[ad_1]

- The previous few months have been marked by an uptick in ETH whale exercise.

- For the reason that SEC accredited ETH spot ETF, there was a rally in every day whale transfers.

Ethereum [ETH] has witnessed a surge in whale exercise up to now few months, Santiment famous in a newly printed report.

In line with the on-chain information supplier, the current uptick in whale exercise has been fueled by rumors and the eventual approval of spot Ethereum exchange-traded funds (ETFs) by the U.S. Securities and Alternate Fee.

On the twenty third of Could, the regulator approved 19b-4 varieties for the ETF functions filed by BlackRock, Constancy, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton.

This approval got here unexpectedly after an prolonged refusal to speak with issuers.

ETH whales take cost

Per Santiment’s report, over the previous 14 months, whale wallets that maintain at the very least 10,000 ETH cash have elevated their cumulative holdings by 27%.

This cohort of ETH holders purchased 21.39 million ETH, valued at $83 billion, at present market costs throughout that interval.

In line with Santiment,

“Ethereum has even gained on Bitcoin (by share) over the previous month after the rumors and eventual approval of the primary Spot ETH ETFs had been introduced by the SEC. So it’s no shock to see that the whale accumulation has not come to an finish.”

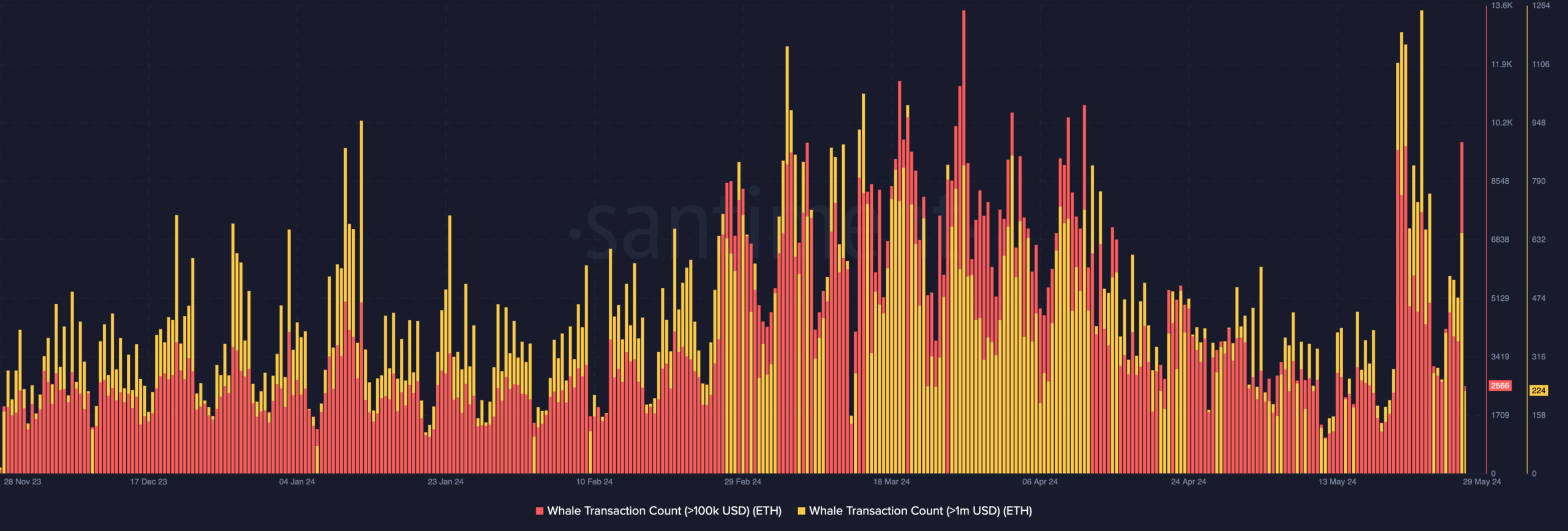

Relating to every day whale transactions involving ETH, the on-chain information supplier famous that after final week’s spot ETF approval, the variety of ETH whale transactions exceeding $100,000 and $1 million surged to YTD highs.

