[ad_1]

- $1.84 billion in Bitcoin quick positions in danger if it hits $70,000.

- Current bullish alerts counsel a possible surge, regardless of ongoing market corrections.

Amid the turbulence of the crypto markets, Bitcoin’s [BTC] resilience is being examined because it battles to reclaim the $70,000 threshold, a worth level teeming with potential liquidations.

Brief sellers, laden with bearish bets, are intently monitoring each market tick, with vital monetary stakes hanging within the stability.

Bitcoin nears key thresholds

Bitcoin was buying and selling at $65,802 at press time, reflecting a slight uptick of 0.7% over the past 24 hours, but it nonetheless data an almost 7% drop over the previous week.

The crypto market’s present state reveals a sturdy battle between hope and warning.

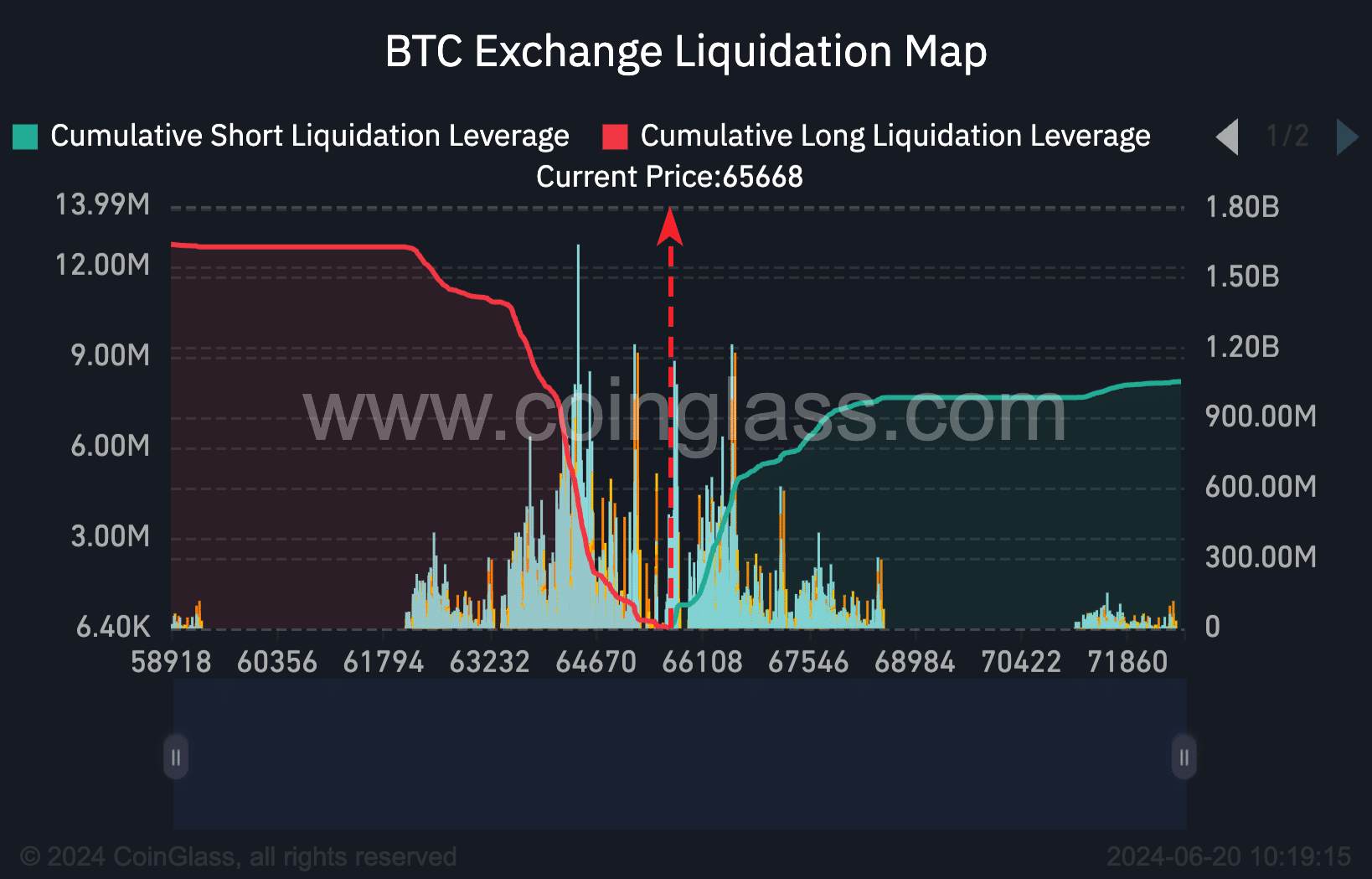

This sentiment is primarily fueled by the intensive quantity of quick positions totaling $1.84 billion, which faces the specter of liquidation, in keeping with data from Coinglass, ought to Bitcoin surge again to $70,000—a degree unseen since early June.

The potential for Bitcoin reaching this pivotal worth has been a subject of appreciable dialogue.

Joshua Jake, CEO of Uncover Crypto, shared his insights on X (previously Twitter), stating,

“Markets are extremely bullish proper now. Bitcoin and ETH Liquidations are stacked. Bounce imminent.”

