[ad_1]

- Ethereum’s value soared by 20%, overtaking Mastercard in market cap, amid sturdy shopping for strain.

- SEC’s shift in direction of probably approval of an ETH ETF has sparked a market rally.

To this point, Ethereum [ETH] has skilled a outstanding surge, ascending by practically 20% in simply the previous day. This spectacular enhance pushed Ethereum’s value to exceed $3,600, marking the best degree since nineteenth April.

The asset’s quantity can also be on an uptrend, indicating sturdy shopping for strain out there. This growth comes amid an indication of Ethereum’s rising affect and adoption, underscoring its place because the second-largest cryptocurrency by market capitalization.

Leon Waidmaqnn, a famous on-chain analyst, has pointed out that Ethereum’s market capitalization has now surpassed that of the worldwide funds big Mastercard, standing at $440 billion in comparison with Mastercard’s $427 billion.

This shift isn’t just a mirrored image of Ethereum’s rising prominence but additionally an indication of the broader acceptance and integration of cryptocurrencies into mainstream finance.

Regulatory modifications and market dynamics

The current upswing in Ethereum’s market worth follows a major growth within the regulatory panorama. The US Securities and Change Fee (SEC) has proven indicators of a constructive shift relating to the approval of spot Ethereum exchange-traded fund (ETF) purposes.

Bloomberg analysts have notably revised their approval possibilities for an Ethereum ETF from 25% to 75%. This modification relies on indications that the SEC is quickly altering its stance, with exchanges being prompted to replace their 19b-4 filings in preparation for a possible approval as early as twenty second Could.

The regulatory pivot seems to be a key driver behind the present bullish momentum in Ethereum’s market.

