[ad_1]

- Within the final two weeks, traders have pulled out $120 million from ETH-focused funding merchandise.

- Ether spot ETF launch timeline has been moved after the SEC requested issuers to resubmit amended S-1 drafts.

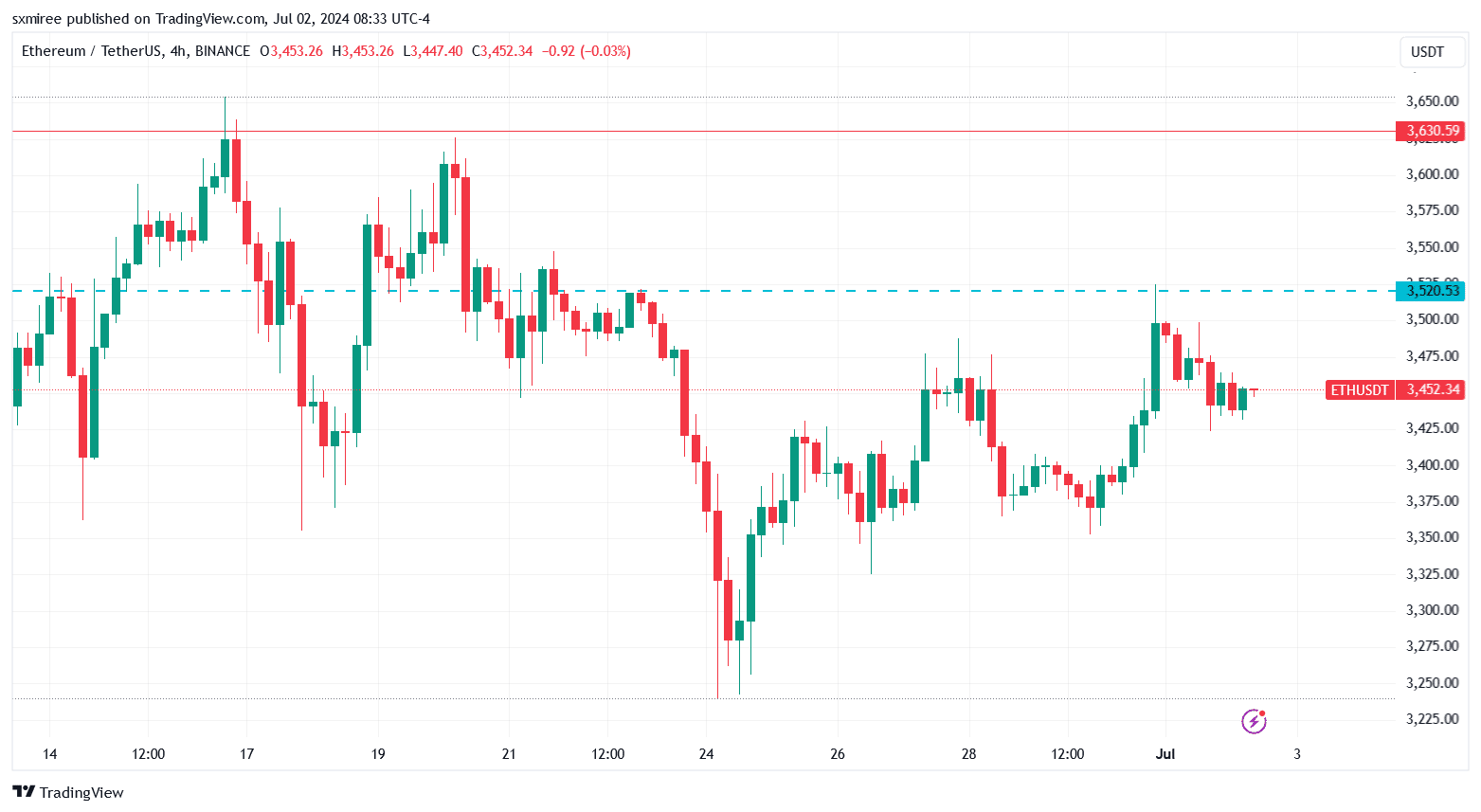

Ethereum [ETH] was buying and selling at round $3,448 on the 2nd of July, barely unchanged in the previous couple of hours however in conformance with the generally positive July narrative.