On that day, the variety of ETH transactions valued above $100,000 reached 7,649, whereas these exceeding $1 million totaled 1,252.

This surge was as a consequence of an uptick in profit-taking exercise among the many coin’s massive holders. Santiment famous,

“This was clearly a chance that whales noticed to revenue take. Nevertheless, costs could proceed to outperform Bitcoin so long as these 10K+ ETH wallets are nonetheless transferring north as an alternative of south via this volatility.”

ETH holders guide positive factors

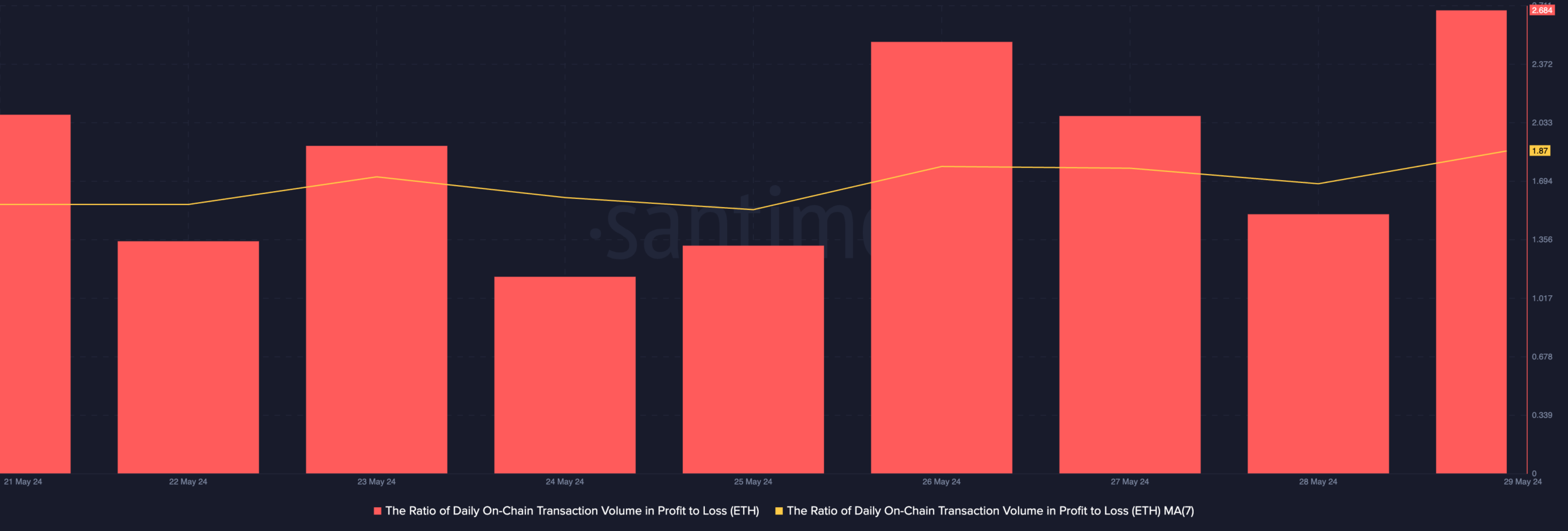

Amid the expansion in whale exercise since final week’s approval, every day transactions involving ETH have been worthwhile.

AMBCrypto assessed the every day ratio of the altcoin’s transaction quantity in revenue to loss (utilizing a seven-day transferring common) and located that it was 1.87.

Is your portfolio inexperienced? Try the ETH Profit Calculator

This meant that for each ETH transaction that led to a loss within the final week, 1.87 transactions returned a revenue.

At press time, the altcoin exchanged fingers at $3,865, in accordance with CoinMarketCap’s information.

[ad_2]

Source link