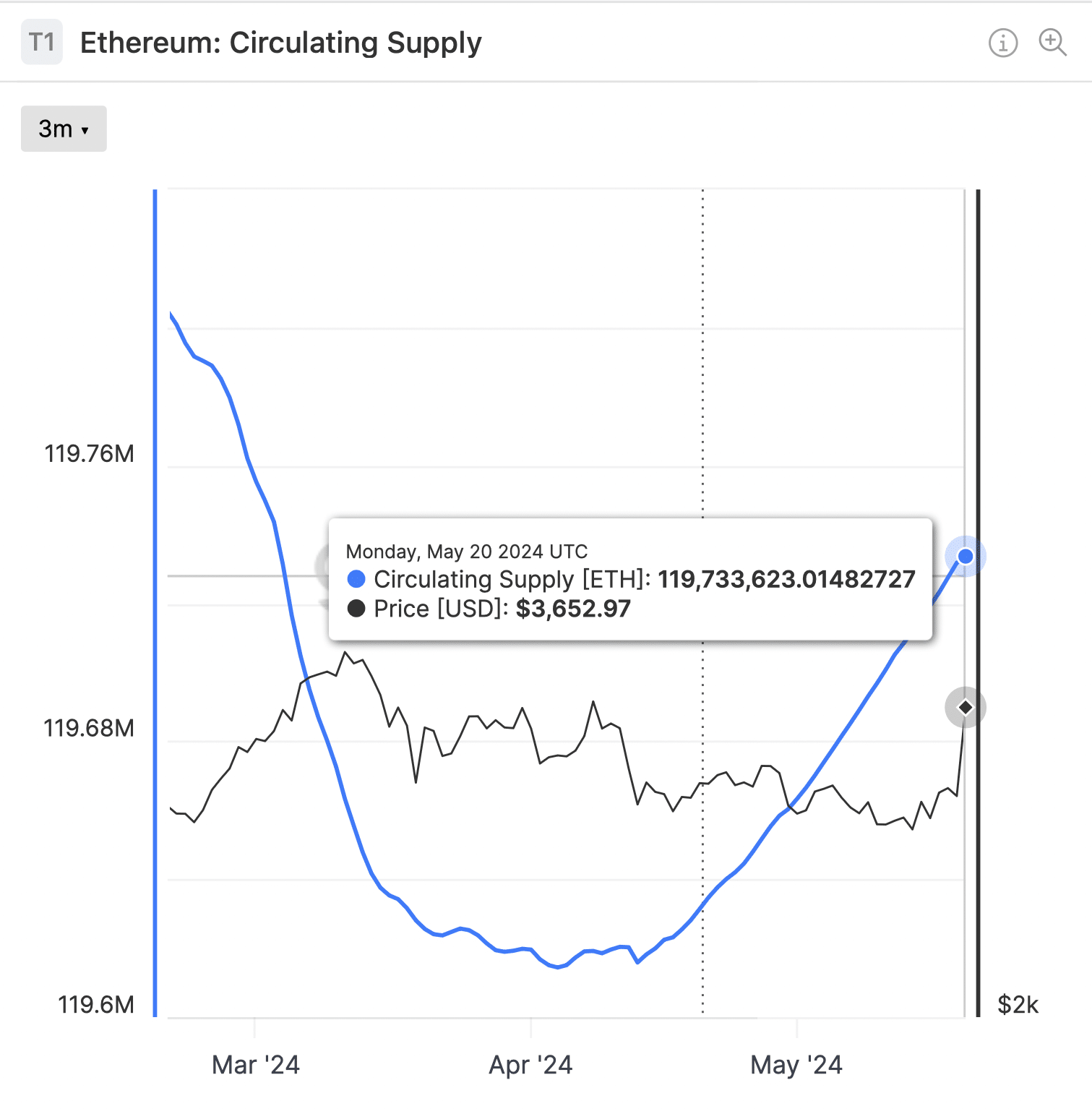

In the meantime, the rise in Ethereum’s circulating provide from 119.6 million ETH in mid-April to 119.73 million ETH at press time, in line with data from Glassnode, suggests extra tokens can be found for buying and selling and transactions.

Though this might usually point out elevated promoting strain, the present market dynamics present that demand stays sturdy, probably fueled by the present anticipation of the ETH spot ETF approval.

Market response and future outlook

Amid these developments, Ethereum has not solely surged in value but additionally proven important actions in different market metrics.

