- Ethereum types a parallel upward channel as value breaks the 52 week shifting common.

- the RSI of ETH/USD is oversold as funding charges change into usually constructive.

The worth of Ethereum [ETH] is beginning to present a transparent development as merchants put together for a possible bull market in late 2024 or early 2025.

On the 4-hour chart, ETH/USDT has shaped a bear flag sample inside a rising channel, heading in the direction of the $2900 stage.

It appears probably that the value of ETH will attain this provide zone, which coincides with the 200 EMA cloud on the 4-hour chart.

For a bullish development to solidify, ETH wants to interrupt above and keep above the 200 EMA. Whereas the general outlook is constructive, warning is suggested if the value stays beneath the $2900 mark for an prolonged interval.

Moreover, ETH value on the weekly chart is following a two-year upward development channel, repeatedly touching the decrease trendline and hinting at a possible rise to the $2900 stage.

Presently, the value is beneath the annual common, highlighting $2900 as a key resistance level.

The chart additionally exhibits that ETH/USDT has just lately damaged via the 52-week exponential shifting common however left a protracted tail on the weekly candle, indicating robust shopping for strain.

This means that regardless of the present value being decrease, there’s vital curiosity and potential for a transfer in the direction of the $2900 mark.

Supply: Tech Charts, TradingView

Altcoins at ranges they bottomed

One other signal that ETH could rise is the present state of altcoins. They’re now at ranges much like these seen in 2020 and 2023, which marked the bottom factors for altcoins.

This means Ethereum is perhaps approaching a backside. With market contributors feeling fearful and altcoins buying and selling at these historic lows, it’s a sign of potential alternative.

Skilled merchants typically advise being extra aggressive when the market is fearful. As retail buyers stay cautious, worthwhile merchants see this as an opportunity to speculate.

Supply: TradingView

RSI of ETH is oversold with constructive funding charges

Wanting into the ETH/USDT value motion, RSI has dropped to the oversold zone and bounced sharply from the 30% stage.

This motion aligns with the ascending assist trendline for ETH/USD, suggesting that the value is ready to rebound from this level. This bounce may drive Ethereum’s value to new highs.

Supply: TradingView

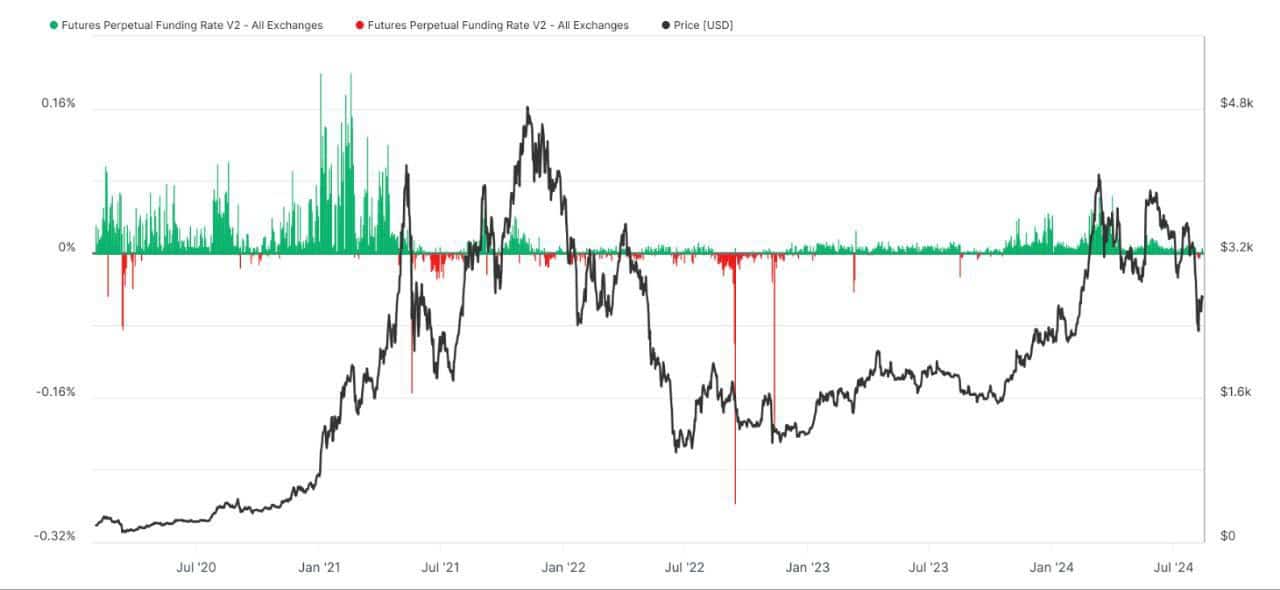

Lastly, detrimental funding charges normally imply that merchants betting towards Ethereum (brief positions) are paying these betting on it (lengthy positions), indicating bearish sentiment.

Nonetheless, Glassnode information exhibits that in 2024, Ethereum’s funding charges have principally been constructive, reflecting bullish expectations.

Supply: Coinglass

Learn Ethereum’s [ETH] Price Prediction 2024-2025

The current drop in Ethereum’s value to $2,100, mixed with falling funding charges, suggests a shift in market sentiment.

Regardless of this current decline, the general constructive funding charges all through 2024 trace at a possible value rally within the close to future.