[ad_1]

- TRON founder Justin Solar bought 1,614 ETH because the approval of Ethereum ETF nears.

- Ethereum’s worth motion was wanting bullish and it might hit the $3,300 degree.

The cryptocurrency market is popping impartial and appears to be recovering after a significant decline. Regardless of the try at restoration, the market sentiment stays bearish.

Nonetheless, few buyers are wanting ahead to the approval of the spot Ethereum [ETH] ETFs (Alternate-Traded Fund) as they began ETH accumulation.

Justin Solar buys $5 million value of ETH

On eleventh July, an on-chain analytic agency spotonchain made a submit on X (beforehand Twitter) stating that TRON founder Justin Solar bought 1,614 ETH value $5 million.

The common shopping for worth of this large ETH was someplace round $3,097.

Apart from this current ETH buy, he has additionally deposited a notable $45 million USDT to Binance which alerts a possible future ETH buy.

Since February 2024, Solar has been constantly accumulating ETH. In keeping with the information, he has bought practically 362,751 ETH value $1.11 Billion at a mean worth of $3,047 by three wallets.

Alternatively, one other whale named Golem seems to have stopped dumping ETH.

Moreover, Golem has staked a big 40,000 ETH value $124.6 million, based on Lookonchain. This current exercise by Justin Solar and Golem, alerts potential upcoming bullish momentum throughout the market.

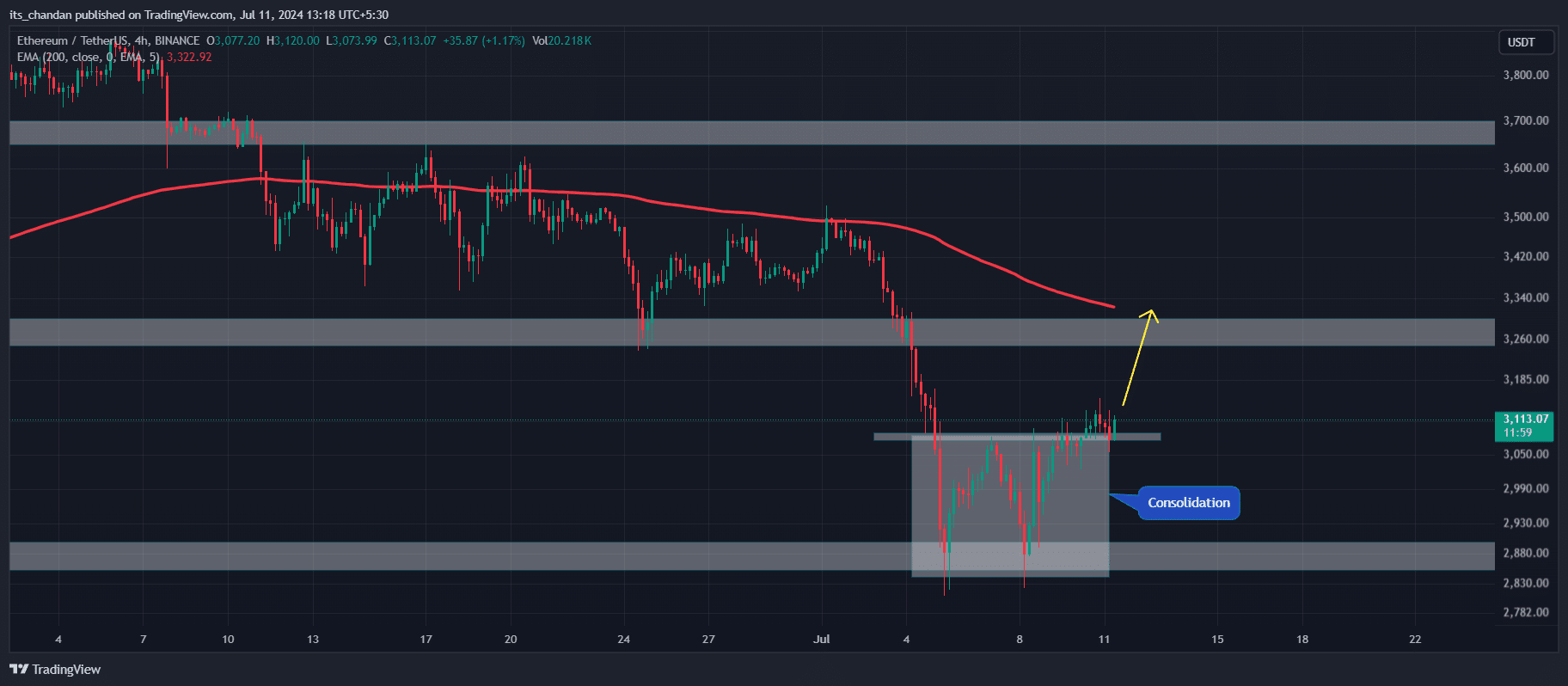

Ethereum technical evaluation and key ranges

In keeping with professional technical evaluation, ETH is wanting bullish because it gave a neckline breakout of a bullish double-bottom worth motion sample in a 4-hour time-frame.

