[ad_1]

- Ethereum has strengthened its restoration course with value motion indicating vendor exhaustion.

- Bullish speculators are betting on the debut of a US-based spot Ethereum ETF to spur a bullish turnaround.

Ethereum [ETH] was buying and selling within the inexperienced on ninth July after an eventful earlier day that noticed potential issuers of a US spot Ethereum exchange-traded fund (ETF) submit their amended registration varieties.

VanEck, 21Shares, Franklin Templeton, Grayscale, Constancy and BlackRock, filed their up to date type S-1s becoming a member of Bitwise, which was the primary to submit its up to date registration assertion final Friday.

US spot Ethereum ETF itemizing on the horizon

Grayscale submitted two amended filings – one for its Grayscale Ethereum Belief (ETHE) and one other for its Mini Belief.

Solely Invesco missed the eighth July deadline set by the US Securities and Alternate Fee (SEC) final month when it returned the preliminary registration varieties from the issuers with highlighted areas to repair earlier than refiling.

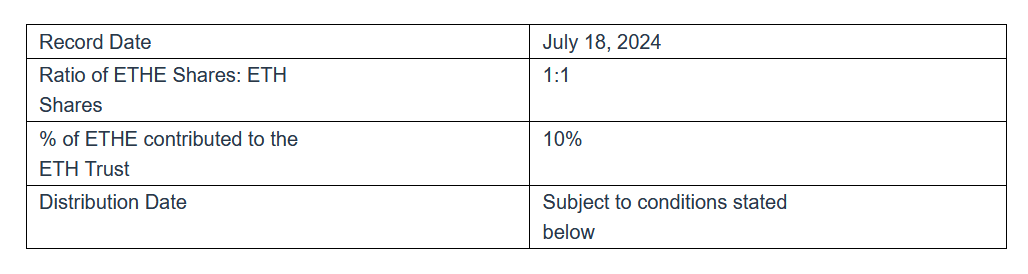

Grayscale shared in a separate announcement to traders that the primary issuance and earliest distribution of shares of its new Ethereum Mini Belief (ETH Belief) will probably be on 18th July.

The asset supervisor additionally confirmed within the announcement that it plans to checklist the ETH Belief on NYSE Arca pending approval.

Another hurdle earlier than it’s time

Relating to the following steps, Bloomberg ETF analyst Eric Balchunas mentioned the SEC is anticipated to evaluation the refiled registration statements and get again to the issuers with a sport plan for the ultimate itemizing.

Balchunas wrote on X,

“[The] SEC requested for the S-1s on July eighth however instructed issuers the price wasn’t [necessary] but. They may give steering again to issuers quickly together with the sport plan. Then the docs come will come again with charges (and each different clean) stuffed after which it’s go time.”

Markets have eagerly anticipated the ultimate greenlight, permitting spot Ethereum ETFs to start buying and selling.

Balchunas projected that the proposed ETFs could go stay on 18th July, though a exact timeline will rely upon suggestions from the US federal securities regulator.

Balchunas added,

“We don’t have a brand new over/below launch date but as a result of we haven’t heard what the SEC’s sport plan is […] However in case you pressured me gun to move type to provide my greatest guess for the date I’d go along with July 18th.”

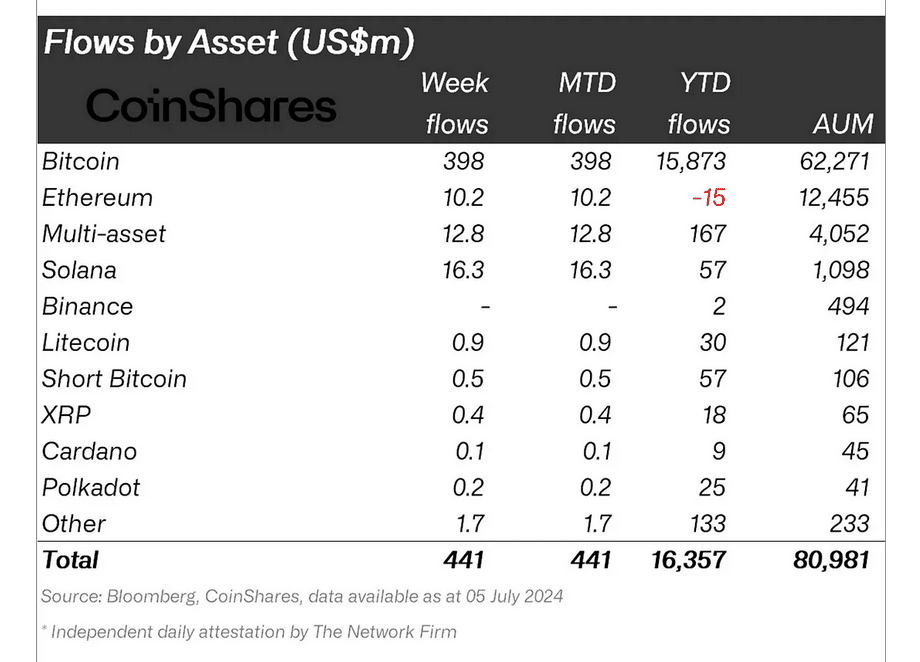

In its digital asset fund flows weekly report printed on eighth July, CoinShares noted that Ethereum-based funding merchandise noticed inflows totalling $10.2 million final week.

