[ad_1]

NFT volumes start to fall

Over the previous month, the entire gross sales of Ethereum NFTs fell by 55%. Standard Ethereum NFT collections resembling BAYC (Bored Ape Yacht Membership), MAYC (Mutant Ape Yacht Membership) and Crypto Punks witnessed a major decline of greater than 40% by way of gross sales and ground costs.

NFTs on different networks resembling Solana and Bitcoin have been gaining traction in comparison with the Ethereum community.

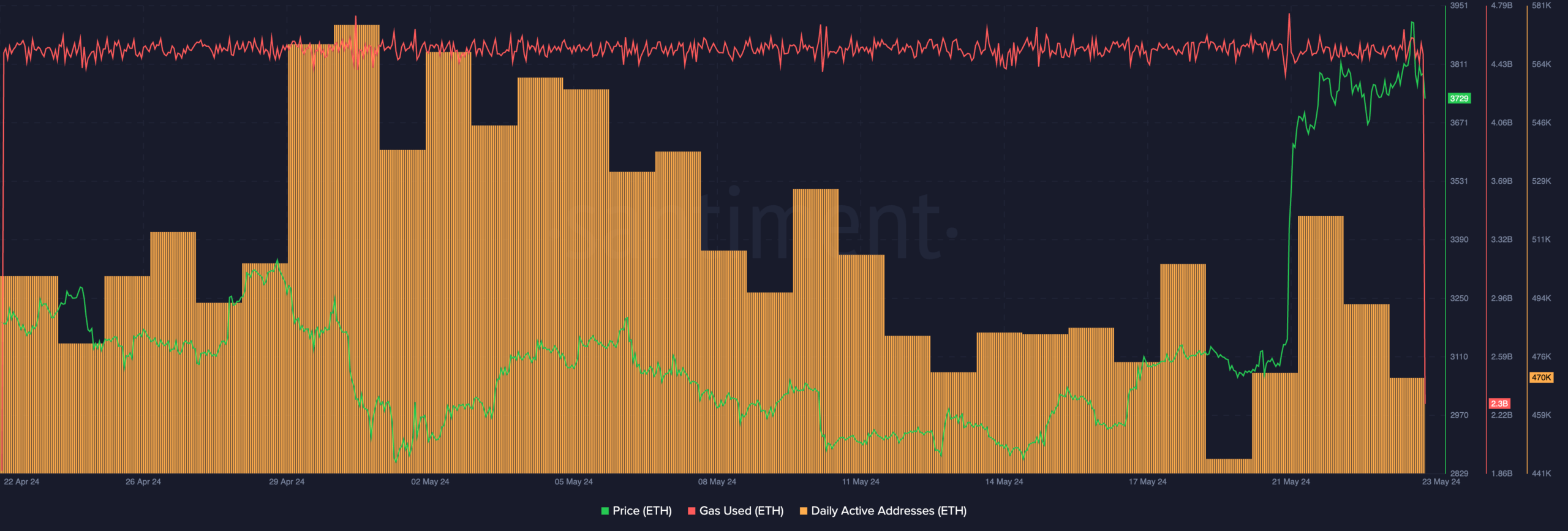

Furthermore, the each day lively addresses on the Ethereum community additionally fell considerably over the previous couple of days together with the gasoline utilization on the community, implying declining total exercise on the Ethereum ecosystem.

This possibly an indication that Ethereum’s recognition as an ecosystem was waning considerably.

Regardless that the curiosity in ETH because of the hype round its ETF has risen and brought about the value to develop, a waning curiosity within the Ethereum ETF’s might trigger an issue for ETH in the long term.

