[ad_1]

- BTC’s value has elevated barely within the final 24 hours.

- Over $17 billion BTC has been collected in the previous couple of months.

Bitcoin [BTC] has entered a re-accumulation section as long-term holders (LTH) have steadily elevated their holdings of late. The transfer may have an effect on BTC’s value because it struggles to reclaim the $60,000 value vary.

LTHs again Bitcoin

AMBCrypto’s evaluation of the long-term holders’ chart on Glassnode revealed notable traits in Bitcoin possession.

Originally of 2024, long-term holders (LTH) managed over 14 million BTC. Nonetheless, this determine considerably dropped within the first quarter, declining to roughly 13.35 million BTC by March 2024.

This decline indicated that long-term holders have been distributing or promoting their Bitcoin, probably reacting to market situations or seizing profit-taking alternatives.

By March 2024, the pattern shifted as long-term holders started steadily rising their Bitcoin holdings. Round 300,000 BTC have been added to long-term holdings by August 2024, marking a re-accumulation section.

This recommended that buyers had renewed confidence in Bitcoin’s long-term worth, as they selected to “HODL” quite than promote.

The pattern demonstrated a transparent upward motion in long-term holdings, reflecting a robust perception in Bitcoin’s prospects amongst seasoned buyers regardless of short-term market fluctuations.

Attainable implications for future strikes

This upward pattern in long-term Bitcoin holdings may considerably have an effect on Bitcoin’s value.

As seasoned buyers accumulate, the elevated confidence in Bitcoin’s future worth will probably contribute to higher value stability.

This renewed bullish sentiment, typically seen amongst knowledgeable buyers, would possibly precede a possible value surge, reflecting their anticipation of future appreciation.

Additionally, The regular accumulation by long-term holders recommended a tightening of provide out there, which may scale back volatility and create a extra secure buying and selling atmosphere.

With fewer BTCs obtainable for short-term buying and selling, there could also be much less dramatic value swings, paving the best way for a extra sustained upward trajectory.

This habits could point out that the market has reached a backside, with long-term holders positioning themselves for a restoration section.

Traditionally, such accumulation phases have led to vital value will increase because the supply-demand dynamics shifts in favor of upper costs.

How BTC has trended

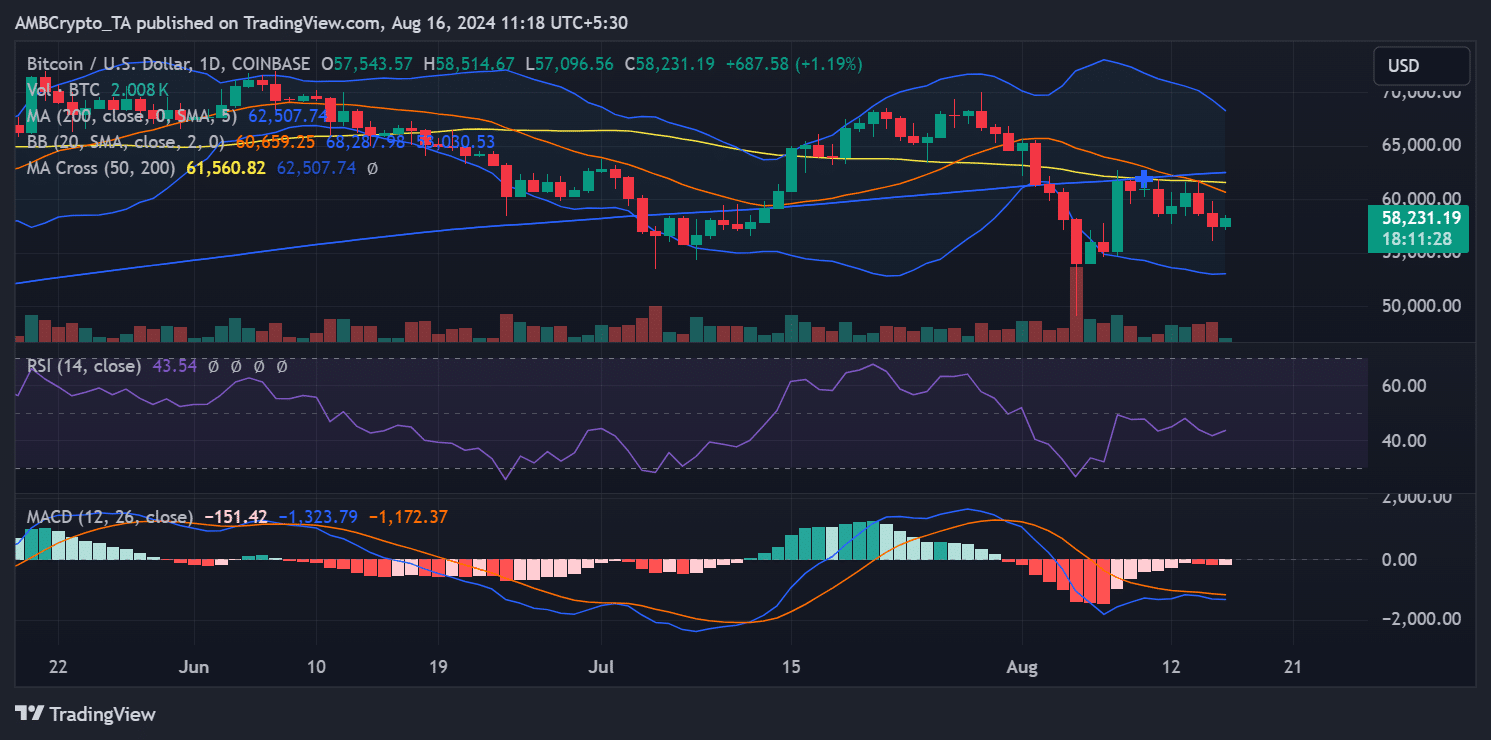

Bitcoin’s press time value was $58,231.19, marking a modest enhance of over 1.19% within the newest buying and selling session. The Bollinger Bands confirmed a contraction, indicating decreased market volatility.

At press time, the worth was trending in direction of the center band, suggesting the potential of sideways motion or consolidation. The higher band was at $68,287.98, whereas the decrease band was close to $50,030.53.

Moreover, the Relative Energy Index (RSI) was round 43.54, putting it within the impartial zone however edging nearer to the oversold territory.

Is your portfolio inexperienced? Take a look at the BTC Profit Calculator

This recommended that Bitcoin could be undervalued, although there has but to be vital shopping for momentum.

Moreover, the RSI indicated that the promoting stress could also be nearing exhaustion, with a possible value reversal on the horizon if Bitcoin breaks above the center Bollinger Band or an uptick in buying and selling quantity.

[ad_2]

Source link