[ad_1]

- Ethereum faces headwinds after a bearish breakout under the 5-month rectangle sample.

- ETH has held onto the essential assist at $2,611, however the short-term sentiment remained bearish.

The constructive U.S. Shopper Value Index (CPI) knowledge launched on the 14th of August turned out to be a sell-the-news occasion, inflicting most cryptos to commerce within the purple.

Inasmuch, the biggest altcoin, Ethereum (ETH) is down by 4% in 24 hours to commerce at $2,622 on the time of writing.

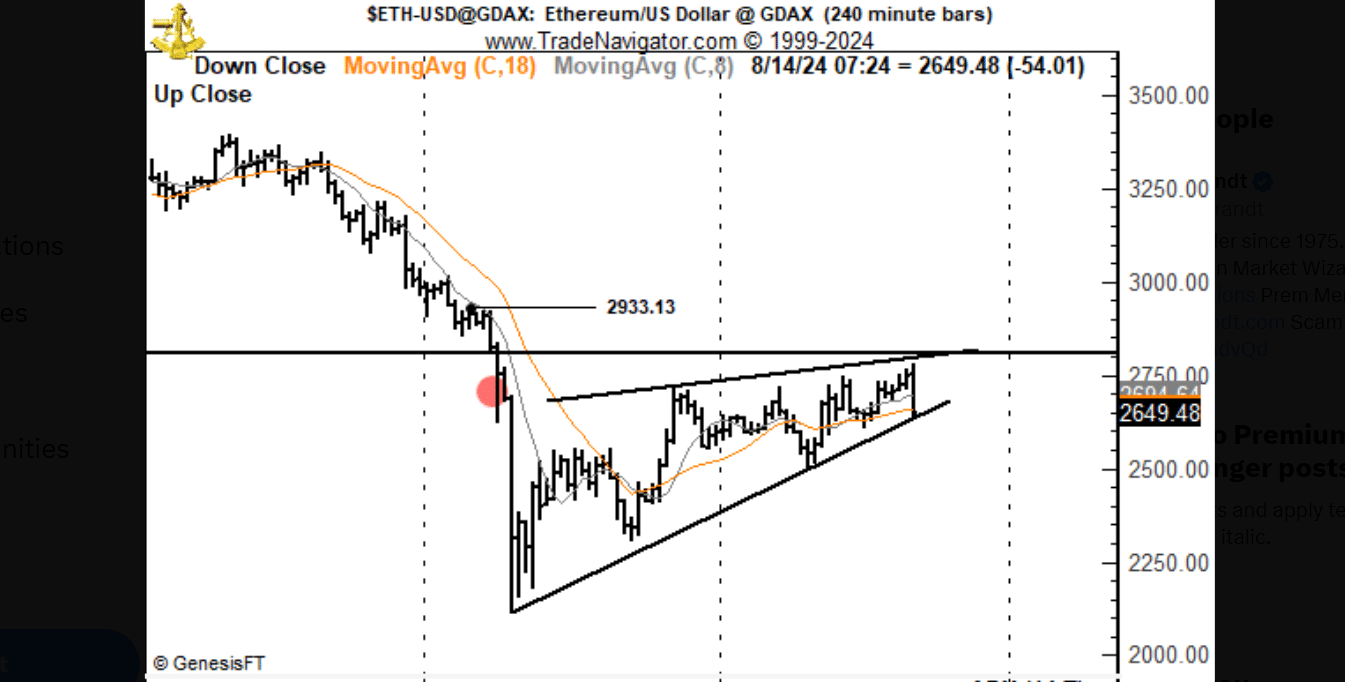

Analyst Peter Brandt believed that ETH was headed for additional headwinds after finishing a five-month rectangle sample on the 4th of August.

ETH’s worth was range-bound through the 5 months, earlier than a bearish breakout that noticed it type a key resistance at $2,933.

ETH tried to rally previous this resistance on the 14th of August, however failed. The rising wedge sample on the intraday chart additionally confirmed weakening momentum and a possible bearish reversal.

With these bearish indicators in play, Brandt predicted a drop to $1,652. The analyst has since created a brief place focusing on this drop. He added that the bearish thesis can be invalidated if ETH strikes above $2,961.

Huge drop forward for Ethereum?

