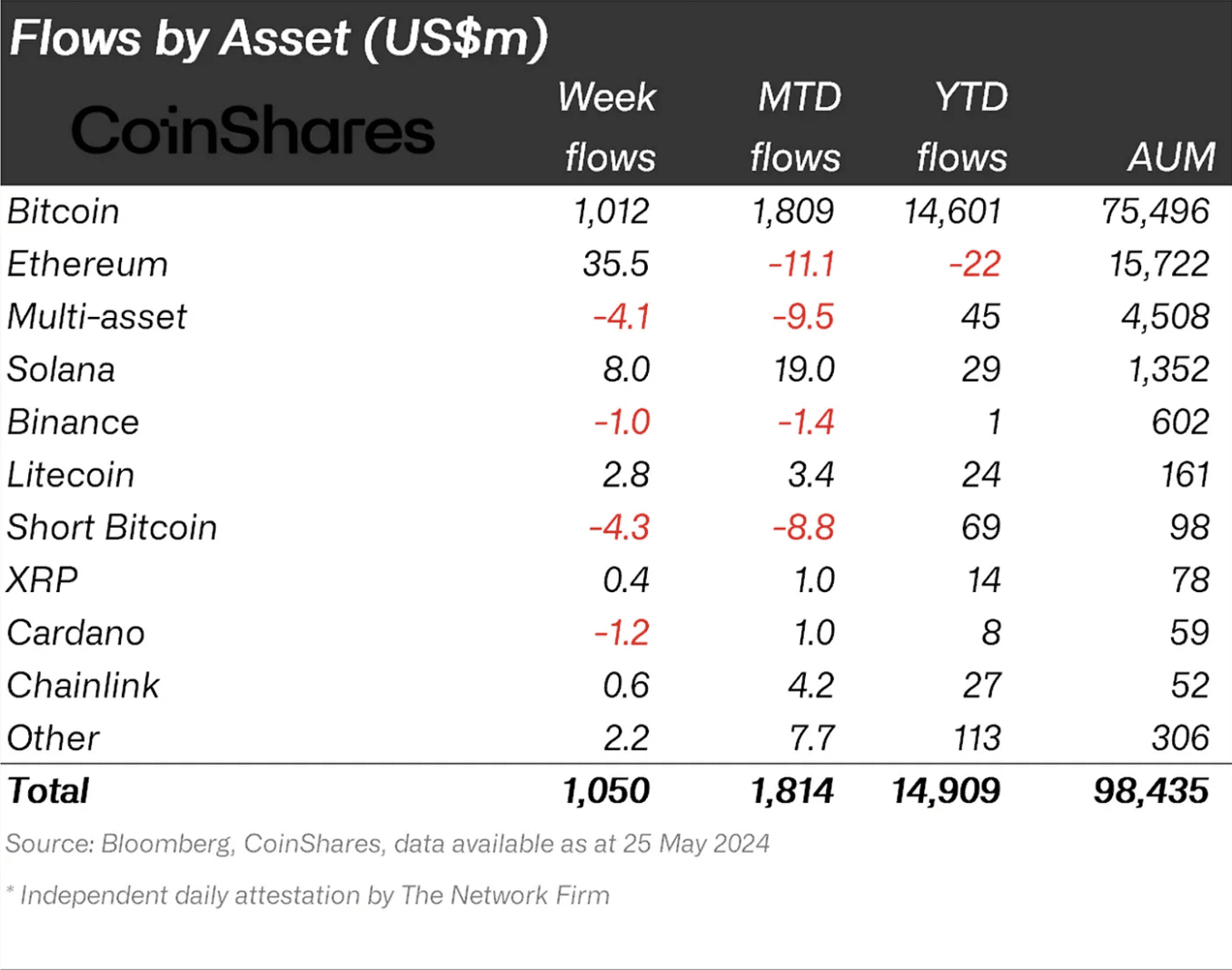

Digital asset funding merchandise recorded inflows totaling $1.05 billion final week, marking the third consecutive week of inflows, digital asset funding agency CoinShares present in its new report.

In keeping with the report, final week’s inflows introduced the year-to-date inflows into cryptocurrency funds to a record-breaking $14.9 billion.

The digital asset funding agency discovered that final week’s crypto market surge positively impacted the exercise round Trade-Traded Merchandise (ETPs).

Throughout that interval, weekly ETP buying and selling quantity climbed by 28% to $13 billion.

On the finish of the interval noticed by CoinShares, the full belongings beneath administration (AUM) for crypto-related funding merchandise was above $98 billion.

This marked a 7% development from the $91 billion recorded the previous week.

Regionally, most of final week’s flows into crypto funds got here from the US, Germany, and Switzerland, with inflows of $1.03 billion, $48 million, and $30 million, respectively.

Curiously, Hong Kong noticed outflows through the week in overview. In keeping with CoinShares,

“Disappointingly, because the preliminary constructive launch of Bitcoin spot-based ETFs in Hong Kong (which noticed US$300m within the first week), there have been additional outflows final week of US$29m.”

Bitcoin’s YTD inflows topple $14 billion

Final week, Bitcoin-backed funding merchandise noticed inflows of $1.03 billion, representing 98% of all inflows recorded throughout that interval.

This pushed the main coin’s YTD inflows to $14.60 billion, an 8% rally from the earlier week’s YTD influx of $13.58 billion.

Concerning short-Bitcoin merchandise, they recorded outflows of $4.3 million final week, bringing their month-to-date outflows to $8.8 million.

CoinShares stated this is perhaps resulting from altering sentiments round Bitcoin from unfavorable to constructive.

“That is probably resulting from buyers deciphering the FOMC minutes and up to date macro knowledge as mildly dovish, it added.”

Ethereum reaches new milestone

Through the week beneath overview, the main altcoin, Ethereum [ETH], witnessed an influx of $38 million into its digital asset merchandise, representing its highest since March.

CoinShares stated this was,

“Probably an early response to the approval of ETH ETFs in the US.”

Nonetheless, because of the collection of outflows that Ethereum-backed merchandise have skilled in previous weeks, its month-to-date flows stood at a deficit of $11.1 million final week.

[ad_2]

Source link