[ad_1]

- The January lows which launched the rally to $4k have been retested within the early hours on the fifth of July.

- It’s too early to name for an Ethereum backside, however traders can await extra readability over the following week.

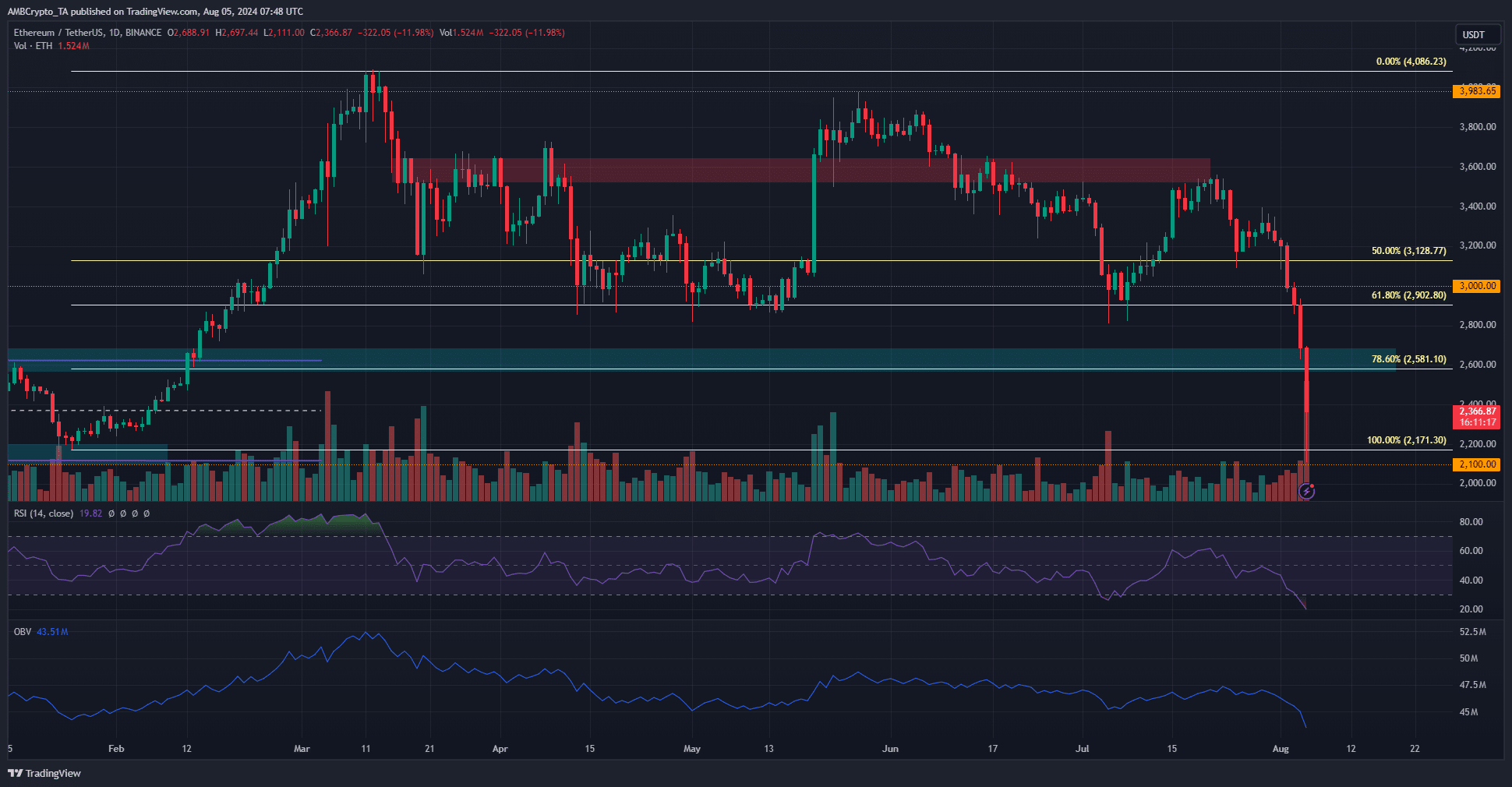

Ethereum [ETH] plummeted to the January lows over the previous few hours. Its descent under $2.9k was adopted by a 27.5% drop over the following 12 hours.

At press time, ETH has bounced to $2366 from the $2.1k lows, a 12.17% bounce.

The good cash that purchased near $20 million when costs have been at $2.9k and $3.1k has not been right this time, smudging a beforehand perfect track record.

The February rally’s launchpad was retested

The worth crash of the previous couple of days was brutal. In simply the final 24 hours, Ethereum markets noticed $346.5 million value of liquidations. The each day RSI fell to 19, the bottom since 18th August 2023.

The each day session has not but closed, however as issues stand, the rally earlier this 12 months has been wholly retraced. The $2.5k-$2.6k zone is more likely to function resistance on the best way upward.

