[ad_1]

- Citi analysts have tipped Coinbase’s COIN for a +30% rally to $345

- Additionally they cited growing regulatory readability in crypto as the key catalyst

Citigroup analysts have upgraded Coinbase shares (COIN) to ‘BUY.’ In line with them, COIN may hit $345 on the charts, a 33% potential rally from its press time value of round $260.

The Citi analysts, led by Peter Christiansen, opined that the enhancing regulatory panorama round crypto is a significant catalyst for the acknowledged bullish outlook for COIN.

“Shifts within the U.S. Election panorama and the Supreme Court docket’s overturning of the long-standing Chevron precedent has modified our view on Coinbase’s regulatory dangers.”

Given the more and more conducive regulatory crypto area, Citi is now projecting an “upside alternative” that might entice extra institutional and retail capital to Coinbase and COIN.

“Doubtlessly unlocking sidelined institutional capital, funding, and elevated crypto-native and conventional finance collaboration.”

Extra catalysts for Coinbase

Aside from the possible easing dangers on the regulatory entrance, the analysts identified some crypto-native optimistic components that might additional bolster Coinbase and its inventory.

Coinbase’s Base, an Ethereum [ETH] L2, has seen huge traction. It’s seen by Citi analysts as “buyer engagement” ripe for long-term alternatives.

To maximise on this entrance, the analysts have implored Coinbase to deal with growing its Base market share to faucet into attainable long-term alternatives. Additionally they cautioned that elevating transaction charges may undermine energetic customers and restrict alternatives.

“The main focus is on engagement, which might be measured by transactions and energetic customers. Elevating transaction charges or neglecting to decrease them when the chance arises can create friction or give rivals a comparative benefit.”

Curiously, the dearth of a staking function on current U.S spot ETH ETFs was additionally deemed a optimistic catalyst. That is true for traders looking for staked ETH yields, forcing them to go for Coinbase alternate, driving up volumes. A part of the evaluation learn,

“Buyers who nonetheless need native yield on ETH will nonetheless must buy these belongings on digital asset exchanges (corresponding to Coinbase) versus inside an ETF – this will help higher-margin buying and selling volumes versus a comparatively small custody price that may be gained from ETF inflows.”

In line with Citi, retail ETH flows could possibly be staked immediately into the Ethereum community. This is able to possible earn extra rewards than the ETF charges from retail flows.

Christiansen and his workforce consider that the one setback and invalidation of this bullish outlook for COIN could be the continuation of the present administration’s enforcement strategy.

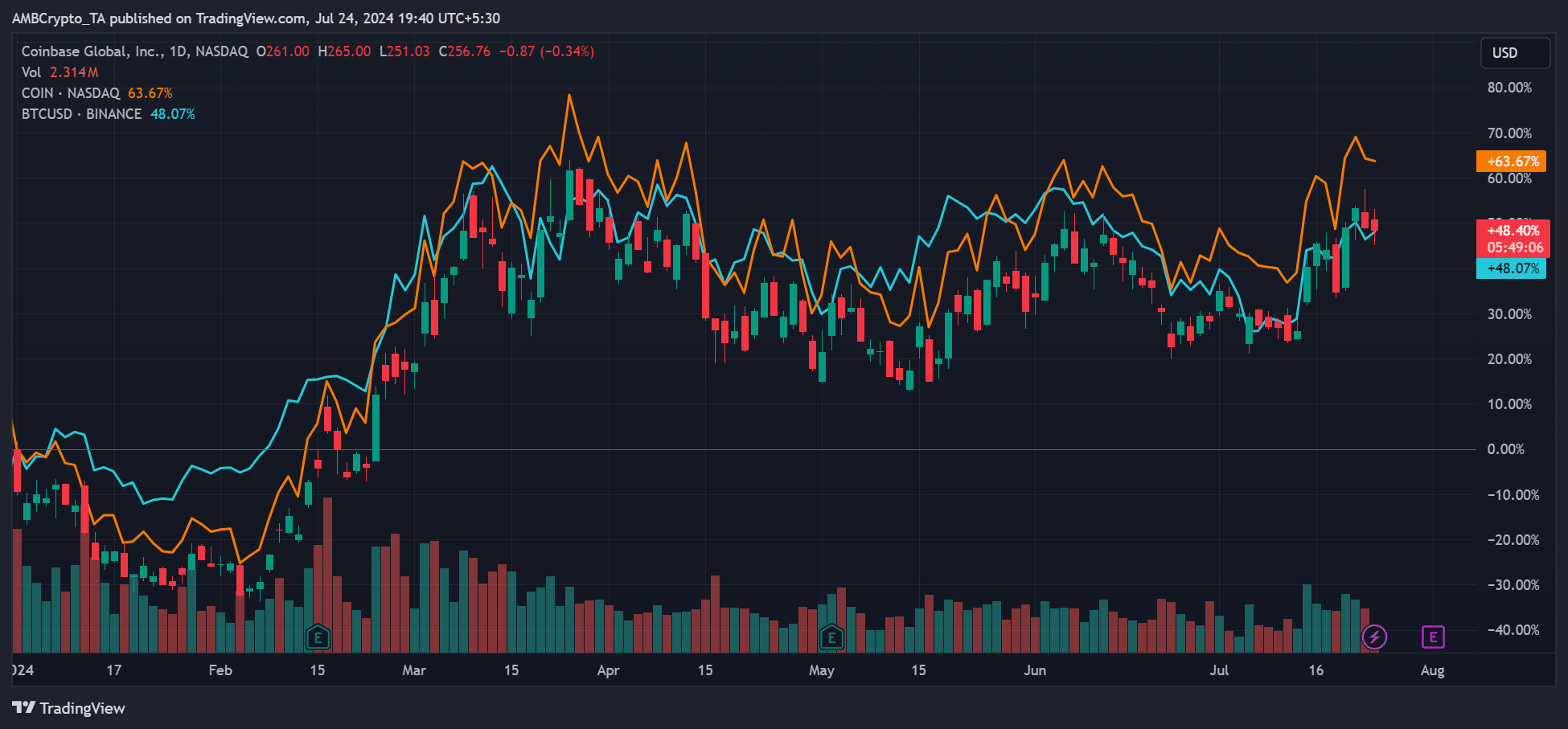

In the meantime, on the time of writing, COIN was up 63% primarily based on YTD (year-to-date). In comparison with Bitcoin’s [BTC] 48% over the identical interval, COIN holders have been higher off with further 15% features.

[ad_2]

Source link