[ad_1]

- CryptoQuant information reveals that Bitcoin and Ethereum change steadiness has been on a decline.

- Technical evaluation signifies important value actions for each cryptocurrencies if key resistance ranges are damaged.

Bitcoin [BTC] was buying and selling simply shy of $70,000 at press time, reflecting a reasonable upswing of two% within the final 24 hours, although it stays under its March peak of over $73,000.

This continued development from the asset is a part of a broader narrative that underscores the complexities of crypto market actions.

Conversely, Ethereum [ETH] has proven exceptional stability, sustaining a place above $3,800. This steadiness comes regardless of a slight 2.5% drop during the last day, stabilizing with a minimal 0.7% improve right this moment.

The steadiness in Ethereum’s value factors to a sustained curiosity within the asset amid fluctuating market circumstances.

Bitcoin & Ethereum market shifts

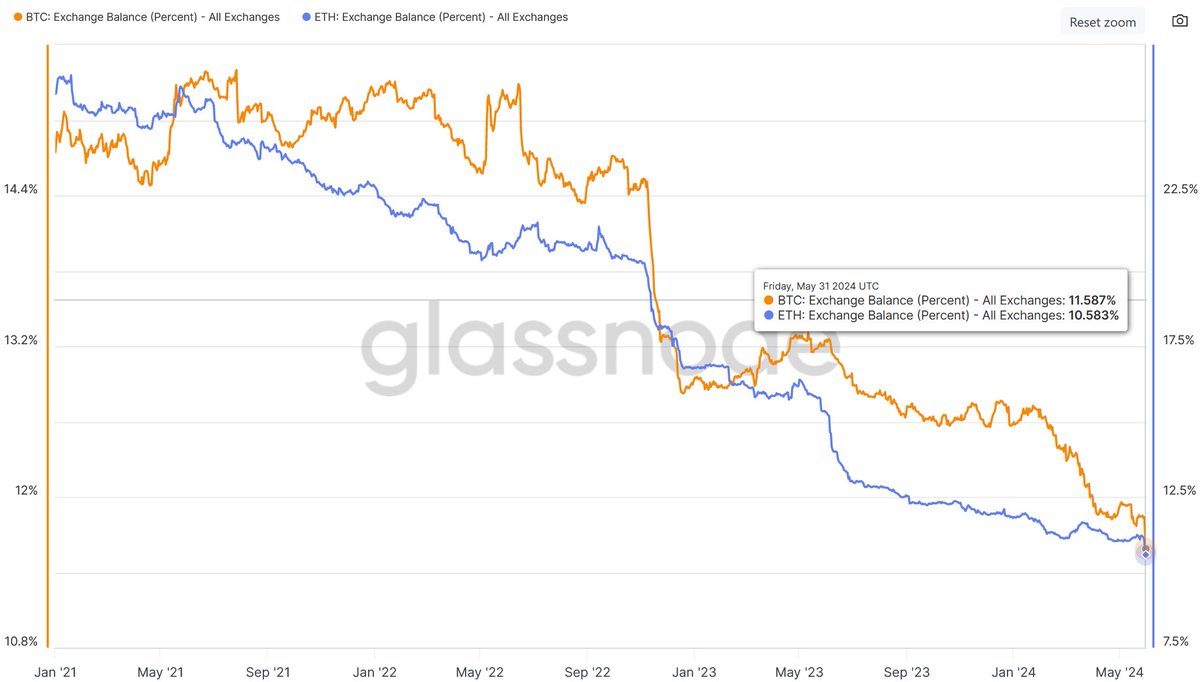

Latest evaluation by BTC-ECHO’s Leon Waidmann revealed that each Bitcoin and Ethereum have witnessed their lowest change steadiness ranges in years.

Particularly, Bitcoin’s presence on exchanges has diminished to 11.6% whereas Ethereum’s has dipped to 10.6%.

This development suggests a major motion of those property away from exchanges and doubtlessly signifies a method amongst buyers to carry onto their cash for longer intervals.