Within the meantime, ETH bulls focused contemporary heights above $3,450 and have been betting on upside potential from the hype round Ether spot exchange-traded funds (ETFs).

The brand new merchandise, anticipated to debut within the U.S. later this month, may assist propel ETH/USDT above the $3,630 resistance, the place it was rejected on the seventeenth of June.

Bullish speculators suffered delicate losses on the first of July after Ethereum did not maintain momentum above $3,520.

ETH tried to interrupt out from the descending channel on the 4-hour timeframe chart in a single day on the day, however as of press time, has been unable to cement the transfer.

Markedly, the most recent advance towards $3,500 won’t quantity to triumph for bulls if ETH is unable to sail above the $3,520 — $3,550 resistance zone.

Ethereum institutional uptake

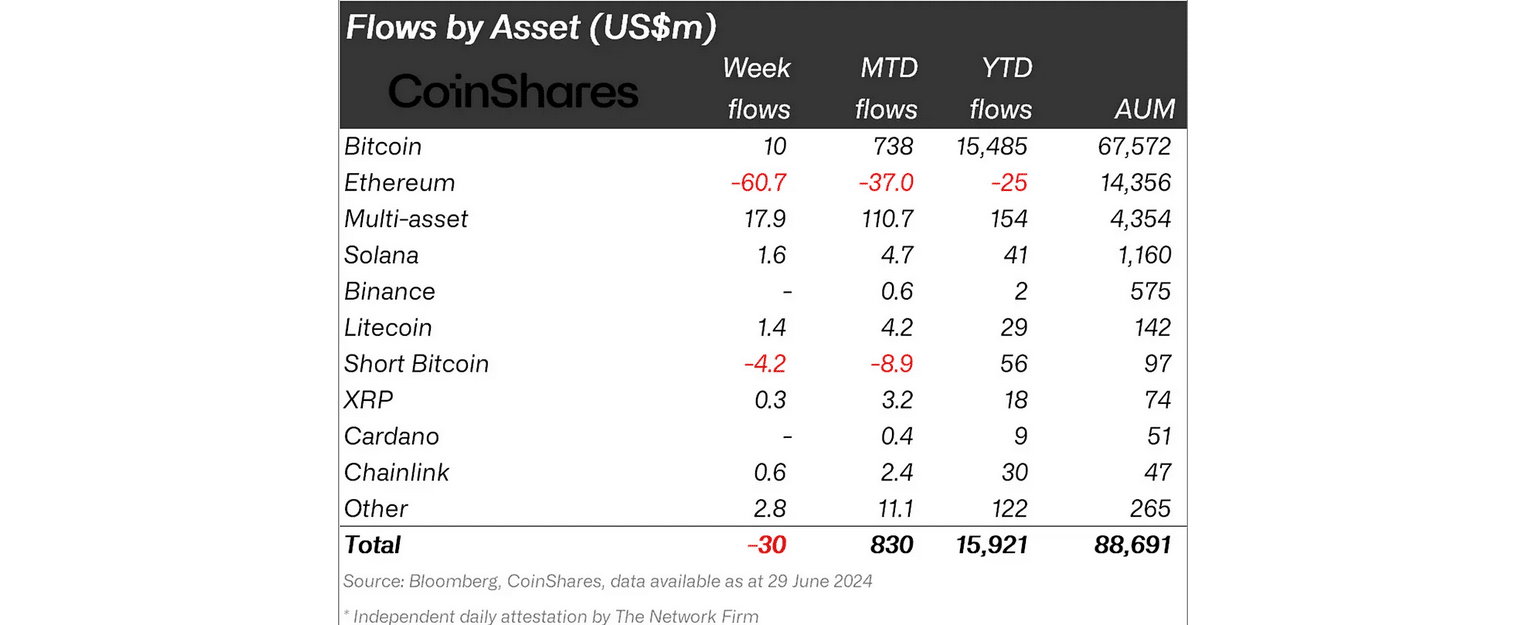

In its digital asset flows report launched on Monday, CoinShares noticed that Ethereum funding merchandise posted outflows of $60.7 million final week.

