[ad_1]

- Despite the fact that the value has decreased, information confirmed BTC has not but hit its backside.

- A deep-dive confirmed that the coin can attain $64,688 so long as demand will increase.

It’s been 83 days for the reason that prestigious Bitcoin [BTC] halving occasion, but the coin has not displayed any glimpse of its conventional post-halving rally. This 12 months, the halving, which reduces the cash created and miners’ rewards, befell on the nineteenth of April.

Throughout that interval, Bitcoin’s worth modified fingers round $63,976. This was after it hit an all-time excessive of $73,750 in March. As anticipated, the broader market took the occasion as a vital one to drive larger BTC costs.

Persistence is the secret

A few month later, BTC retested $71,000. Nevertheless it didn’t take lengthy for the value to retrace. 83 days for the reason that Bitcoin halving, the value of the crypto has undergone notable corrections, and lose about 12.76% of its worth.

Whereas Bitcoin traditionally goes via a downturn after the halving, this one appears to be extraordinary. Notably, it is because the value motion has been underwhelming for about three months.

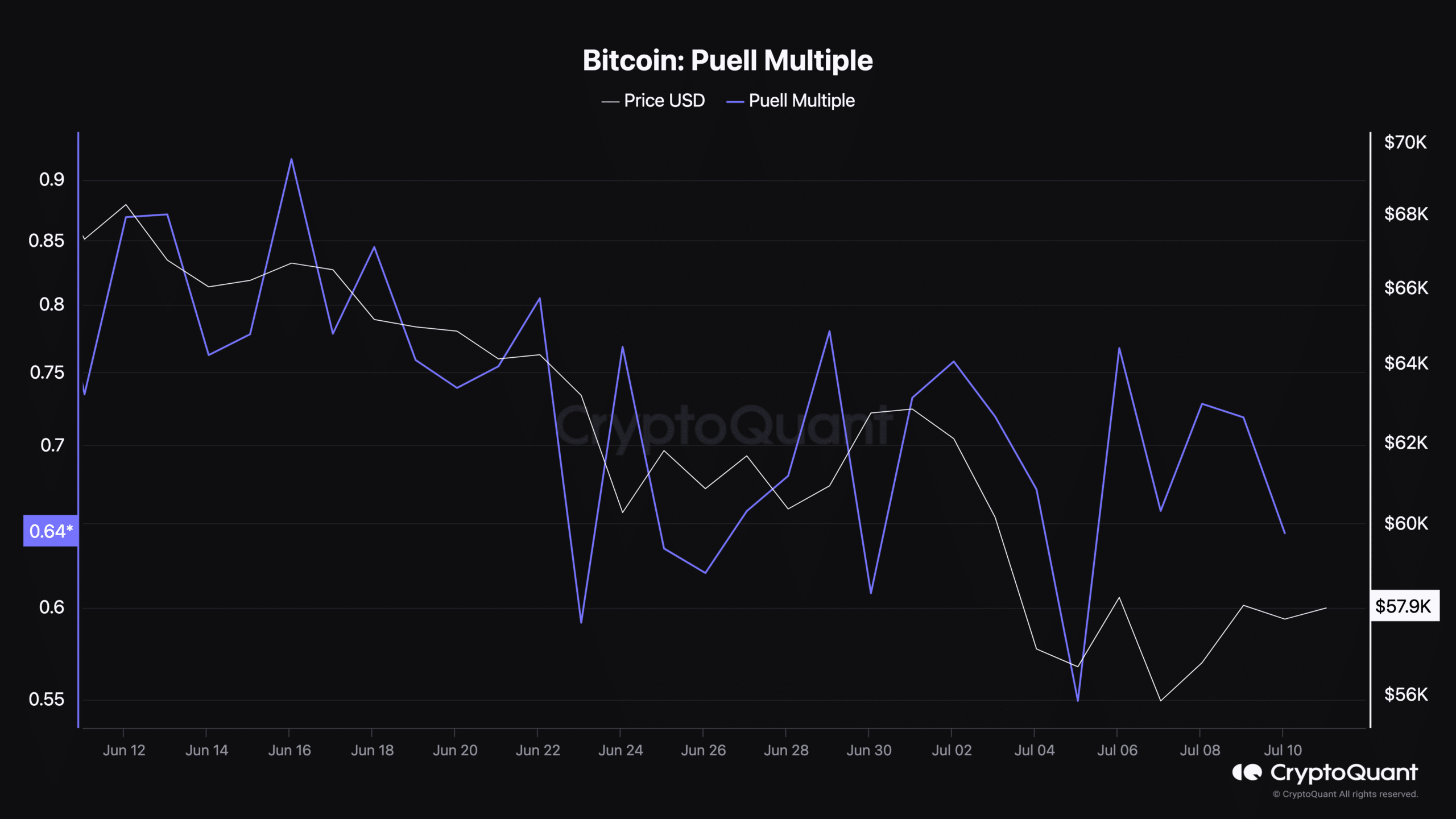

At press time, BTC’s worth was $57,908. Based on AMBCrypto’s analysis of the Puell A number of, the anticipated bull run won’t be right here but.

Puell A number of exhibits the distinction between the short-term Bitcoin miners revenue and that of the long run. It does this by dividing the day by day issuance of BTC by the 365-day issuance.

Usually, if the ratio is between 1 and 6, it signifies that costs are larger. Values over 6 point out that the value may need hit the highest.

Then again, if the Puell A number of is decrease than 1, it signifies that costs are down with values decrease than 0.40 suggesting the underside.

Based on CryptoQuant, Bitcoin’s Puell A number of was 0.64, indicating that correction continues to be ongoing. Nevertheless, if the ratio reaches 0.40, it may point out a backside for Bitcoin, and a rebound may very well be subsequent.

Nevertheless, it’s noteworthy to say that it may take one other month or so for Bitcoin to succeed in its backside. If that is so, the bull run won’t occur till the beginning of the fourth quarter (This fall) or near the top of Q3.

HODLers received’t simply quit

However additionally it is vital to notice that issues can change shortly. Ought to this occur and demand will increase, AMBCrypto’s prediction of $75,000 by the top of July may come to cross.

