[ad_1]

Following up with the extra enjoyable notion of dogecoin as written about yesterday, at present we have a look at blockchain.

When you’re like me, that you must improve your understanding of why blockchain expertise is a sport changer in our evolving digital world.

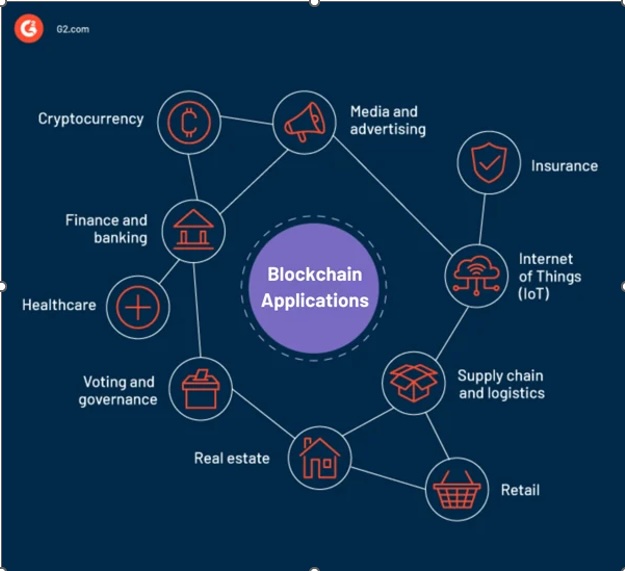

Everyone knows that blockchain is most famously related to cryptocurrencies, enabling safe and decentralized funds.

Listed here are a couple of extra mainstream makes use of:

The principle advantages of all of the functions in these areas are better effectivity, accuracy, transparency, and cost-savings.

Nevertheless, it isn’t with out its challenges.

- Scalability, as there are mounted block dimension limits.

- Power consumption, as blocks eat substantial computational energy.

- Pace, as within the processing velocity is slower in comparison with conventional strategies of transactions.

- Lack of common requirements, which may make navigating for builders tougher.

Nonetheless, at present, we see many of the high mining corporations not solely underperforming the general market, but in addition underperforming Bitcoin.

With a few exceptions.

After I checked a listing of main mining corporations, a couple of very recognizable names got here up.

The primary 2 names are Coinbase and Block (previously often known as Sq.).

The chart of Block exhibits a latest pop following the information or rumor of an ETF for Ethereum coming quickly.

The Actual Movement exhibits a bearish divergence as the worth is above the 50-DMA however not the momentum.

Block is although, in a bullish section and above the January 6-month calendar vary excessive.

A transfer over 34.50 or a drop to round 27.50 seem like the very best parameters to look at for indicators of shopping for.

With Coinbase COIN, there was an early within the day try and get the worth to rise above the 50-DMA, but it surely didn’t maintain.

COIN is beginning to outperform SPY.

On Actual Movement, COIN has but to show it may clear the shifting averages and stays in a bearish divergence.

We now have a place in COIN, full disclosure, and imagine that the inventory has enormous potential to rise additional in value.

So far as the opposite corporations, solely Microsoft has a powerful technical chart,

IBM, PayPal, and FedEx are all on the listing as properly.

None of these corporations have proven something a lot in the way in which of efficiency.

Therefore, like with all megatrends, timing on investments is all the things.

Twitter: @marketminute

The creator could have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t characterize the views or opinions of some other individual or entity.

[ad_2]

Source link