[ad_1]

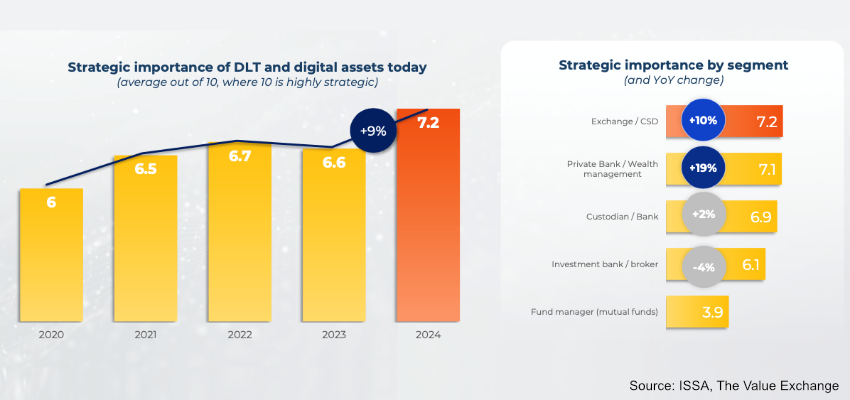

Distributed ledger technology (DLT) is turning into more and more essential globally this 12 months, with exchanges, fintechs, and custodians being the largest adopters, a brand new report has revealed.

The report, “DLT within the Actual World,” was revealed by the Worldwide Securities Companies Affiliation (ISSA), a global body whose members embrace central securities depositories (CSDs), custodians, tech companies, and different gamers within the securities sector.

ISSA’s survey, which concerned over 340 securities companies globally, discovered that DLT’s significance to the sector had elevated 10% since final 12 months. General, the expertise’s strategic significance hit a file excessive after a slight dip final 12 months.

ISSA discovered that whereas DLT customers are diving deeper into the expertise, the general deployment has stagnated. The share of dwell deployments stayed fixed at 37%. Whereas digital tokens now account for over $15 billion, half of the initiatives have an annual turnover beneath $1 million.

Reducing prices and growing income have change into the 2 key elements driving DLT adoption within the securities sector, changing studying and experimentation.

Bonds have additionally cemented their spot as the commonest asset class deployed on DLT. Among the world’s largest firms have been experimenting with blockchain bonds for years now, and governments have just lately provided their assist.

This 12 months, Swiss cities have settled tons of of tens of millions of {dollars} in digital bonds via the nation’s wholesale CBDC. Hong Kong accomplished the sale of $750 million in digital inexperienced bonds earlier this 12 months, which the Philippines has partnered with the Asian Improvement Financial institution to explore.

ISSA additional discovered important variance in DLT growth throughout areas. Within the Center East and Africa, the best variety of respondents had been within the proof-of-concept stage, and Latin America had its highest share in growth.

In North America, Asia, and Europe, almost one in two respondents have a dwell utility on the DLT.

The commonest challenges cited had been low return on funding and an absence of a compelling enterprise case. Different widespread hurdles included restricted liquidity of tokenized securities and authorized uncertainty.

The report additional revealed that public blockchains are more and more shedding their market share to personal blockchains. The latter now controls 65% of the market, up from 55% final 12 months, with securitized belongings and personal debt the commonest personal blockchain use instances.

Watch: Figuring out blockchain’s financial worth

New to blockchain? Try CoinGeek’s Blockchain for Beginners part, the last word useful resource information to study extra about blockchain expertise.

[ad_2]

Source link