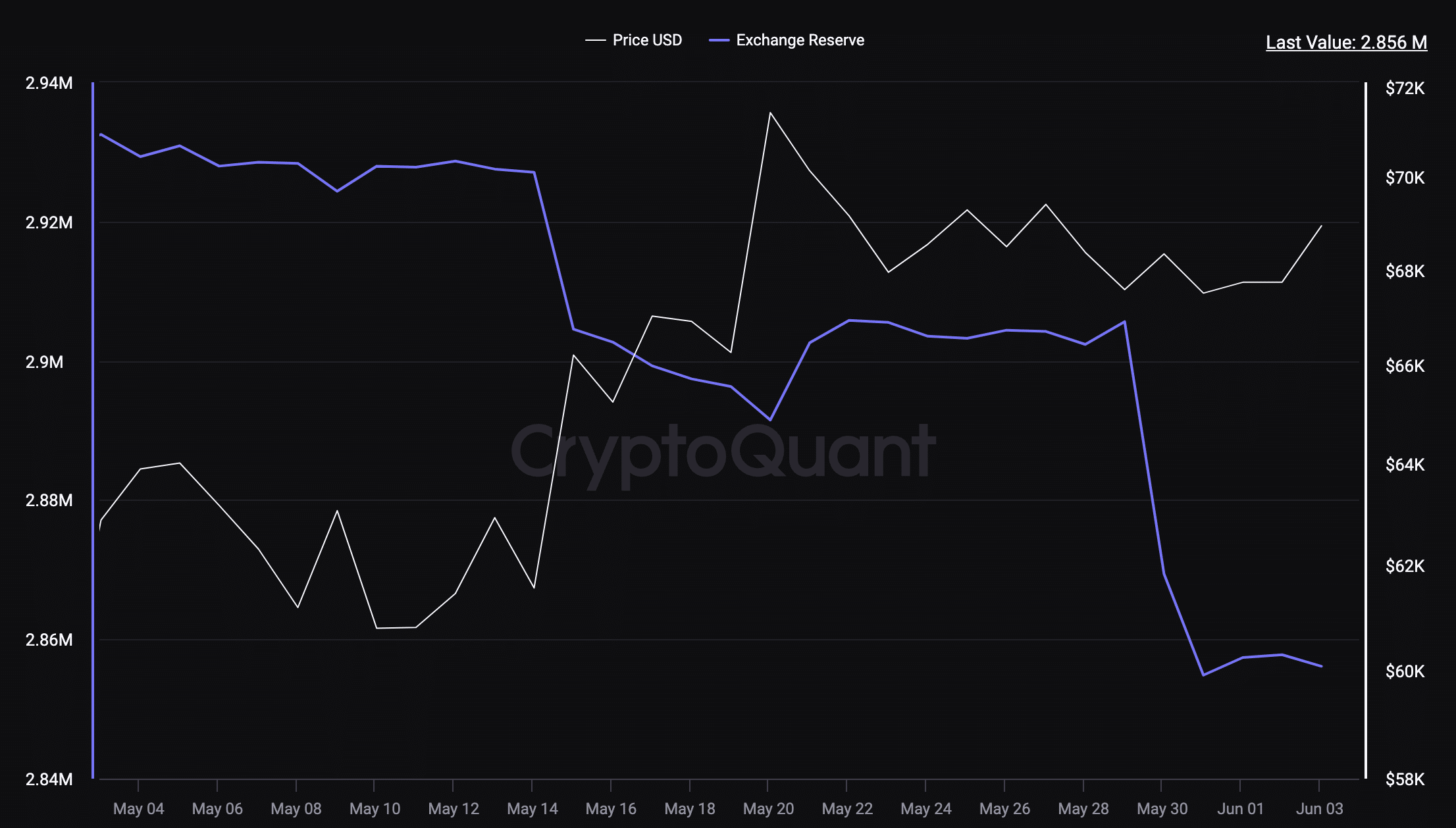

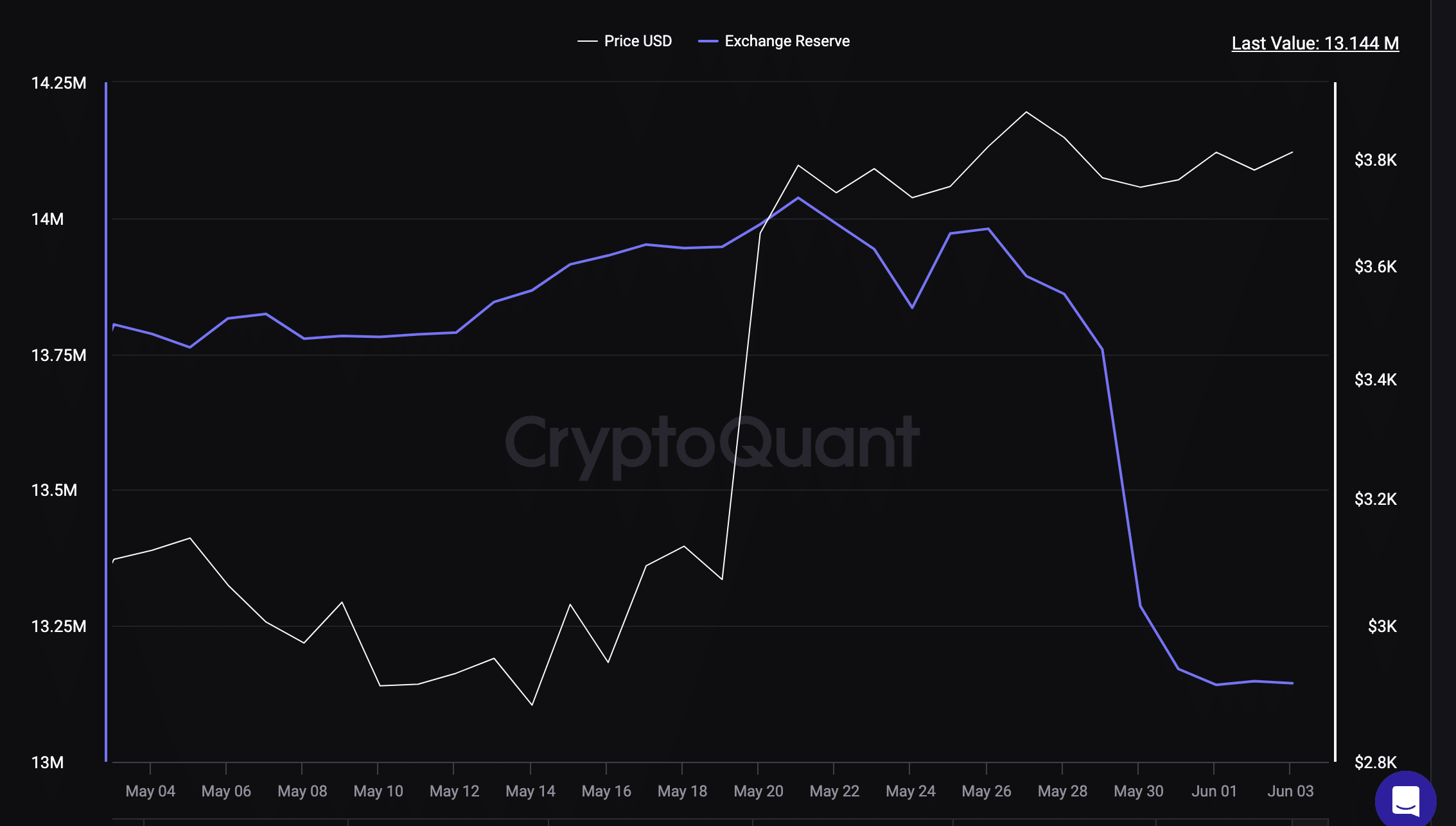

AMBCrypto’s examination of CryptoQuant data additional revealed a considerable outflow of those cryptocurrencies from exchanges.

Over $5 million value of Bitcoin and greater than $1 billion in Ethereum have withdrawn from exchanges since early Might.

This motion is noteworthy because it follows the approval of spot Ethereum ETFs within the US, hinting at a doable provide squeeze on the horizon.

The discount in change reserves implies that fewer cash are actually obtainable for fast buying and selling, pointing to a possible value improve on account of shortage.

Waidmann anticipates this may result in a provide squeeze, urging buyers to arrange for important market actions, noting:

“Whales proceed to build up. Provide squeeze incoming. Prepare for the subsequent large transfer.”