The report additionally ranked Solana high among the many listed property by way of weekly crypto asset flows – with $16.3 million inflows in comparison with Ethereum’s $10.2 million.

Price noting, VanEck and 21Share are individually in search of approval for his or her spot Solana ETFs – the VanEck Solana Belief and the 21Shares Core Solana ETF.

The Chicago Board Choices Alternate (CBOE) filed two varieties 19b-4 with the SEC for the VanEck and 21Share merchandise on eighth July. VanEck and 21Shares earlier filed their SEC type S-1s on twenty seventh June and twenty eighth June, respectively.

ETH/USDT technical evaluation

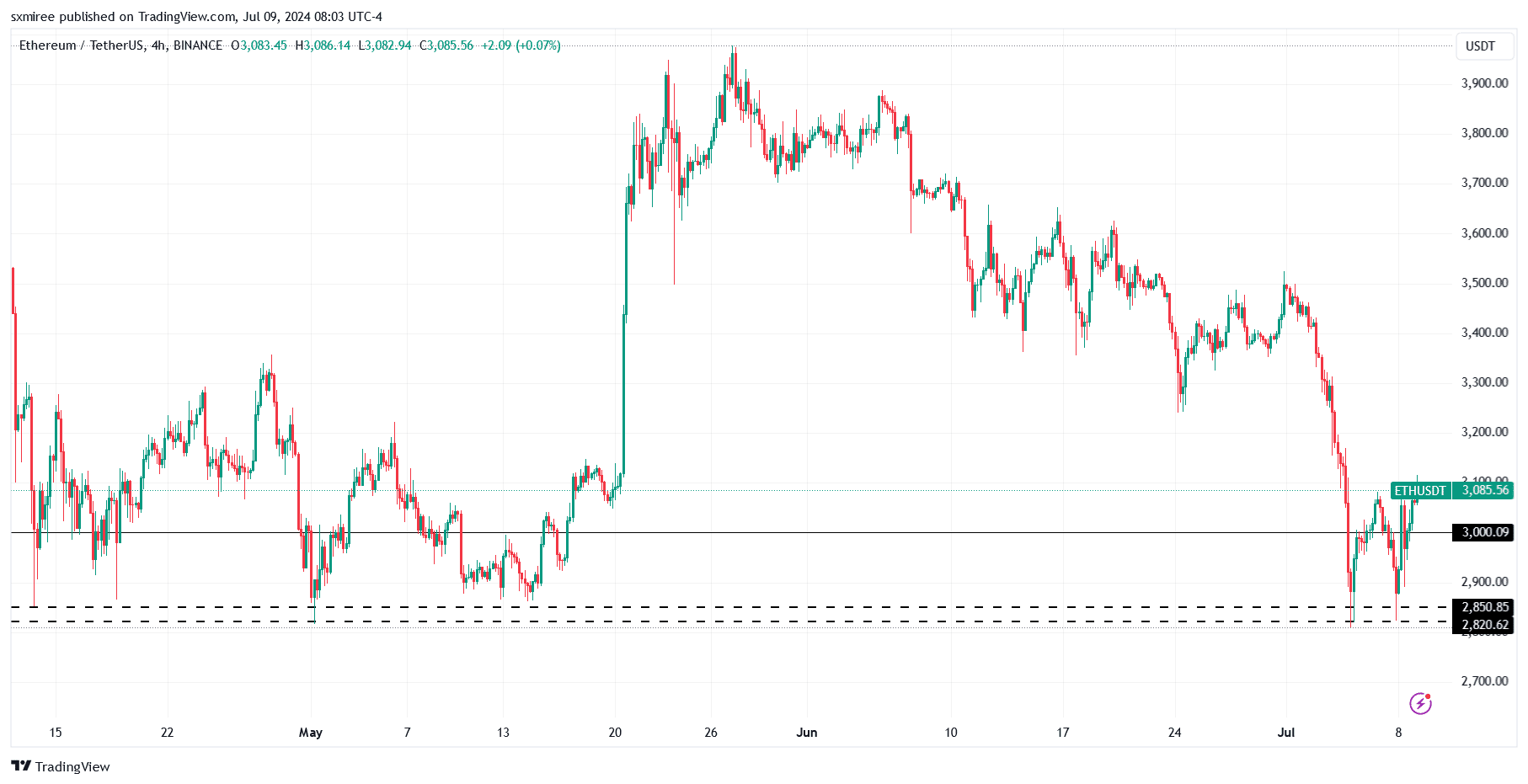

ETH briefly retested the assist zone round $2,800 to $2,850 on eighth July earlier than bouncing above the $3,000 psychological stage forward of the each day shut.