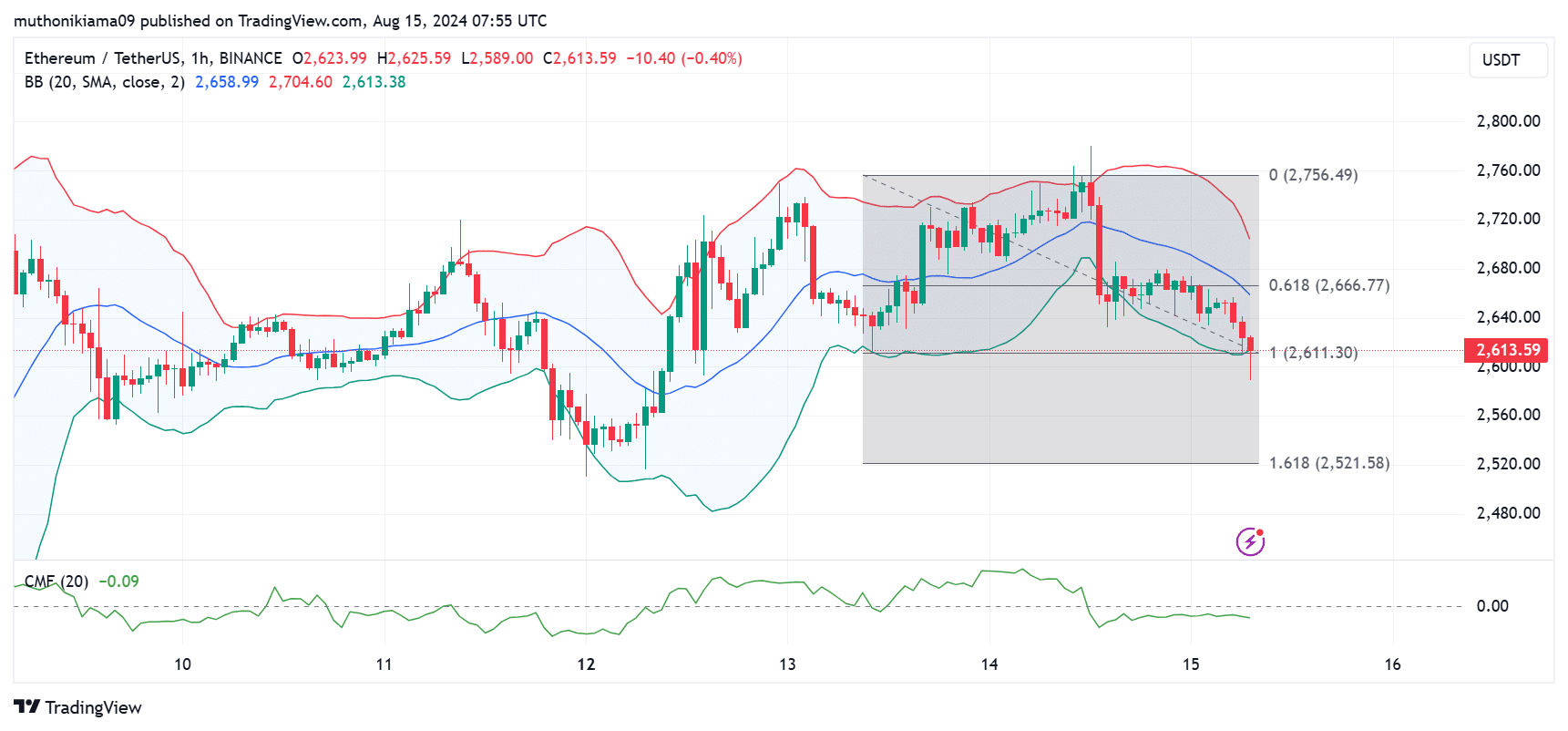

Technical indicators indicated a short-term bearish thesis round ETH. The Chaikin Cash Move (CMF) was at -0.09 exhibiting promoting strain.

The CMF has additionally remained flat, suggesting a scarcity of market confidence in ETH and a reluctance by consumers to open new positions.

The Bollinger bands have widened, exhibiting rising volatility through the downtrend. The worth has dropped from the higher band to the decrease band over the previous day, with this transfer indicating a pointy bearish reversal.

Ethereum was holding a vital assist stage at $2,611. If it fails, it would register a drop to the 1.618 Fibonacci stage ($2,521).

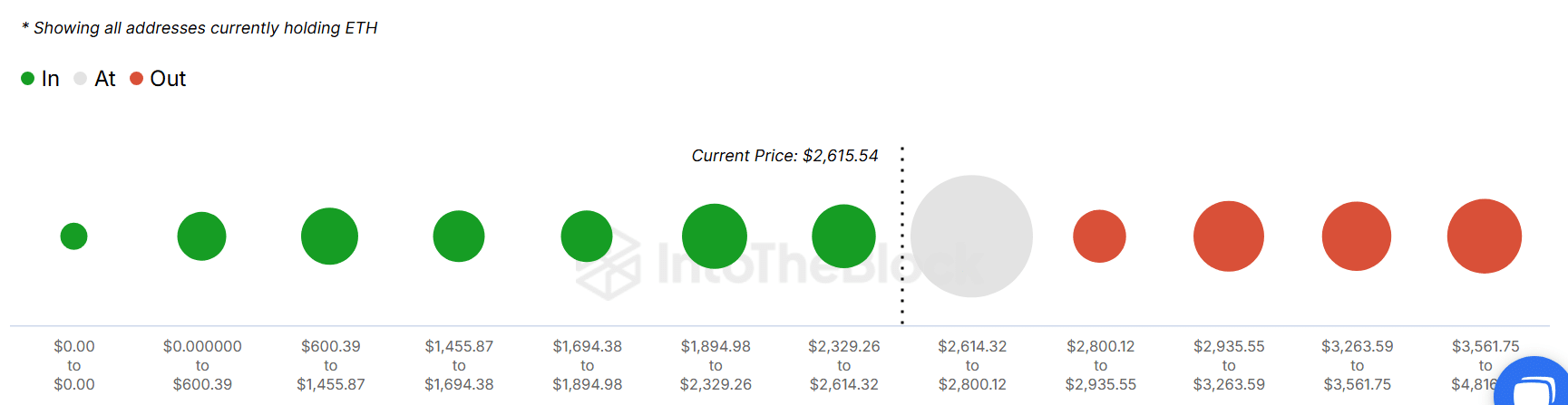

Ranges between $2,614 and $2,800 have been essential as a lot of addresses that purchased at these costs have been “On the Cash.” at press time.

Dropping under dangers further promoting strain if merchants select to promote and decrease their losses.

An additional have a look at the Futures market indicated that merchants have been betting in opposition to ETH. The Lengthy/Quick Ratio was at 0.90 at press time, suggesting that extra merchants have been taking brief positions and abandoning lengthy positions.

Is your portfolio inexperienced? Try the ETH Profit Calculator

The opposite indication that Futures merchants are much less satisfied about ETH’s worth is the three% drop in Open Curiosity (OI).

Per Coinglass knowledge, OI has been on a gentle drop from over $14 billion firstly of the month to the present $10 billion.

[ad_2]

Source link