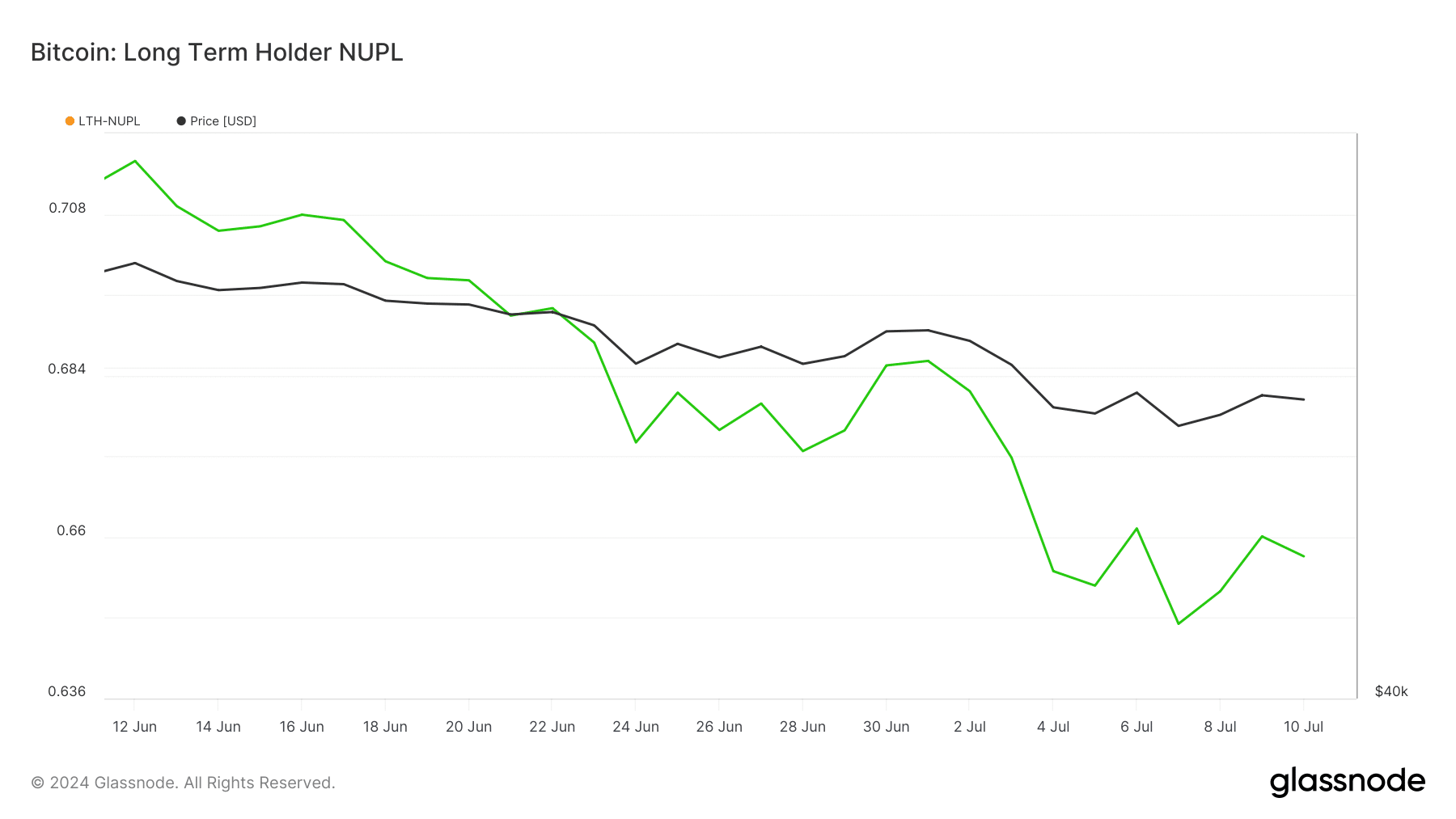

Regardless of the unimpressive worth motion for the reason that halving, long-term holders are displaying confidence within the coin’s potential. We noticed this after analyzing the LTH-NUPL.

LTH-NUPL stands for Lengthy Time period Holder- Web Unrealized Revenue/Loss. This on-chain metric analyzes the conduct of Bitcoin holders who’ve owned the coin for not less than 155 days.

Based on Glassnode, the LTH-NUPL was within the inexperienced zone, indicating belief in the long-term potential of BTC. Ought to this stay the identical going ahead, demand for Bitcoin would possibly enhance, probably pushing the value larger.

Nevertheless, if it retraces to the optimism or concern degree, Bitcoin’s momentum would possibly decelerate. Between the sixth of June and seventh of July, Bitcoin’s worth has decreased 21.46%.

Is a retest of $71,000 doable quickly?