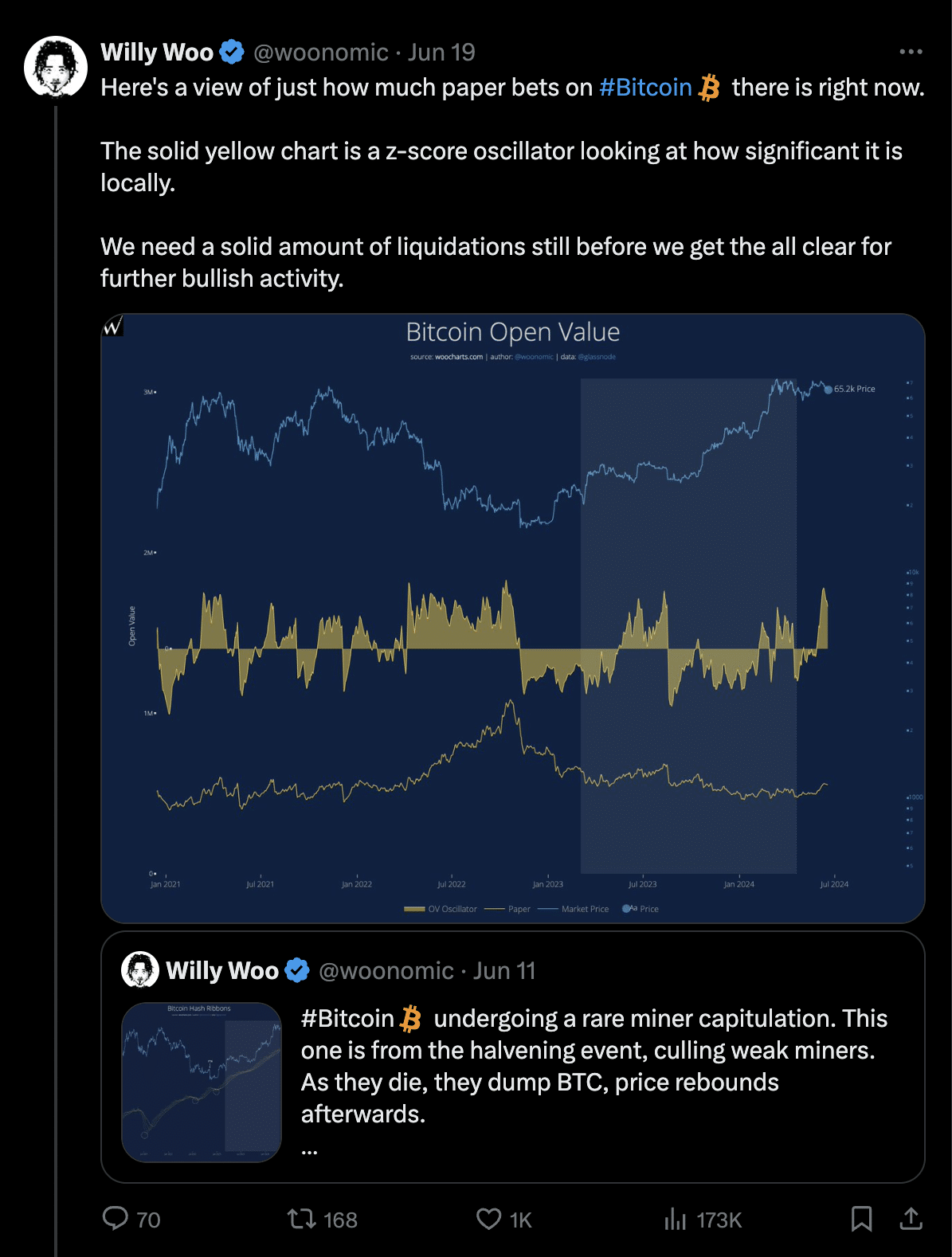

This sentiment was echoed by distinguished crypto analyst Willy Woo, who steered on the identical platform {that a} substantial wave of liquidations may be essential to clear the trail for a bullish resurgence.

