[ad_1]

- Solana’s founder proposed a mechanism to decrease entry boundaries to node operations.

- The chief mulled methods of coping with voting charges to deal with the difficulty.

Solana [SOL] and Ethereum [ETH] leaders have debated numerous points within the house for some time.

Most lately, the Solana Basis’s clampdown on validators utilizing MEV (Most Extractable Worth) sandwich assaults caught main consideration.

The Basis withdrew monetary assist to some validators to cut back the assaults.

It emerged that working a Solana validator node could be very costly, about $65K per yr, which requires the Solana Basis to supply monetary assist in some circumstances.

Quite the opposite, an Ethereum validator prices 32 ETH as a one-off fee, and excludes {hardware} and different assets.

Why Solana nodes are 10x costlier

Solana founder Anatoly Yakovenko clarified the associated fee distinction on ‘Ethereum’s higher funding’ in its consensus system.

‘Financial barrier for sincere nodes take part in consensus on Solana is 10x larger than ethereum atm. Largely as a result of funding Ethereum has made into BLS aggregation for consensus messages.”

The BLS refers to Boneh-Lynn-Shacham, an environment friendly signature scheme leveraged by Ethereum. Notably, the scheme can include a number of independently verified messages by validators.

This enables a number of messages to be aggregated successfully, reducing total prices.

As Yakovenko famous, Solana’s present mechanism doesn’t match Ethereum’s method. Nevertheless, the founder added that Solana would finally implement such a system.

‘Possibly that’s one thing that Solana will implement finally, possibly it will likely be voting subcommittees, possibly nothing. As {hardware} improves, the decrease sure payment to ship a message to all the cluster will drop, so the associated fee per vote will drop, and the financial barrier will drop as properly’

Nevertheless, one consumer famous that a lot of the price was inflated by voting charges and requested how Solana would clear up that. In his response, Yakovenko said,

‘Voting subcommittees would permit reducing the vote payment, and rotating the containers in/out of the committee, which would scale back the vote load and leads to decrease vote prices’

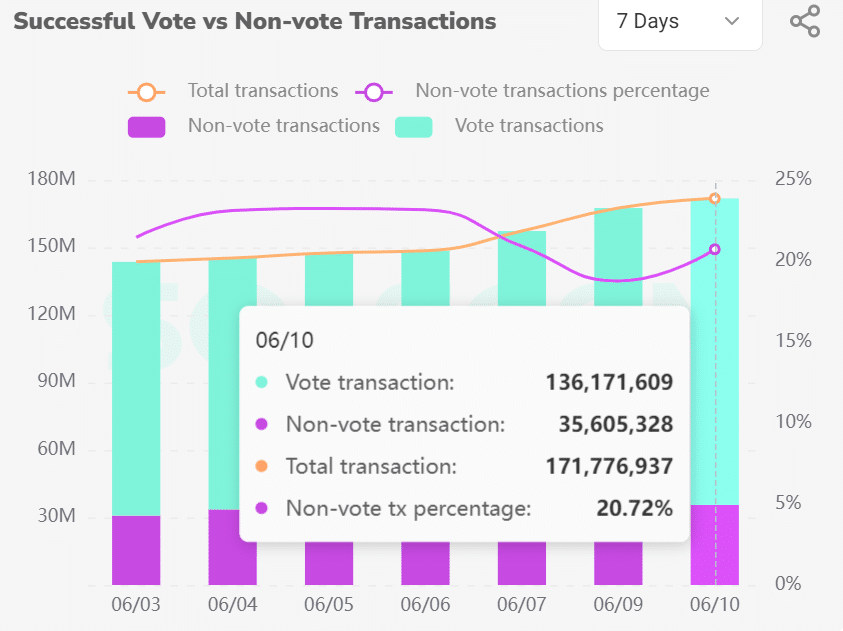

Up to now seven days, 80% of whole Solana transactions have been associated to votes, underscoring their dominance on block transactions.

Because the vote transactions additionally entice charges like the remaining, validators bear the associated fee. Their larger dominance means that voting charges are the principle contributor and maybe barrier to entry into the house.

It stays to be seen whether or not Solana will implement the answer as floated by the founder.

Within the meantime, SOL shed 6% as crypto buyers de-risked forward of the FOMC (Federal Open Assembly Committee) assembly.

SOL hit a low of $145 on the eleventh of June, the extent final hit in mid-Might, because the market rout prolonged liquidations throughout the markets.

[ad_2]

Source link