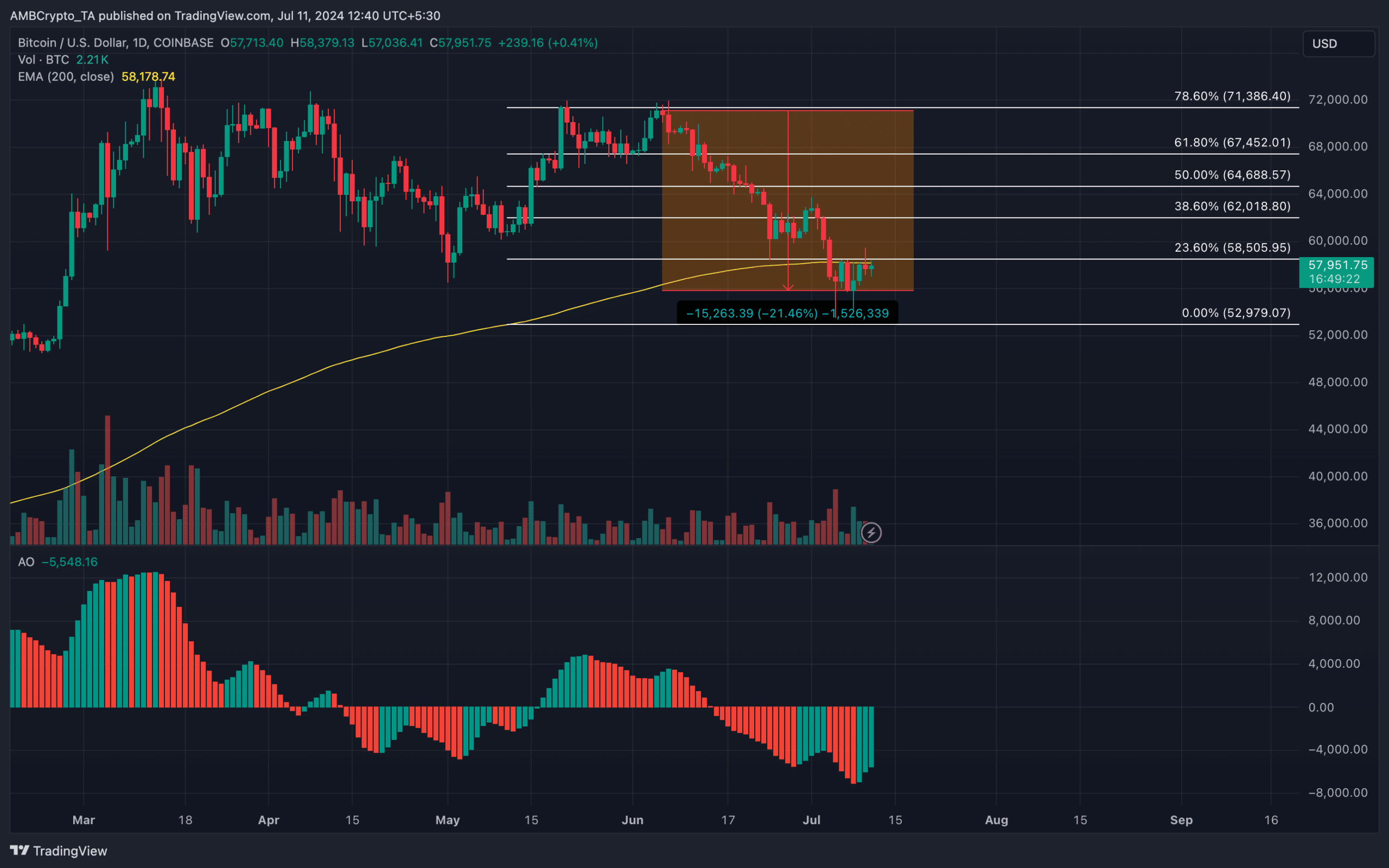

Whereas the value was near retesting $58,000, it nonetheless trades under the 200 EMA (yellow). EMA stands for Exponential Transferring Common (EMA). This indicator measures pattern path over a given interval.

If the value trades above it, it means the pattern is bullish. However whether it is under it, it signifies a bearish pattern. Nevertheless it was totally different for Bitcoin contemplating that the value was near flipping the zone

Ought to this occur, accompanied with indicators of accelerating upward momentum from the Superior Oscillator (AO), Bitcoin would possibly return to its bull phase.

Particularly, this might drive Bitcoin to retest its halving and doable commerce round $64,688.

In a extremely bullish case, the value would possibly bounce to $71,386, probably setting the stage for a bull run that takes the value towards $80,000.

Is your portfolio inexperienced? Verify the Bitcoin Profit Calculator

In the meantime, there was feedback from analysts per Bitcoin’s worth motion. One among them was from pseudonymous deal with on X Rekt Capital. Based on Rekt Capital, it’d take some time earlier than the bull run begins as he mentioned that,

“Bitcoin is just not prepared to interrupt the downtrend simply but”

[ad_2]

Source link