Market dynamics and technical evaluation

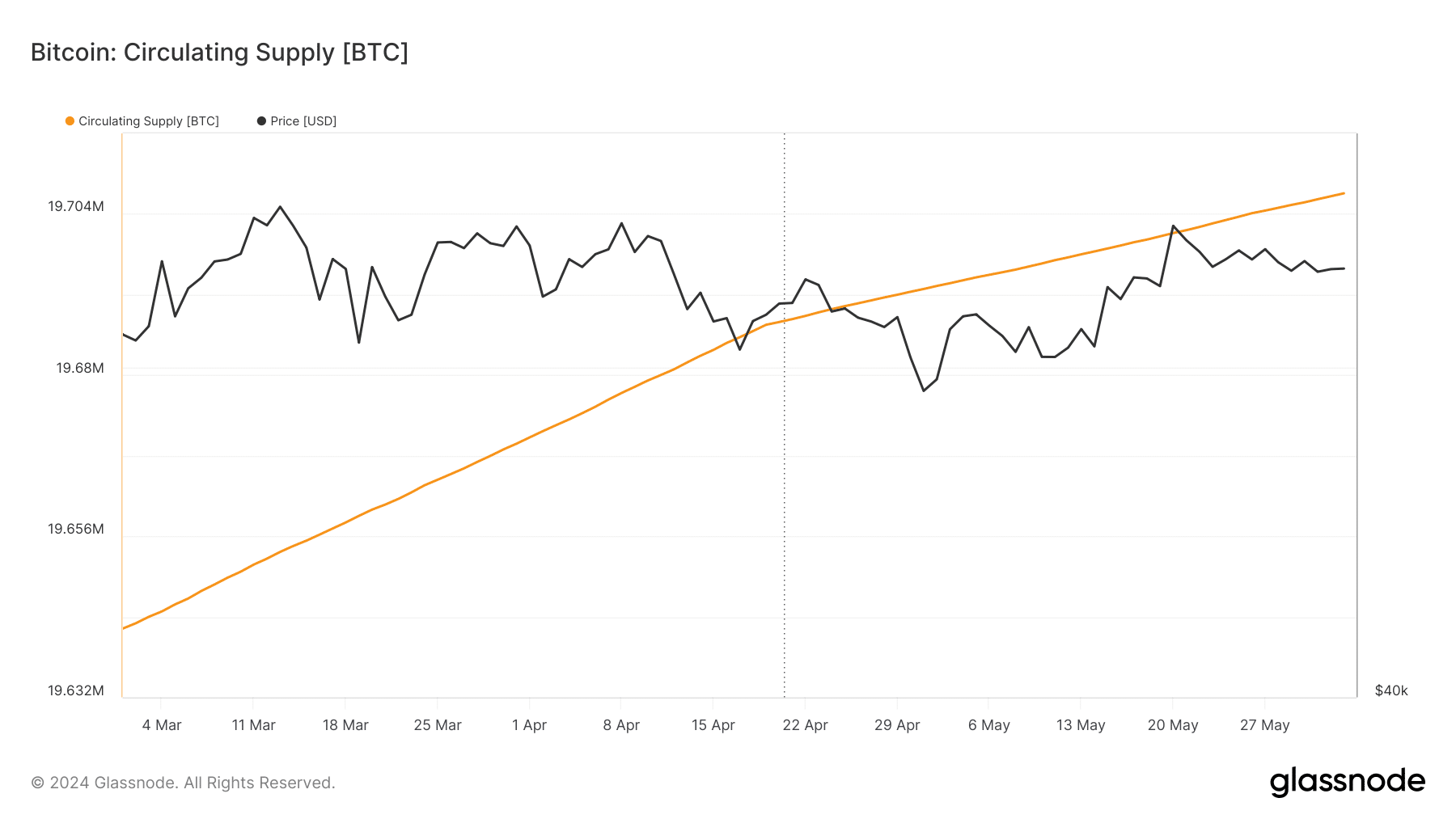

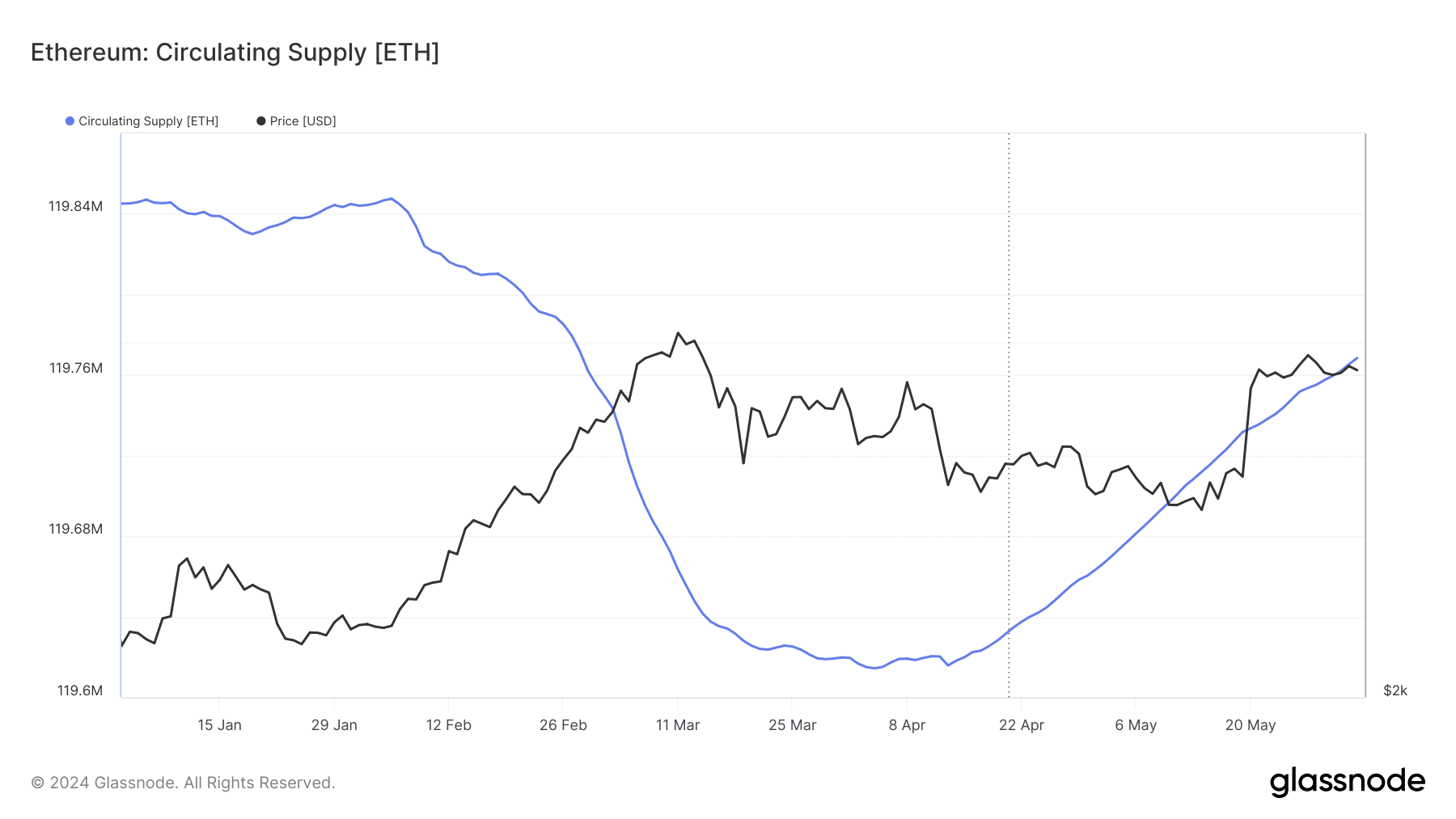

Nonetheless, Glassnode data presents a contrasting view, displaying a rise within the circulating provide for each cryptocurrencies, suggesting that regardless of diminished change availability, the general market provide stays excessive.

This state of affairs units the stage for potential value corrections if demand fails to maintain tempo with the rising provide. Nonetheless, the present market indicators recommend demand is maintaining, as there was no notable value dip regardless of the rising provide.

