[ad_1]

- With OpenAI’s new mannequin on the horizon, some altcoins are more likely to outperform.

- Buyers can seek advice from the Synthetic Intelligence sector of altcoins to maximise positive aspects.

- Worldcoin, andTokenFi might proceed to outperform their friends.

The Synthetic Intelligence (AI) firm OpenAI announced on Tuesday that it has begun coaching its new frontier mannequin.

OpenAI has just lately begun coaching its subsequent frontier mannequin and we anticipate the ensuing programs to carry us to the following degree of capabilities on our path to AGI.”

This information, coupled with rumors that the GPT-5 (Generative Pre-trained Transformer) has already been skilled, means that the discharge of the following mannequin will not be too far-off.

As a result of folks at the moment are severely beginning to say that the brand new mannequin that OpenAI says they’re beginning to practice is GPT-5, right here is the reference once more.

GPT-5 was already examined by the pink workforce in April. Coaching has lengthy since been accomplished.

What has now been began in coaching… https://t.co/vIwa3DuhYz— Chubby♨️ (@kimmonismus) May 28, 2024

Some sectors of cryptocurrencies are usually swayed by the developments within the AI area. For instance, the GPU-manufacturing firm Nvidia’s earnings performed a key function in some AI-based altcoins’ efficiency. Likewise, the discharge of the extremely anticipated GPT-5 mannequin might set off an analogous rally within the AI class of altcoins.

Learn extra: AI, meme coins and prediction market tokens soar ahead of Ethereum ETF decision