On eleventh July, 2024, if the ETH 4-hour candle offers a closing above the $3,135 degree then there’s a excessive chance that ETH may attain the $3,300 degree.

Moreover, on a each day time-frame, ETH has moved above the 200 Exponential Shifting Common (EMA). A worth above 200 EMA signifies that the asset is in a bull cycle on the next time-frame.

Moreover, the Relative Power Index (RSI) a technical indicator additionally signifies a bullish reversal.

Nonetheless, this bullishness will proceed as soon as the SEC approves Ether ETF. Lately, Bloomberg ETF professional Eric Balchunas has predicted that there’s a excessive chance that the SEC could inexperienced gentle spot Ether ETF by 18th July, 2024.

In a submit on X, he acknowledged that,

“We don’t have a brand new over/underneath launch date but as a result of we haven’t heard what the SEC’s recreation plan is. Hope to listen to quickly. However should you compelled me gun to move model to provide my finest guess for date I’d go together with July 18th.”

Regardless of the bullish outlook for ETH, within the final 24 hours, the open curiosity (OI) has been destructive (-0.53%) which suggests decrease curiosity from buyers and merchants on this present fearful market.

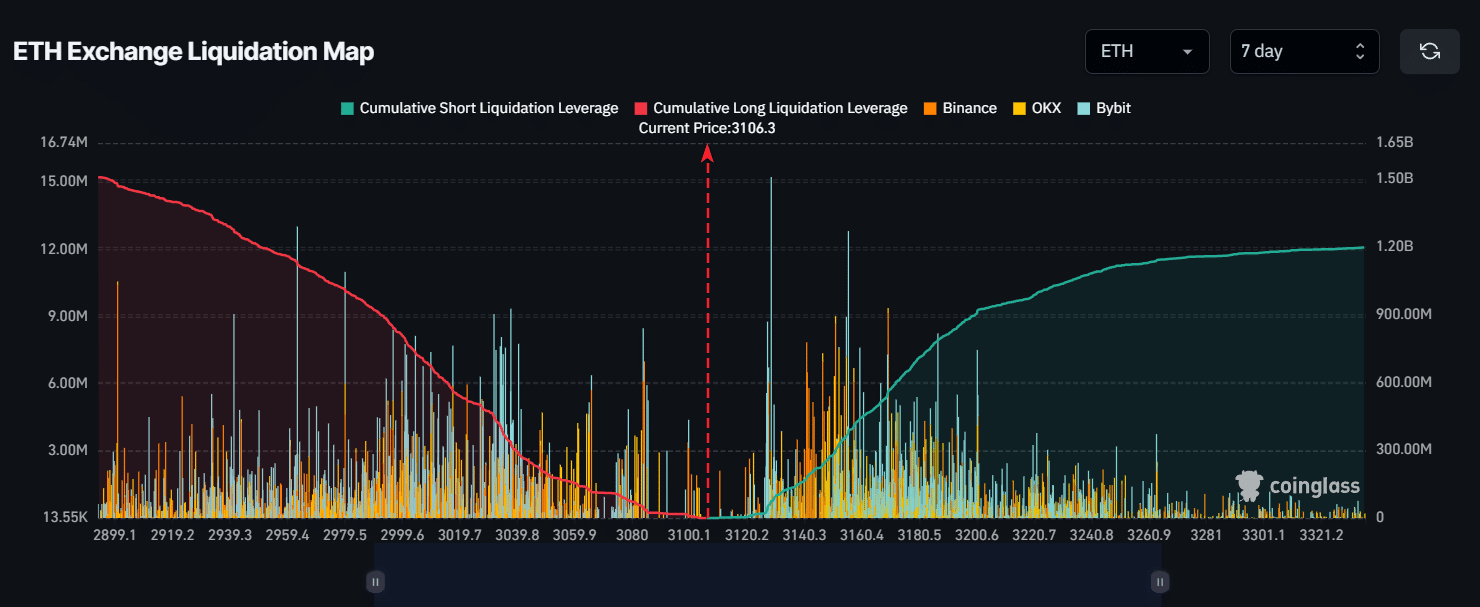

Liquidation and price-performance evaluation

Knowledge from CoinGlass for the final seven days additionally alerts that bulls are again to supporting Ethereum. If ETH reaches $3,300, roughly $1.18 billion value of quick positions may very well be liquidated.

Learn Ethereum’s [ETH] Price Prediction 2024-2025

In the meantime, if ETH fails to maintain the present breakout and falls again to the $2,900 degree, roughly $1.46 billion value of lengthy positions may very well be liquidated.

On the time of writing, ETH was buying and selling close to $3,115 and it skilled a 0.5% upside within the final 24 hours.

[ad_2]

Source link