[ad_1]

The latest introduction of Bitcoin exchange-traded funds (ETFs) in the US, thought of a watershed second for the cryptocurrency’s mainstream adoption, has sparked a nuanced response characterised by a mix of optimism and skepticism. Regardless of an preliminary surge in funding, latest knowledge indicators a decline in general Bitcoin pockets exercise, introducing a component of uncertainty relating to the lasting affect of those ETFs.

Diminishing Enthusiasm

Issues over diminishing enthusiasm are substantiated by knowledge from Santiment, an information analytics agency, revealing a constant discount within the variety of crypto wallets holding any quantity of the cryptocurrency because the ETF approval roughly 4 weeks in the past. This downward development suggests a possible retreat from direct Bitcoin possession, with fears of uncertainty and doubt (FUD) doubtlessly influencing investor sentiment.

📉 #Bitcoin‘s wallets (with larger than 0 cash) are nonetheless declining as #crypto nears 4 weeks because the #SEC‘s 11 Spot #ETF approvals. This may be attributed to crowd #FUD, and fewer curiosity in direct $BTC possession as a result of different funding alternate options. https://t.co/tjnjELxGw1 pic.twitter.com/xRymU7C0ro

— Santiment (@santimentfeed) February 7, 2024

A extra granular evaluation by IntoTheBlock additional illuminates this development, highlighting a major lower in each day lively and new addresses. This means a diminishing stage of consumer engagement and hints at a attainable shift in curiosity in direction of different investments. Intriguingly, the overall variety of BTC addresses has remained comparatively secure, showcasing minor fluctuations over the previous month.

Conflicting Narratives

Interpretations of this knowledge differ throughout the business. Notable figures like Anthony Scaramucci downplay pessimism, underscoring the substantial $5 billion ETF debut and difficult critics to redefine their standards for achievement. Nevertheless, monetary establishments corresponding to LPL Monetary advocate for a cautious method, reflecting a divided sentiment throughout the market.

BTC market cap at present at $842.298 billion. Chart: TradingView.com

Bitcoin Miners On The Transfer

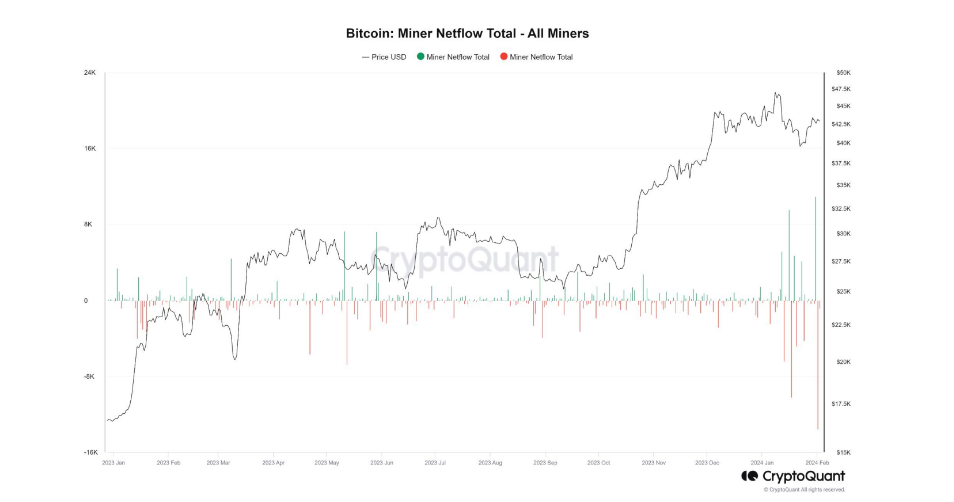

Past investor conduct, the launch of Bitcoin ETFs has considerably impacted crypto miners, who validate community transactions and obtain Bitcoin rewards. Bitfinex Alpha studies a noteworthy improvement, with over $1 billion price of Bitcoin flowing from miner wallets to exchanges within the first 48 hours of buying and selling – a six-year excessive in miner outflow. This phenomenon suggests potential promoting strain or strategic rebalancing actions by mining firms.

On-chain knowledge exhibiting miner pockets Bitcoin inflows and outflows after ETF approval. Supply: CryptoQuant/Bitfinex Alpha

Whereas the preliminary funding in Bitcoin ETFs confirmed promise, the next drop in pockets exercise and the surge in miner promoting actions increase questions in regards to the long-term implications of those monetary merchandise.

The true narrative stays obscured by varied components, together with the restricted timeframe analyzed, the precise profiles of traders withdrawing from wallets, and the affect of broader financial situations on cryptocurrency markets.

Featured picture from Adobe Inventory, chart from TradingView

[ad_2]

Source link