The determine marked essentially the most vital unfavorable 7-day circulate in virtually two years, and introduced the cumulative two-week outflows to $119 million.

The report additional highlighted that Ethereum was the worst-performing crypto asset in 2024, based mostly on web flows, with—$37 million and—$25 million MTD and YTD flows, respectively.

U.S. Ethereum spot ETF

A U.S. Ether spot ETF has been nigh this summer time after the Securities and Trade Fee (SEC) accredited 19b-4 filings of eight potential issuers on the twenty third of Might.

Nonetheless, the ETF merchandise are but to be cleared to go dwell, pending approval of the S-1 registration statements.

The latest setback within the approval course of has been laid on the door of the U.S. securities regulator. Final week, the SEC reviewed S-1 kinds from issuers and requested resubmissions incorporating its feedback by the eighth of July.

Consequently, the timeline for the launch of the spot Ethereum ETFs has been pushed to mid-or finish of July.

Market anticipation

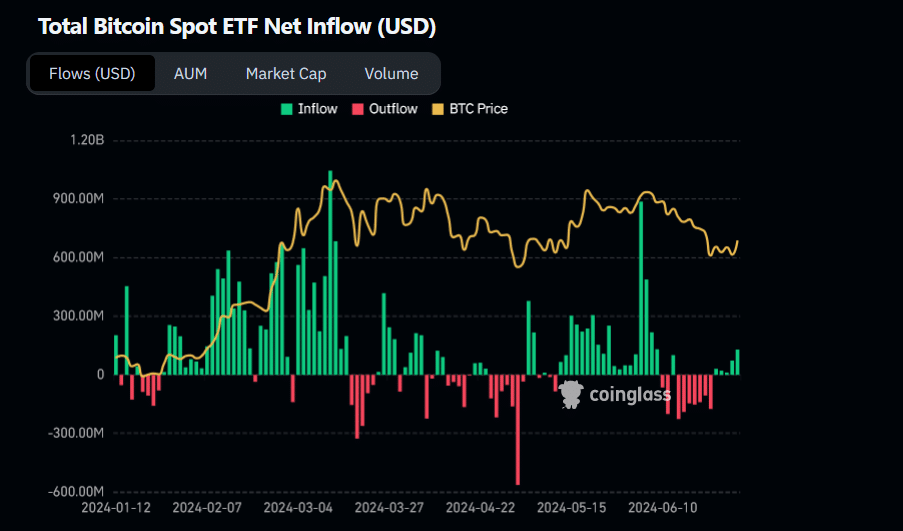

Final week, Bernstein analysts Gautam Chhugani and Mahika Sapra forecasted that Ether spot ETFs will see barely decrease demand once they go dwell, in comparison with Bitcoin [BTC] ETFs, since they largely share the identical sources of demand.

The co-authors additionally cited “the dearth of an ETH staking characteristic” within the accredited spot Ether ETFs as a deterrent that might dampen curiosity within the merchandise.

Bitcoin ETFs have to date attracted $55 billion since their introduction in the beginning of the yr.

Although inflows have waned from the February highs, analyst projections present that the determine is anticipated to eclipse $100 billion by the tip of 2025.

J.P. Morgan, however, forecasted that Ether ETFs may see web inflows of about $3 billion ($6 billion if staking is permitted) by the tip of the yr.

Learn Ethereum’s [ETH] Price Prediction 2024-25

J.P. Morgan additionally anticipated the market’s immediate reception to be mildly unfavorable, citing attainable profit-taking by traders who purchased the Grayscale Ethereum Belief (ETHE) in expectation of its conversion to an ETF.

Individually, within the final week, Bitwise CIO Matt Hougan projected that Ether spot exchange-traded funds (ETFs) would attract $15 billion of web inflows within the first dozen and a half months.

[ad_2]

Source link