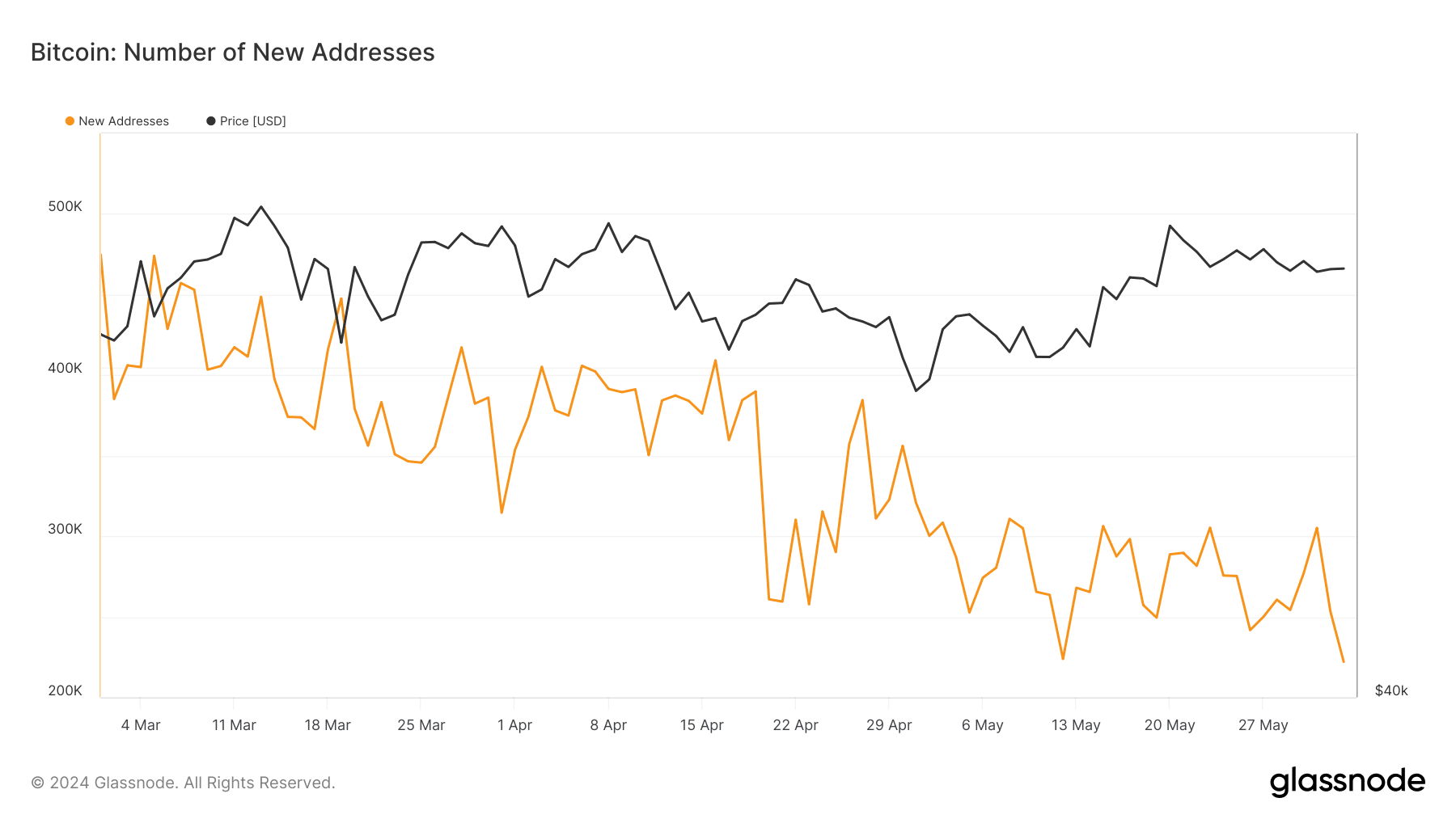

In the meantime, there’s a decline in new addresses for each Bitcoin and Ethereum which might point out a cooling curiosity amongst new buyers, doubtlessly impacting future demand.