AI cheat sheet for GPT-5 launch

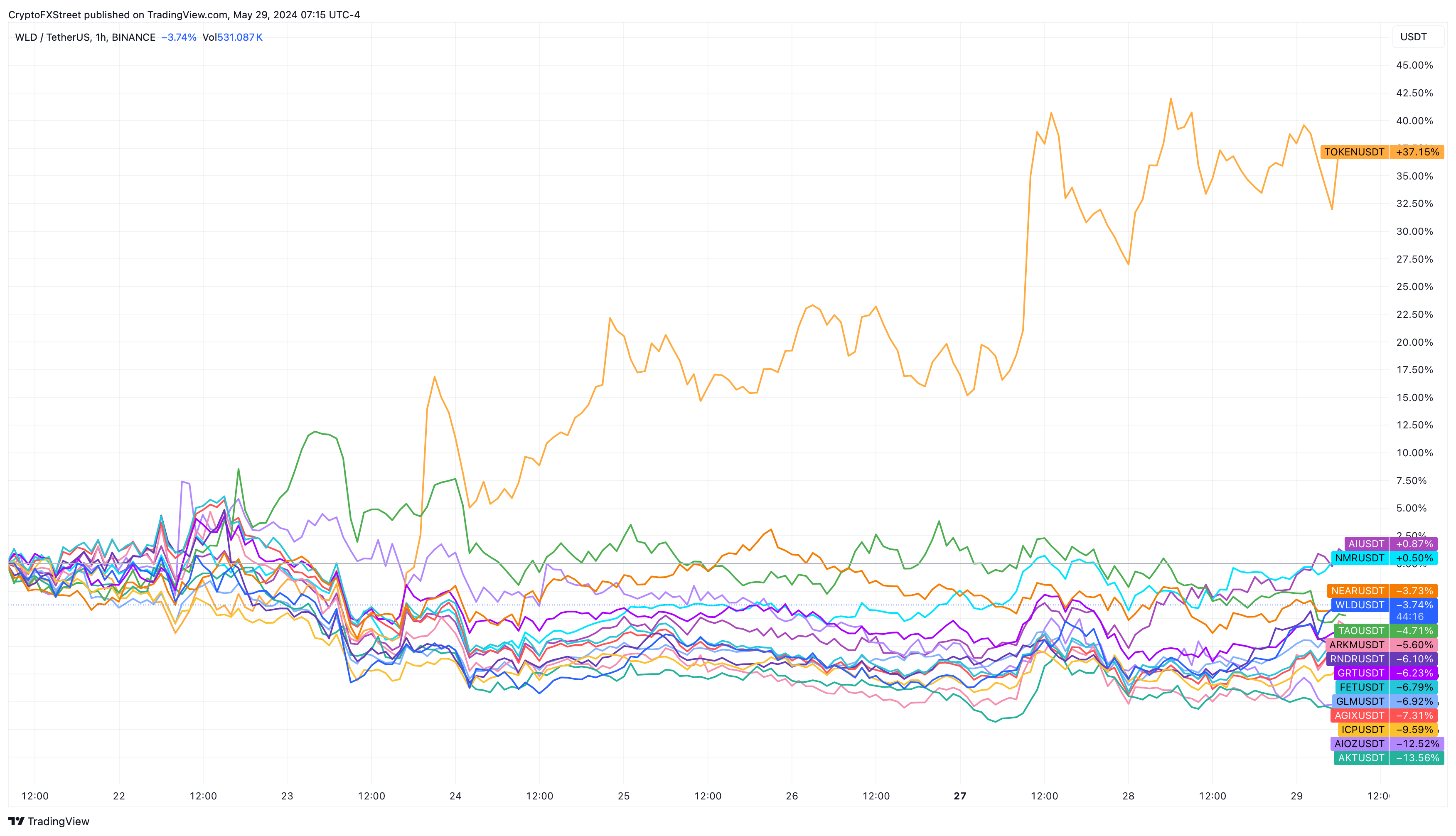

Under is the efficiency of a number of the AI-based altcoins. TokenFi (TOKEN) is a transparent winner, with a 37% achieve prior to now seven days. The positive aspects of different cryptocurrencies are minuscule and can’t be in contrast with TOKEN.

AI Altcoins’ efficiency

No matter their efficiency within the final seven days, listed here are two tokens that might see a large enhance within the upcoming days.

- Token (TOKEN), as a result of momentum it has.

- Worldcoin (WLD), resulting from its reference to OpenAi, i.e., Sam Altman.

Learn extra: Worldcoin price could rally 20% if Nvidia earnings beat estimates

Let’s perceive the place the TokenFi value might go subsequent.

The 12-hour chart for TOKEN exhibits that it’s at a vital level in its uptrend journey. Up to now, the TokenFi value has surged 42% prior to now two weeks and is presently retesting $0.161, the midpoint of the $0.0762 to $0.246 vary. Moreover, this degree coincides with the Quantity Profile’s high-volume node. This indicator tracks the distribution of buying and selling quantity throughout totally different value ranges and may be interpreted as locations of high-volume and low-volume nodes. The previous can function a help or resistance degree relying on the relative place of the value. The latter, nevertheless, is seen as liquidity pockets that act as purchase zones and entice value reversals.

Going ahead, in case of rejection on the $0.161 key hurdle, traders can count on TOKEN to retest the $0.135 and $0.129 help ranges . This 15% correction generally is a good alternative to build up for sidelined and long-term traders. The Relative Power Index (RSI) is hovering within the overbought zone and helps the potential pullback. Nevertheless, traders want to notice that there aren’t any short-term promote indicators that help this correction.

Regardless, if the mentioned pullback happens, TokenFi might stablize across the above-mentioned ranges. Following this, a bounce might see TOKEN try a retest of the 62% retracement degree at $0.181, which coincides with Quantity Profile’s high-volume node, making it a great degree to e book income, at the very least for swing merchants.

TOKEN/USDT 12-hour chart

However, if TokenFi value fails to bounce across the $0.135 and $0.129 ranges, it might denote weak point amongst patrons. In such a case, TOKEN bulls might have an opportunity to type a base round $0.110, which is known as the Level of Management (POC) and is the very best quantity traded degree for the chosen vary, in keeping with the Quantity Profile indicator.

A breakdown of $0.110 degree will create a transparent break of market construction by producing a decrease low beneath the Could 23 swing low of $0.108. Such a devastating transfer would invalidate the bullish thesis and will set off an additional 30% correction to $0.0762.

[ad_2]

Source link