[ad_1]

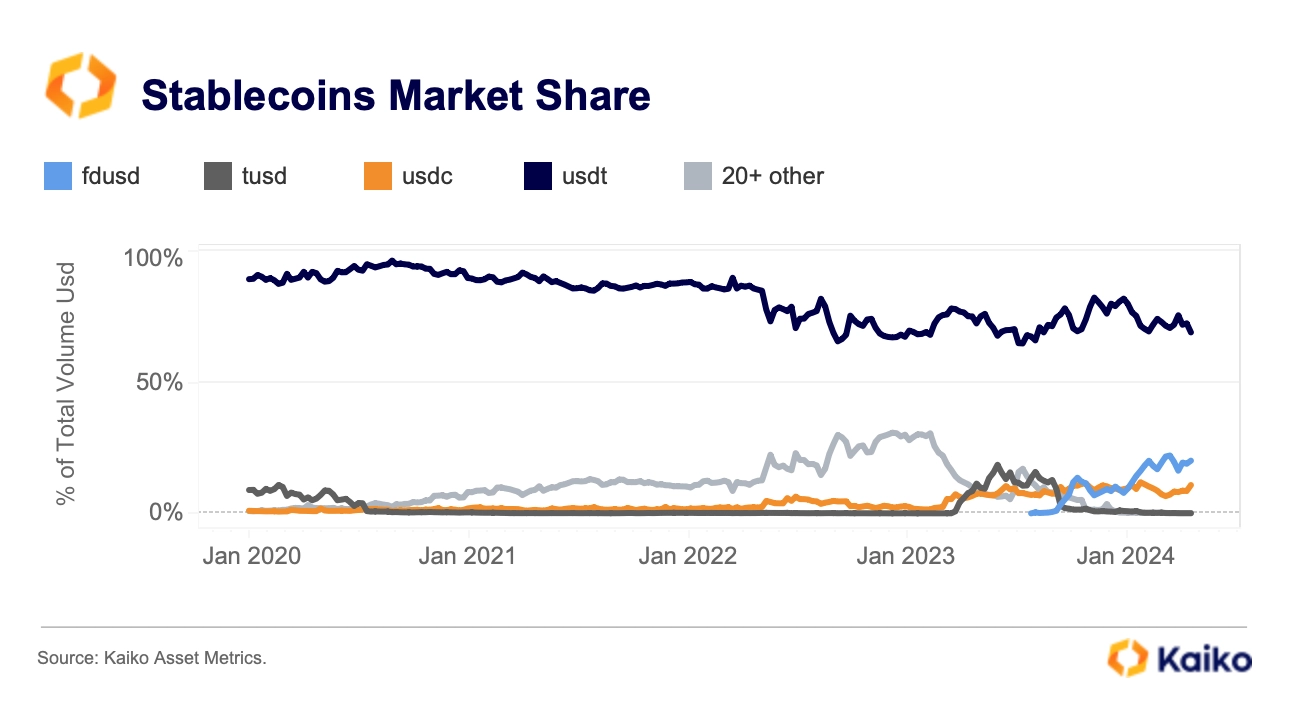

Market intelligence platform Kaiko Analytics stories that new opponents are chipping away at Tether’s (USDT) stablecoin dominance.

In a brand new report titled “Tether Loses Market Share,” Kaiko Analytics says that the stablecoin issuer’s market share over centralized alternate platforms (CEXs) has dipped 13% year-to-date (YTD) because of the development of rival dollar-pegged digital belongings, corresponding to FDUSD and USDC.

“Regardless of its dominant market place, USDT’s market share on CEXs has been trending downwards, declining from 82% to 69% YTD. This lower might be partly attributed to rising competitors from stablecoins like FDUSD which profit from Binance’s zero-fee promotions.

USDC has additionally skilled an increase in its market share, signaling a rising desire for regulated options. At current, stablecoins issued within the US make up 10% of the general stablecoin commerce quantity.

Solely one of many prime 5 stablecoins by market cap, Circle’s USDC, is regulated below state US cash transmitter frameworks. Nonetheless, its share has elevated from lower than 1% in 2020 to 11% at present.”  In accordance with Kaiko, different rivals corresponding to Ethena (USDe), which uniquely provides yield, may be slicing into Tether’s market dominance.

In accordance with Kaiko, different rivals corresponding to Ethena (USDe), which uniquely provides yield, may be slicing into Tether’s market dominance.

“One more reason for Tether’s declining market share might be linked to the emergence of modern yield-bearing options corresponding to Ethena’s USDe. Since its launch in February, USDe’s quantity has grown considerably, though it has retreated from April’s all-time excessive of greater than $800 million following Ethena’s ENA airdrop.”

In accordance with Tether’s 2024 Attestation Report, the agency posted a record-breaking $4.52 billion in earnings through the first quarter of the 12 months.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Price Action

Observe us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any losses chances are you’ll incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/balabolka

[ad_2]

Source link