Analyzing BTC’s fundamentals

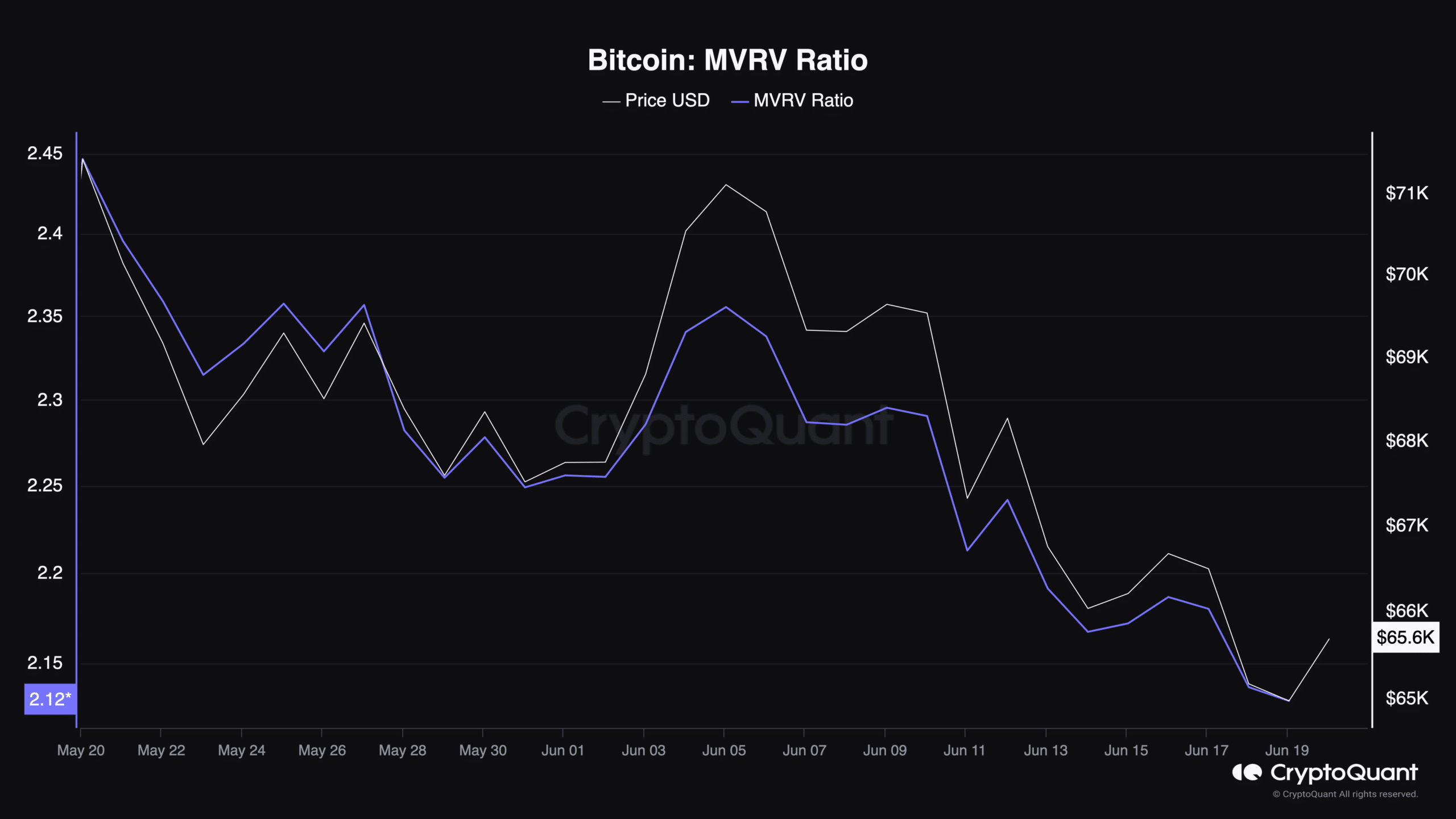

Delving into Bitcoin’s fundamentals, the MVRV ratio—a metric that compares the market worth to realized worth—has not too long ago declined alongside the worth, at present standing at 2.12, in keeping with data from CryptoQuant.

This determine means that Bitcoin would possibly nonetheless be undervalued, providing a probably profitable entry