[ad_1]

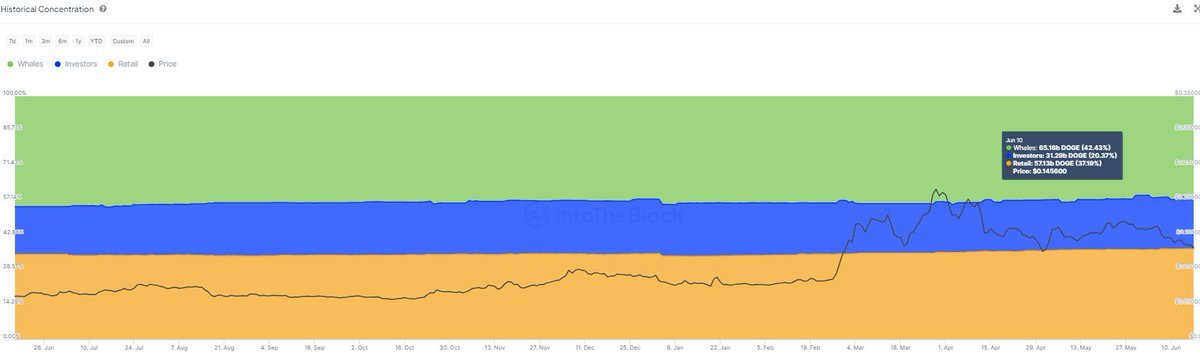

Because the crypto market endures one other tumultuous interval, Dogecoin has seen vital modifications in its possession construction. Latest information from IntoTheBlock reveals a notable shift, with main Dogecoin whales—these holding greater than 0.1% of the entire provide—lowering their stakes.

Dogecoin Redistribution: Who Is In Cost Now?

IntoTheBlock data signifies that this place discount from these whales has been ongoing for the previous 12 months. Particularly, the share of Dogecoin managed by these massive holders has decreased from 45.3% to 41.3%.

This development suggests a doable decentralization of possession or a strategic shift within the holdings of bigger buyers, maybe in response to market circumstances or broader cryptocurrency traits.

Concurrently, this lower amongst main holders has been accompanied by elevated possession amongst retail and mid-sized buyers. These smaller buyers have seized the chance to build up extra Dogecoin, elevating their collective stake within the whole provide.

This redistribution of Dogecoin holdings might point out a rising democratization within the funding panorama of this explicit cryptocurrency.

As extra people and smaller buyers grow to be vital stakeholders, the dynamics of market reactions to information and occasions might shift, probably resulting in elevated market stability or completely different volatility patterns based mostly on these new majority holders’ trading behaviors.

Worth Dips: Merchants Undergo, Analysts Stay Optimistic

In the meantime, the decentralization of Dogecoin holdings contrasts with the present market circumstances, the place the price of Dogecoin has fallen almost 10% within the final 24 hours to $0.211.

This decline is a part of a broader downturn that noticed the cryptocurrency shed 12.5% of its worth over the previous week, bringing its market capitalization under $18 billion.

This downward development in Dogecoin’s value is impacting traders considerably. In response to Coinglass, the final 24 hours have seen 165,199 merchants liquidated, contributing to $459.04 million in whole market liquidations.

Dogecoin merchants alone have confronted about $61.89 million in losses. Liquidation within the crypto market refers back to the compelled closure of leveraged positions as a consequence of a partial or whole lack of the dealer’s preliminary margin. This occurs after they can not meet the margin necessities for his or her leveraged place.

Regardless of the prevailing bearish traits, the sentiment isn’t universally unfavourable. Santiment reports a lower in crowd sentiment in direction of Dogecoin, suggesting that the present low costs would possibly provide a shopping for alternative for affected person buyers.

This attitude aligns with observations from market analysts who see the potential for restoration. Notably, Dealer Tardigrade, a famend crypt analyst on X, describes a “Ladle Sample” in Dogecoin’s value actions, indicating a possible bullish development.

$DOGE has been forming Ladle Sample in every cycle.

The bowl is prepared

Are you prepared for the shaft??

Trip on it#Dogecoin pic.twitter.com/zJQBnWuoSv

— Dealer Tardigrade (@TATrader_Alan) June 15, 2024

In the meantime, Crypto analyst Javon Marks predicts a significant upswing for Dogecoin, anticipating a value surge based mostly on historic efficiency and projecting an optimistic future for the meme coin amidst its present lows.

Featured picture created with DALL-E, Chart from TradingView

[ad_2]

Source link