The restoration extending to press time got here on the again of a profitable protection of the long-held assist zone, which bulls beforehand defended between April and mid-Could.

Steadying costs within the final 24 hours again technical indicators and alerts hinting at a possible rebound.

Learn Ethereum’s [ETH] Price Prediction 2024-2025

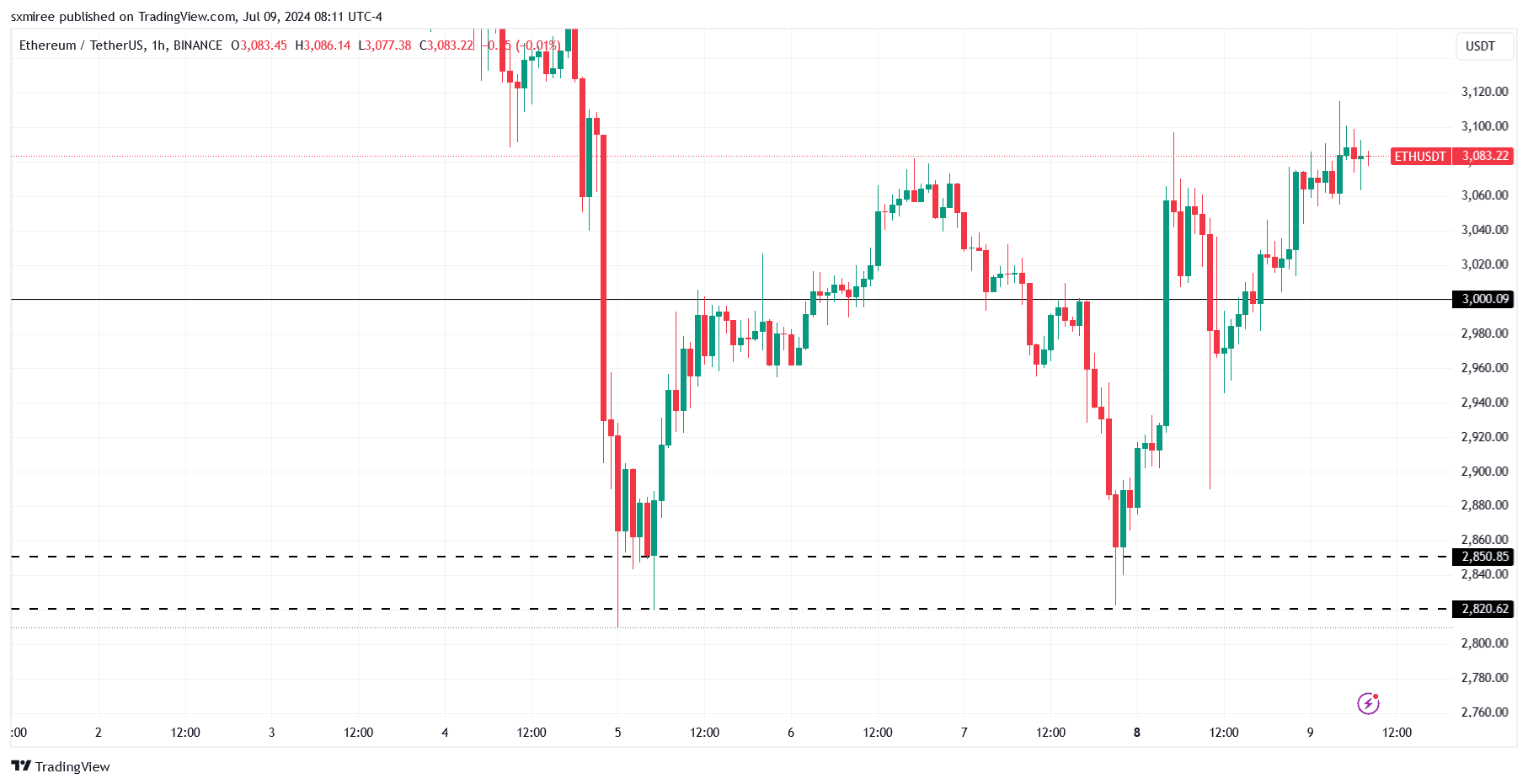

On the hourly chart, the ETH/USDT pair traced a W-shaped double-bottom sample above the essential assist coming off the weekend, teasing a bullish turnaround.

Lengthy-wick candles across the $2,800 – $2,850 vital assist additional counsel vendor exhaustion on the zone and a possible development reversal to the upside.

[ad_2]

Source link