level for traders who imagine within the forex’s long-term viability.

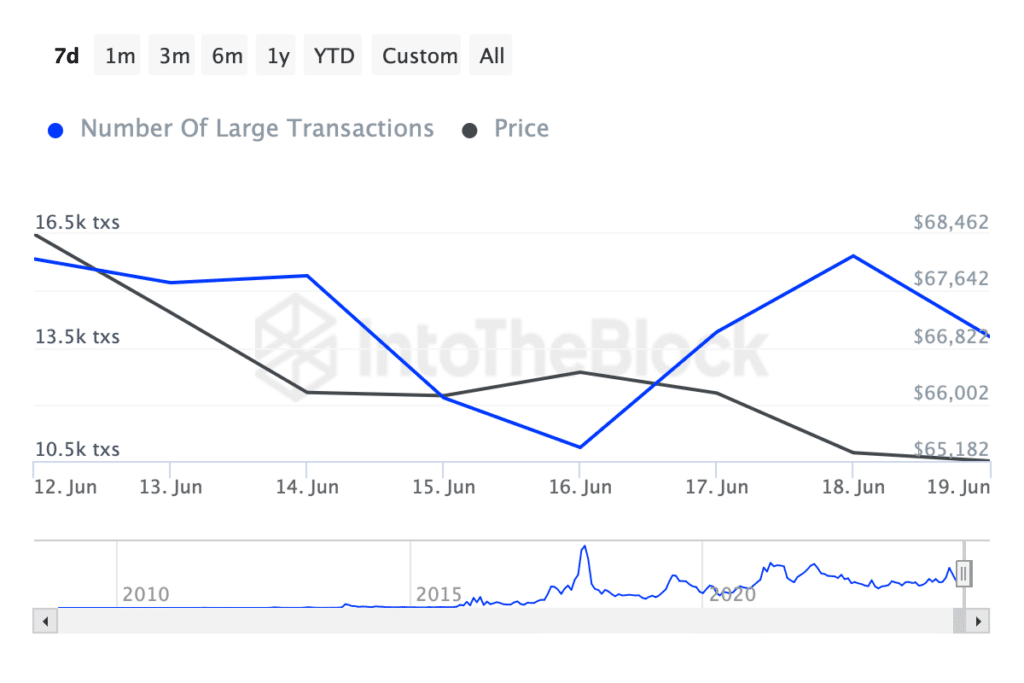

Moreover, there was a notable enhance in Bitcoin transactions exceeding $100k, which rose from under 10,000 to 13,000 transactions over the previous week.

This surge in giant transactions is usually seen as an indication of heightened exercise and curiosity from substantial traders or establishments.

