[ad_1]

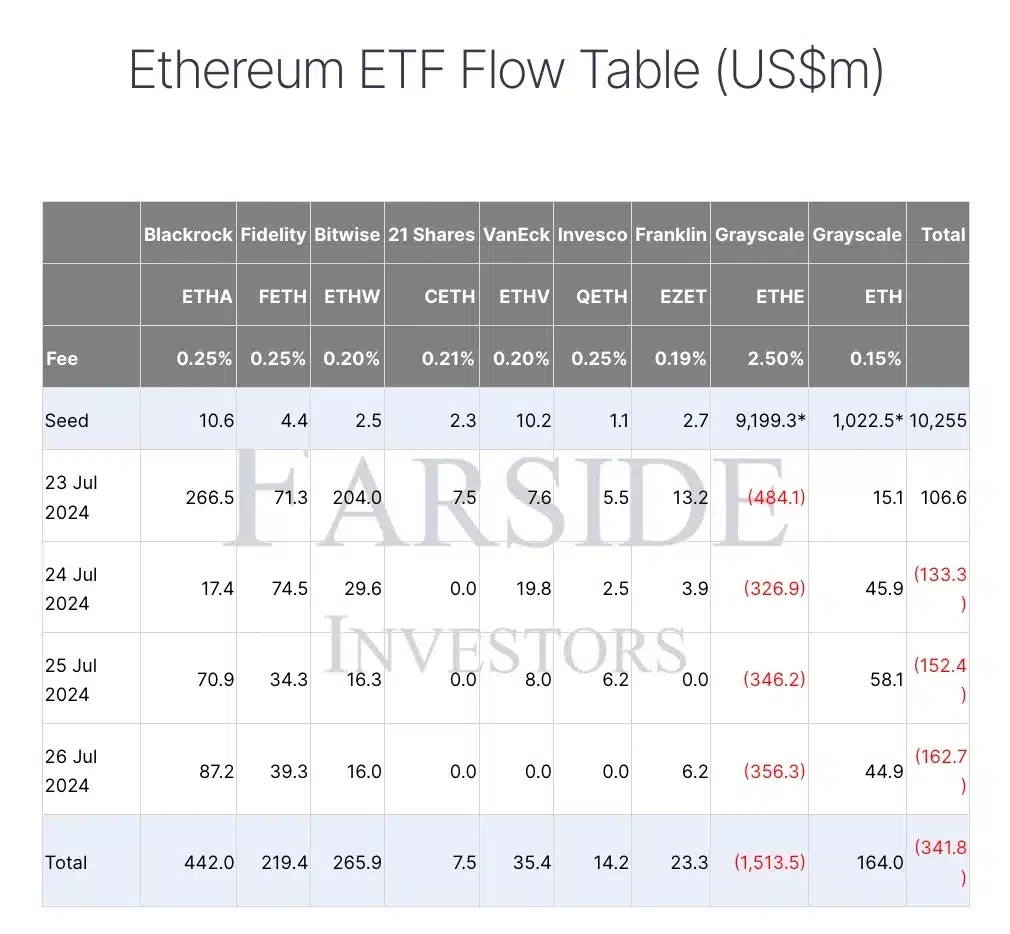

- Grayscale’s Ethereum Belief ETF noticed $1.5 billion in outflows from the twenty third to the twenty sixth of July.

- BlackRock’s iShares Ethereum Belief ETF attracted $87.2 million in inflows on the twenty sixth of July.

Because the approval of the spot Ethereum [ETH] ETF for buying and selling, Grayscale Ethereum Belief ETF [ETHE] has skilled vital outflows.

Grayscale breaks report

From the twenty third to the twenty sixth of July, the ETH ETF noticed complete outflows exceeding $1.5 billion, with a single-day web outflow of $356 million on the twenty sixth of July, in accordance with Farside Investors.

This sharp decline highlighted a notable shift in investor sentiment and raises a query: Ought to buyers purchase ETH earlier than Grayscale’s dwindling provide drives up the worth attributable to increased demand?

In response to this, market analysts @CuratedByR famous on X (previously Twitter),

“There is no such thing as a simpler commerce than the ‘purchase simply earlier than Grayscale runs out of $ETH ’ commerce. Don’t overcomplicate issues.”

Impression on ETH’s worth

Addressing these considerations, AMBCrypto analyzed ETH’s market traits and located that the most important altcoin was buying and selling at $3,366, reflecting a 4% improve over the previous 24 hours, per CoinMarketCap.

The Relative Energy Index (RSI), positioned above the impartial stage at 51, additionally indicated ongoing bullish momentum.

Moreover, the closing Bollinger Bands signaled reducing volatility, reinforcing the expectation that the present bullish development was more likely to proceed.

ETH ETF movement evaluation

Grayscale’s Ethereum Mini Belief ETF (ETH) skilled a optimistic shift with a web influx of $44.9 million on the twenty sixth of July, bringing its complete web inflows to $164 million since its inception.

In the meantime, BlackRock’s iShares Ethereum Belief ETF (ETHA) had garnered vital investor curiosity, recording a considerable web influx of $87.2 million on the identical day.

As anticipated, this surge elevated ETHA’s complete web inflows to $442 million, highlighting its main place out there.

Therefore, regardless of Grayscale’s underperformance, investor optimism for ETH ETFs remained robust, due to inflows into different ETFs.

X person Joseph put it finest when he stated,

[ad_2]

Source link