The OBV fashioned a brand new low to encapsulate the thought of maximum promoting quantity. The day’s buying and selling quantity is 1.55 million ETH and counting, the best in 2024.

Whereas it may be a great purpose to purchase, extra conservative merchants and traders would wish to see costs reclaim key assist zones and keep above them for a number of days earlier than they’re assured sufficient to bid.

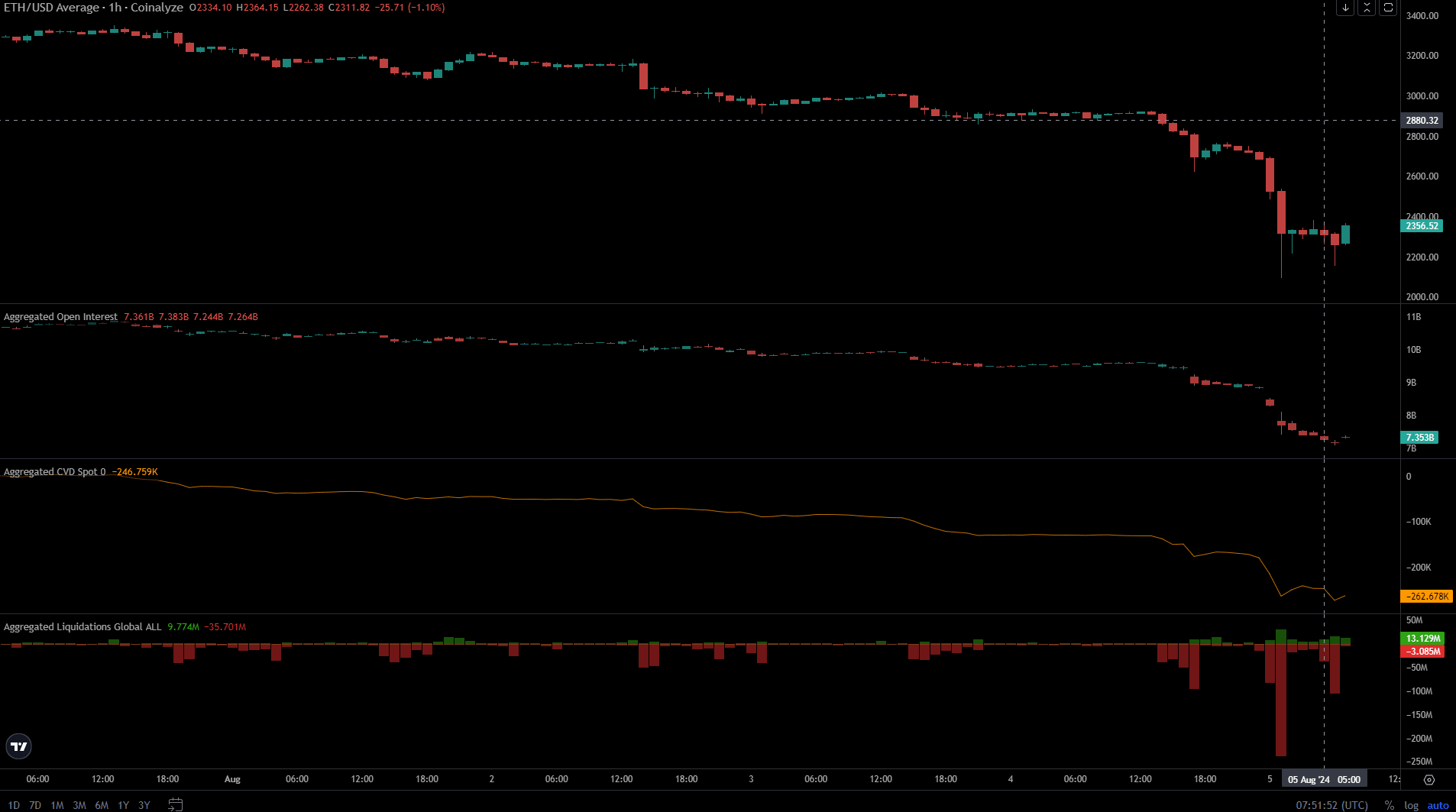

The Futures market worn out swathes of ETH merchants

Supply: Coinalyze

Market crashes like these aren’t a great time to be in a leveraged commerce, as 270k+ crypto traders discovered over the weekend. The Open Curiosity has fallen from $9.9 billion on the third of August to $7.35 billion at press time.

Is your portfolio inexperienced? Try the ETH Profit Calculator

The spot CVD fell deeper, supporting the thought of intense promoting. The liquidations of the previous couple of days have been largely lengthy, as anticipated.

A bounce towards $2.5k was potential, however the New York buying and selling session can see added promoting strain.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

[ad_2]

Source link