[ad_1]

- World attain of BTC ETFs broaden with the Australian Inventory Trade set for a brand new itemizing on twentieth June.

- It stays to be seen whether or not the US spot ETH ETF approvals will enhance demand for BTC ETFs.

Australian Inventory Trade (ASX), the most important alternate in Australia, has joined the Bitcoin [BTC] ETF social gathering by approving its first BTC ETF product from asset supervisor VanEck.

The product, VanEck Bitcoin ETF (VBTC), will probably be listed on June twentieth, marking the historic debut of an ETF involving the most important digital asset on ASX.

Andrew Campion, ASX’s normal supervisor of funding merchandise, told the Australian Monetary Assessment (AFR) that the delay in approving BTC ETFs on the alternate was as a result of 2022 crypto winter. Campion added,

“However with the restoration of cryptocurrency costs, we’ve had a good bit of curiosity during the last 12 months, and that’s culminated within the approval.’

ASX signaled renewed curiosity after US and Hong Kong spot BTC ETFs went reside.

Demand for Bitcoin ETF Australia

On his half, Arian Neiron, Asia Pacific managing director at VanEck, emphasised the rising investor demand for BTC.

‘Bitcoin has remained an rising asset class that many advisers and buyers need”

The ASX’s itemizing is a superb sign for Australian buyers searching for regulated avenues for buying and selling and investing in BTC.

Comparable merchandise have additionally not too long ago been launched on the second largest Australian alternate, Cboe Australia, a key competitor to ASX.

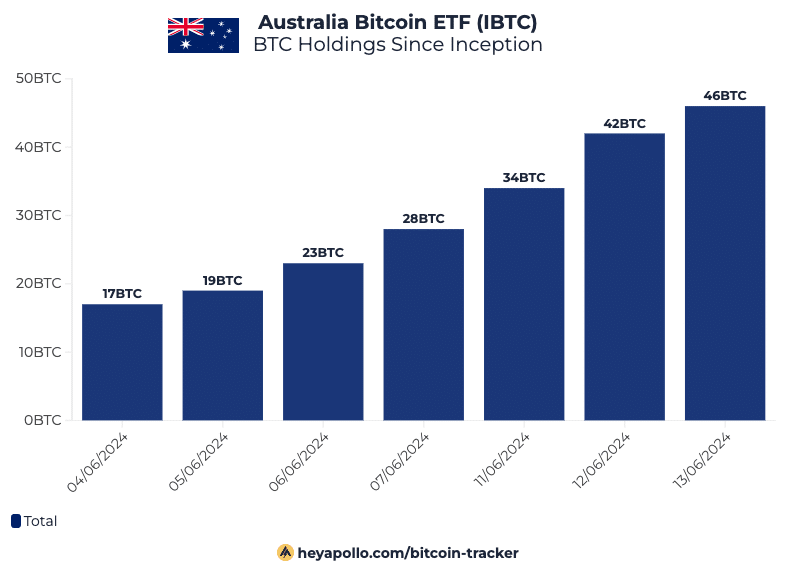

Notably, Monochrome Bitcoin ETF (IBTC) debuted and began working on Cboe Australia on June third. As of June 14th, the product had accrued 46 BTC, Julian Farher, a Bitcoin analyst and investor, revealed.

Curiously, the ASX’s itemizing will begin buying and selling just some days earlier than US spot Ethereum [ETH] ETF approval. Many analysts view it as a catalyst for the general market. Whether or not or not it’ll ramp up demand for the Australian BTC ETFs stays to be seen.

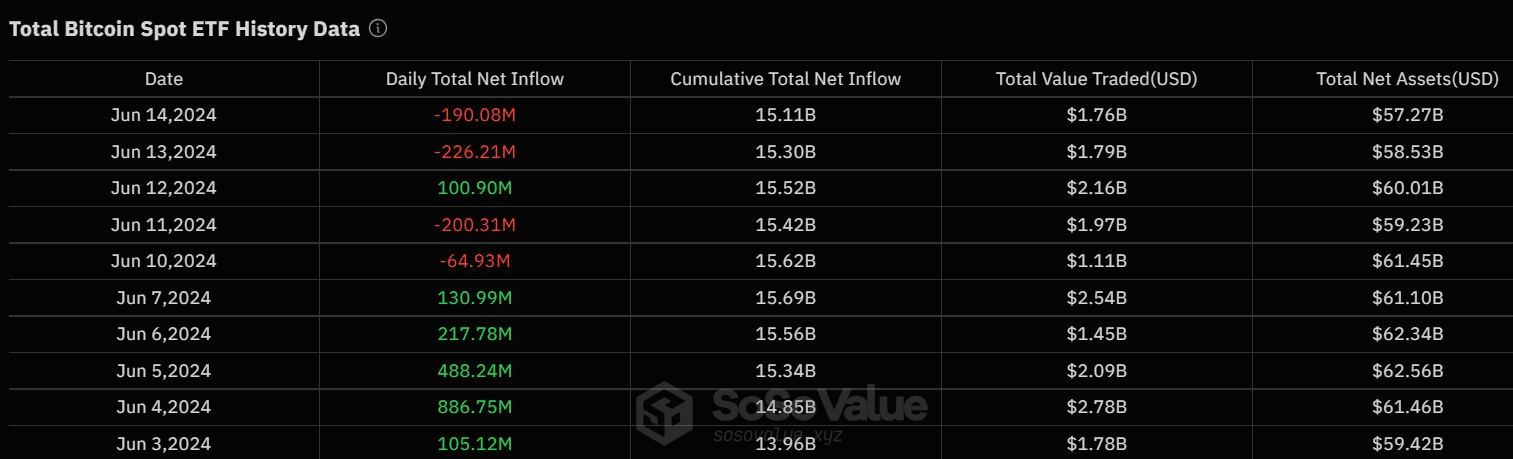

Nonetheless, the spot US BTC ETFs recorded vital outflows final week as buyers de-risked earlier than and after the Fed’s choice to maintain rates of interest unchanged for the seventh time.

Other than 12 June, the remainder of final week noticed huge outflows value over $680 million, underscoring US buyers’ risk-off strategy.

As of press time, the king coin slipped beneath $66K. It might development decrease to the vary low if the bearish sentiment persists.

Moreover, per Coinglass data, the general market’s Open Curiosity (OI) charges have been purple as of press time, indicating low liquidity within the derivatives market and reinforcing the bearish sentiment.

[ad_2]

Source link