[ad_1]

- On 2 September, WazirX held a digital townhall assembly to debate their plan to recuperate stolen funds

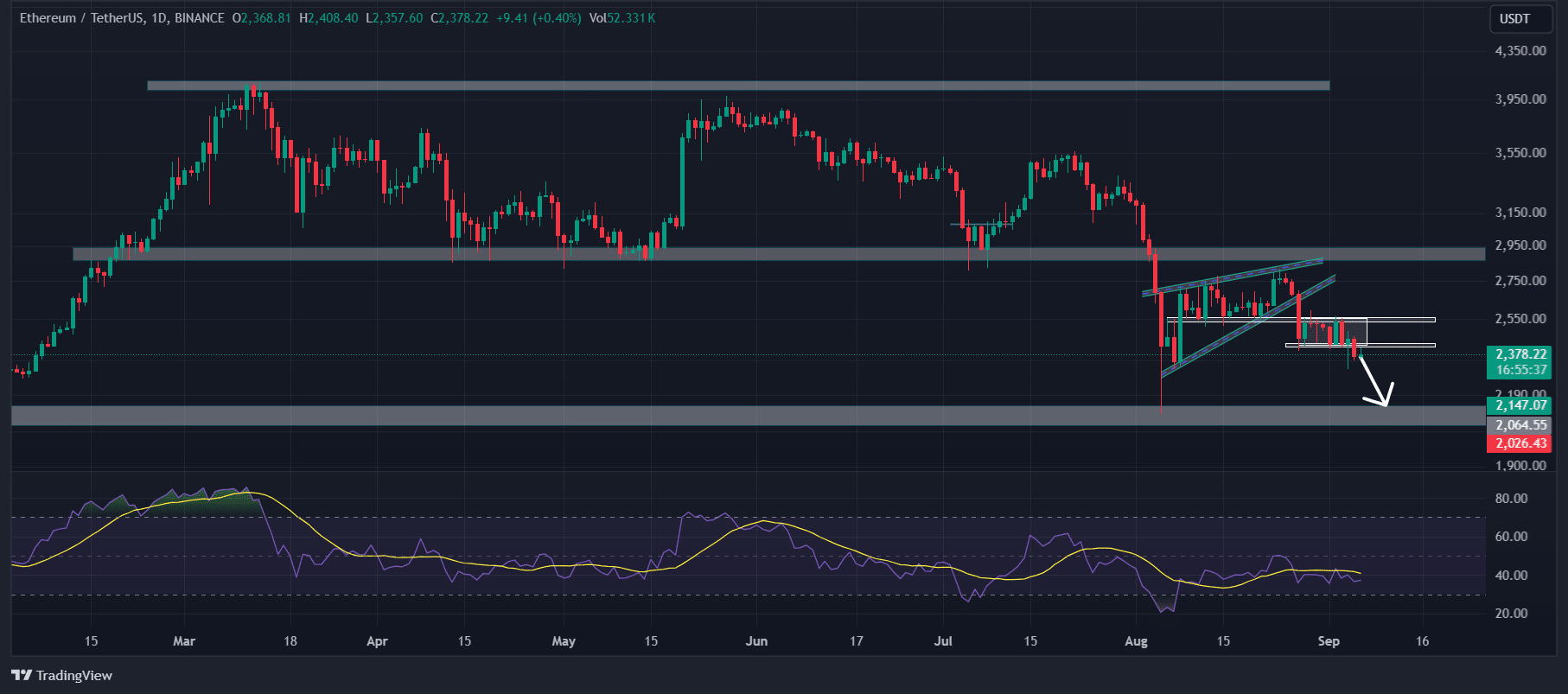

- ETH may fall to $2,200 and even decrease because it breaks out of the week-long consolidation zone

The latest actions of the WazirX, Penpiexyz, and Fenbushi exploiters have captured everybody’s consideration. Particularly as they’ve began transferring tens of millions value of stolen funds amid the market’s bearish sentiment.