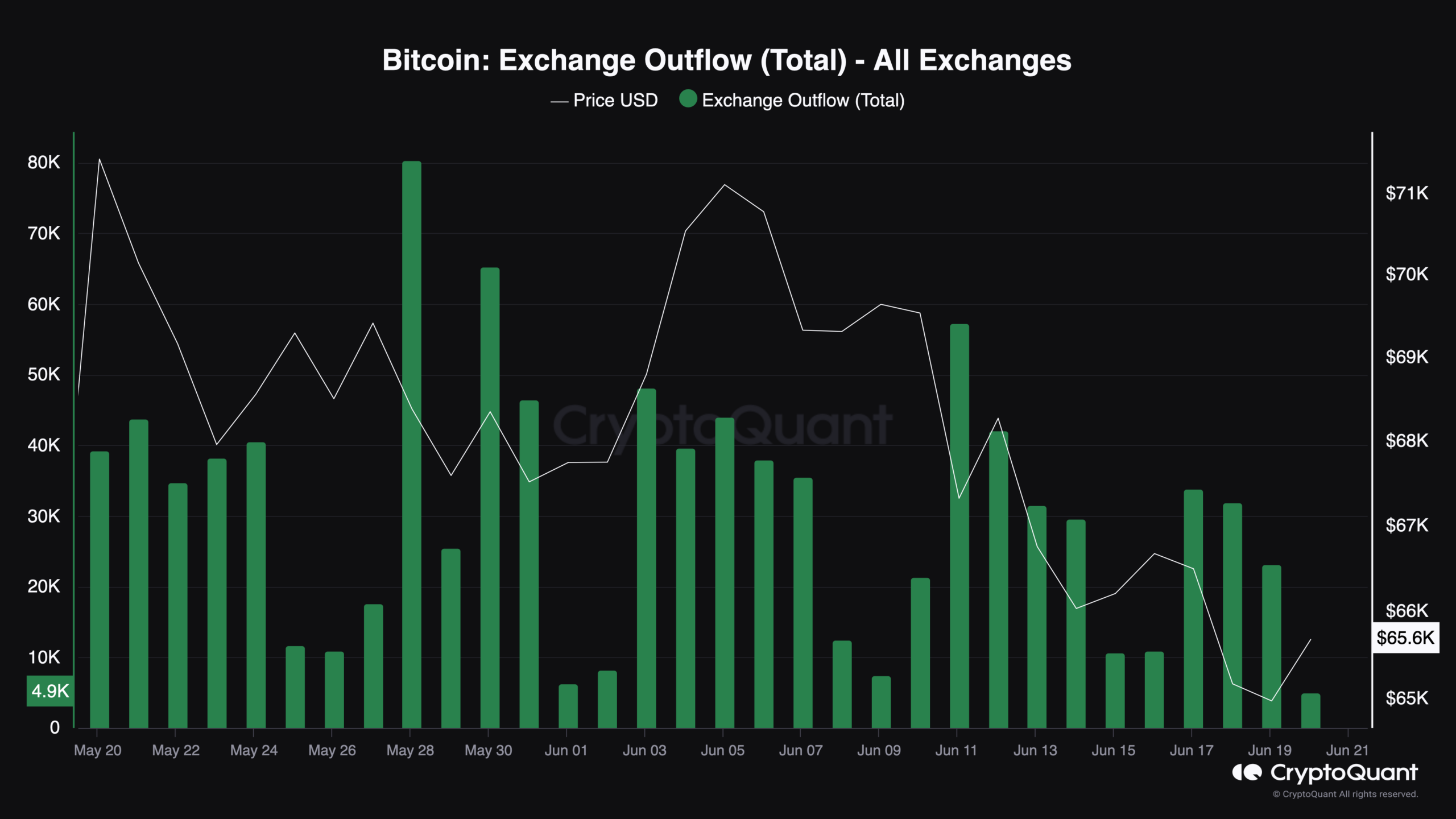

Complementing the transactional information, alternate outflow metrics from CryptoQuant have additionally indicated elevated exercise.

Particularly, Bitcoin outflows from exchanges spiked to over 33,000 BTC on seventeenth June, a major rise from figures recorded simply days prior.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Such outflows can typically sign accumulating conduct by traders, suggesting a attainable preparation for a worth enhance as cash transfer from exchanges to non-public wallets for long-term holding.

Regardless of these probably bullish indicators, there stays a cautionary word from AMBCrypto, which reported a key Bitcoin metric signaling a possible additional correction that would depress costs to as little as $54,000.

[ad_2]

Source link