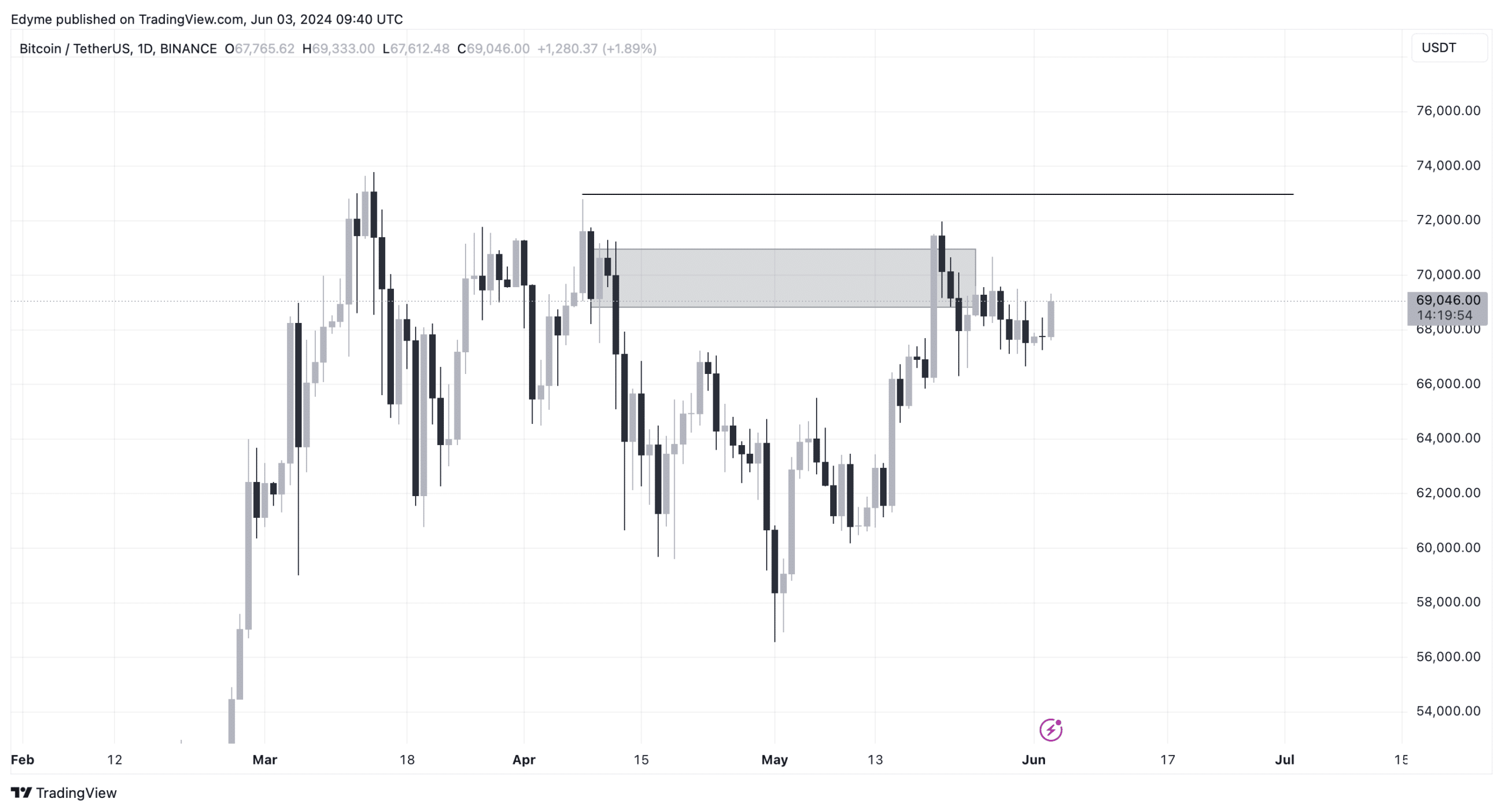

In the meantime, technical evaluation of each Bitcoin and Ethereum’s charts reveals a doubtlessly intriguing efficiency on the horizon.

Specializing in Bitcoin’s every day chart, it illustrates a sample the place the cryptocurrency has been breaking by decrease help ranges, not too long ago reversing to faucet into a significant provide zone.

This motion sometimes indicators a continuation of the downtrend. Nonetheless, if Bitcoin surpasses the $72,000 mark, breaking the earlier decrease excessive and negating the bearish setup, this might recommend a reversal to an upward development.

AMBCrypto, citing an analyst from XBTManager on CryptoQuant, reported that Bitcoin is poised for a notable ascent. The analyst suggests,

“Bitcoin is gathering power for the subsequent rise. When it gathers sufficient power, a pointy rise appears to be imminent. It appears doubtless that rises akin to these seen in Q3-This autumn will proceed.”