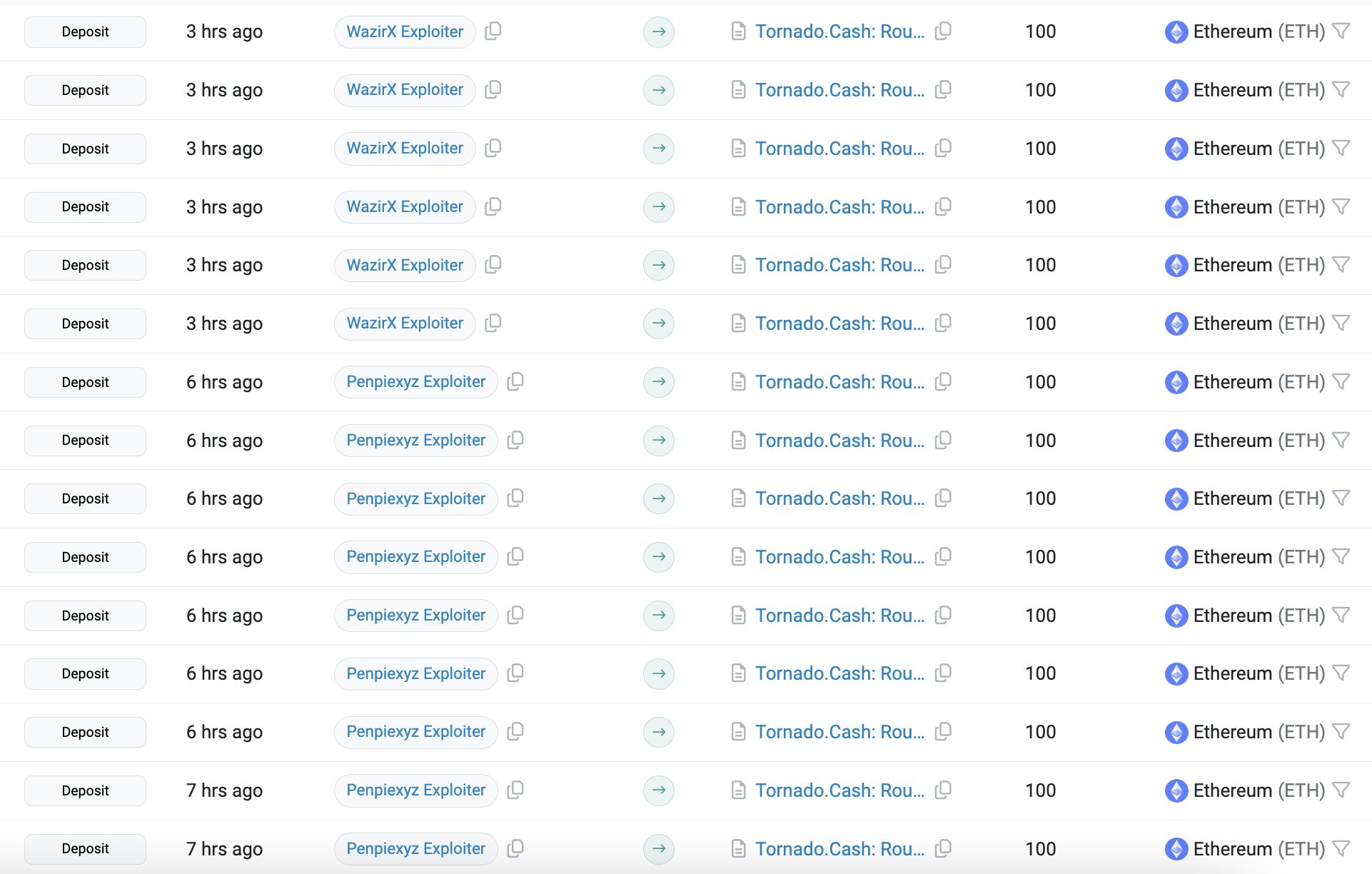

On 6 September 2024, the on-chain analytics agency Lookonchain revealed that these hackers deposited a major 17,800 ETH value $42.7 million into Twister Money within the final three days.

WazirX exploiter strikes tens of millions value of ETH

Nonetheless, one concern amongst buyers and establishments is the restoration of the stolen funds. On 2 September 2024, WazirX held a digital townhall assembly to debate their plan to recuperate the stolen funds from the exploiter.

For the reason that assembly, the WazirX exploiter has transferred 7,200 ETH value $17.3 million into Twister Money. It seems that they haven’t any plans to return a major $235 million value of crypto.

Moreover, Penpiexyz exploiters, who drained $27 million value of belongings, additionally deposited a major 9,600 ETH value $23 million to Twister Money.

On this delicate market situation, these vital fund transfers could set off panic and gas promoting strain.

Ethereum technical evaluation and key ranges

On the day by day charts, ETH’s price action appeared tremendous bearish. After the breakdown of the rising wedge value motion sample on a day by day timeframe, it consolidated for every week.

On the time of writing, it was breaking out of that consolidation zone whereas closing a day by day candle under the zone.

Based mostly on the historic value momentum, there’s a excessive probability that ETH may fall to the $2,200 degree and even decrease.

Then again, the Relative Power Index (RSI) was in an oversold space which may doubtlessly level to a value reversal. Nonetheless, given the market circumstances and whale exercise, this could be unlikely.

ETH’s value momentum

On the time of writing, ETH was buying and selling close to $2,374 following a value drop of 1% within the final 24 hours, in response to CoinMarketCap. In the meantime, its buying and selling quantity additionally dropped by 6% over the identical interval, indicating decrease participation from merchants amid the market sell-off.

Quite the opposite, ETH’s Open Interest hiked by 1.2% within the final 24 hours, indicating rising ETH Future contracts amid value decline.

[ad_2]

Source link