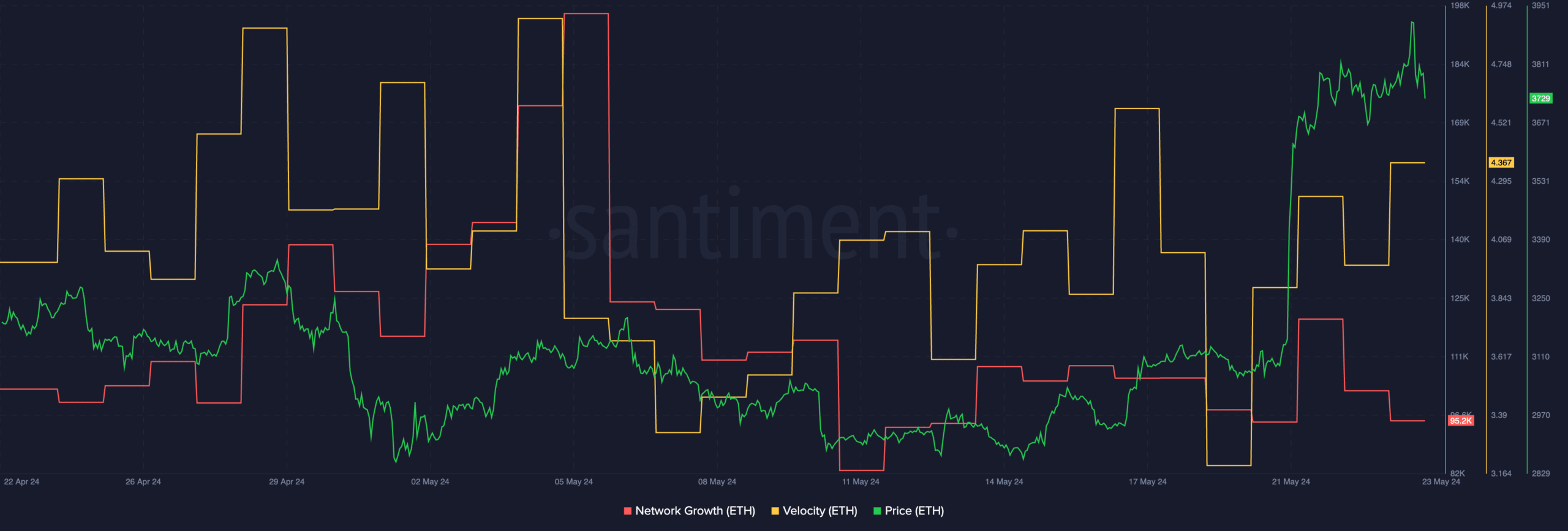

At press time, ETH was buying and selling at $3,786.76 and its worth had fallen by 0.68%. The community development across the ETH token had fallen considerably, implying that the variety of new addresses fascinating with ETH had drastically declined.

An absence of curiosity from new addresses recommended that the market was not prepared to purchase ETH at its present worth.

Some bulls might look forward to a correction earlier than accumulating extra ETH sooner or later.

Moreover, the rate at which ETH was buying and selling at had grown, indicating that the frequency with which ETH was buying and selling at had risen.

Solely time will inform whether or not the value motion of ETH co relates with the rising velocity, giving bulls some hope in regards to the future.

Is your portfolio inexperienced? Verify the Ethereum Profit Calculator

How are addresses holding up?

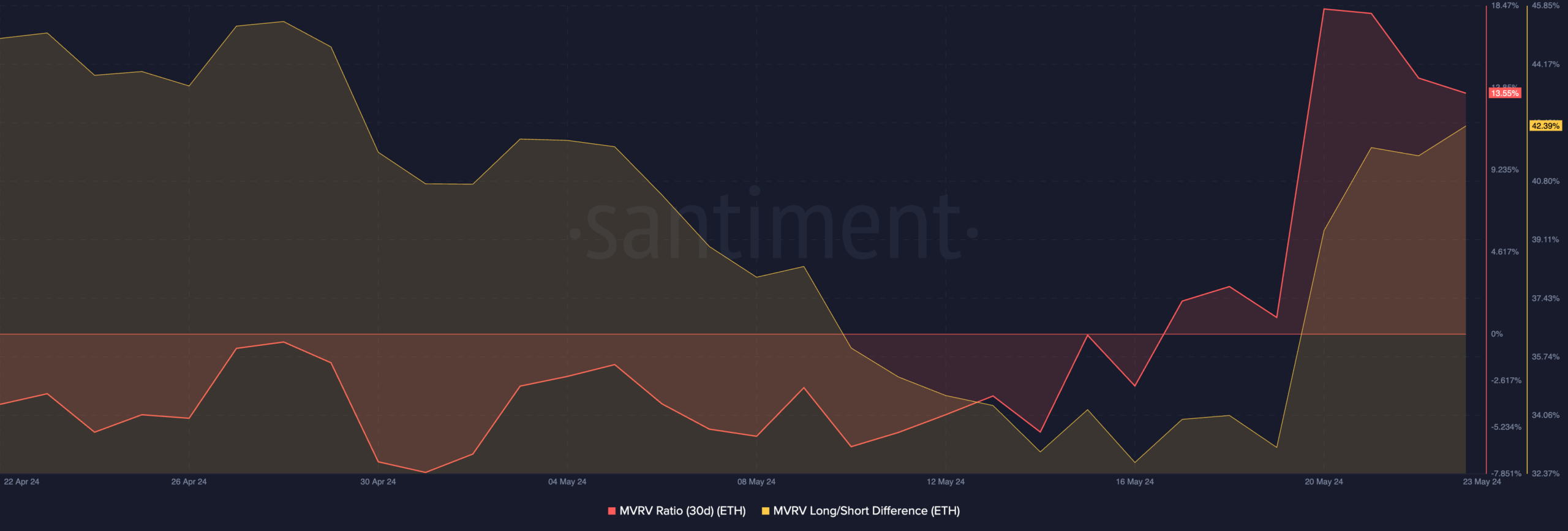

Coming to the state of the holders, it was seen that the majority addresses have been worthwhile, as indicated by the excessive MVRV ratio for ETH.

Regardless that a excessive MVRV ratio implies that extra holders are incentivized to promote their holdings, the presence of long run holders showcased by the excessive Lengthy/Quick distinction implies that a big sell-off might not occur anytime quickly.

[ad_2]

Source link