Is your portfolio inexperienced? Test the Bitcoin Profit Calculator

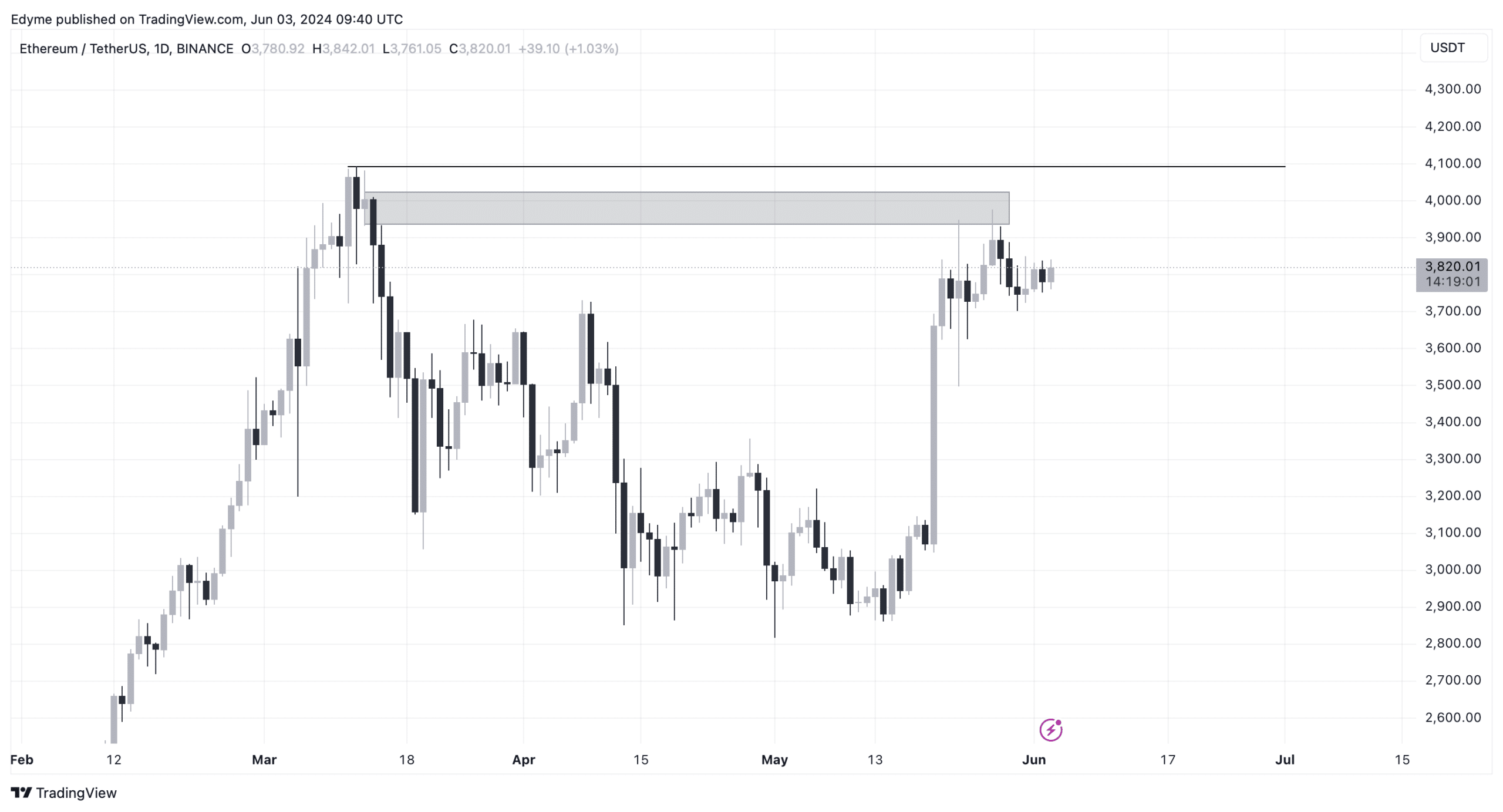

An identical sample emerges on Ethereum’s every day chart. Ethereum has not too long ago entered a significant provide zone, suggesting an impending sell-off.

Nonetheless, if Ethereum breaks above the $4,000 threshold, surpassing the latest decrease excessive and overturning the present promote sign, this might pave the way in which for an upward motion.

[ad_2]

Source link