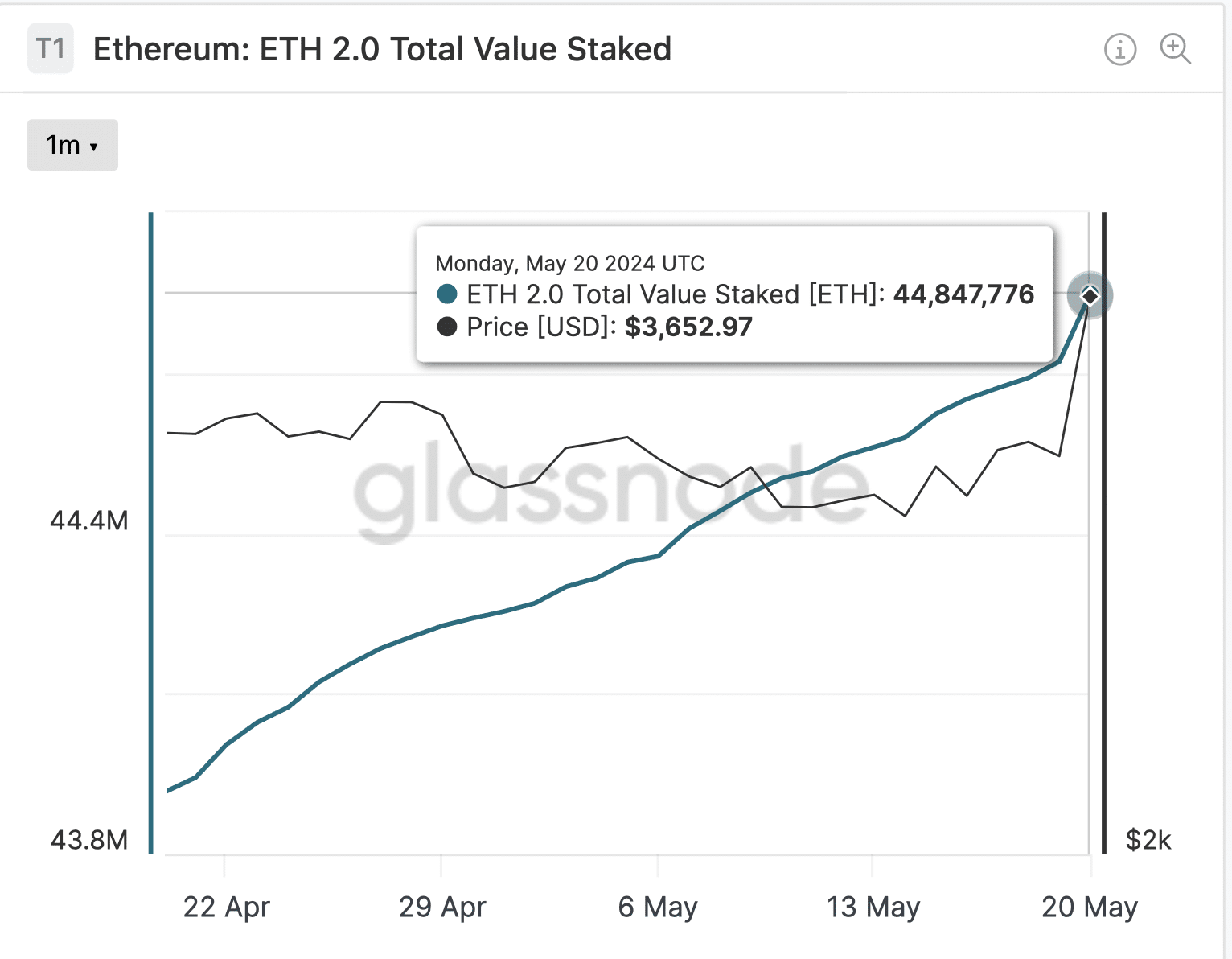

For instance, the full worth staked in Ethereum has additionally risen from 43 million ETH final month to over 44 million ETH, in line with Glassnode.

This enhance in staked ETH underscores the rising confidence of buyers in Ethereum’s long-term worth and utility.

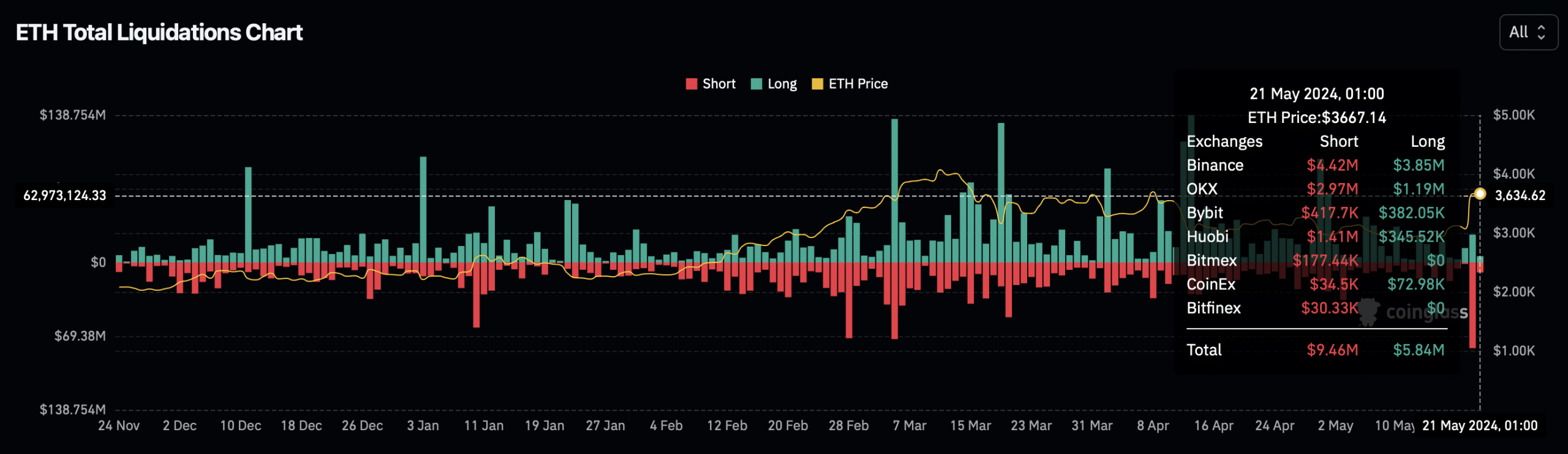

Nonetheless, not all market individuals are benefiting from this rise. Coinglass data revealed over $10 million in liquidations within the Ethereum market over the previous 24 hours, with quick sellers bearing the brunt of those losses.

This follows a bigger pattern of quick place liquidations price over $80 million the day prior to this, indicating that many who wager towards Ethereum had been caught off-guard by its speedy ascent.

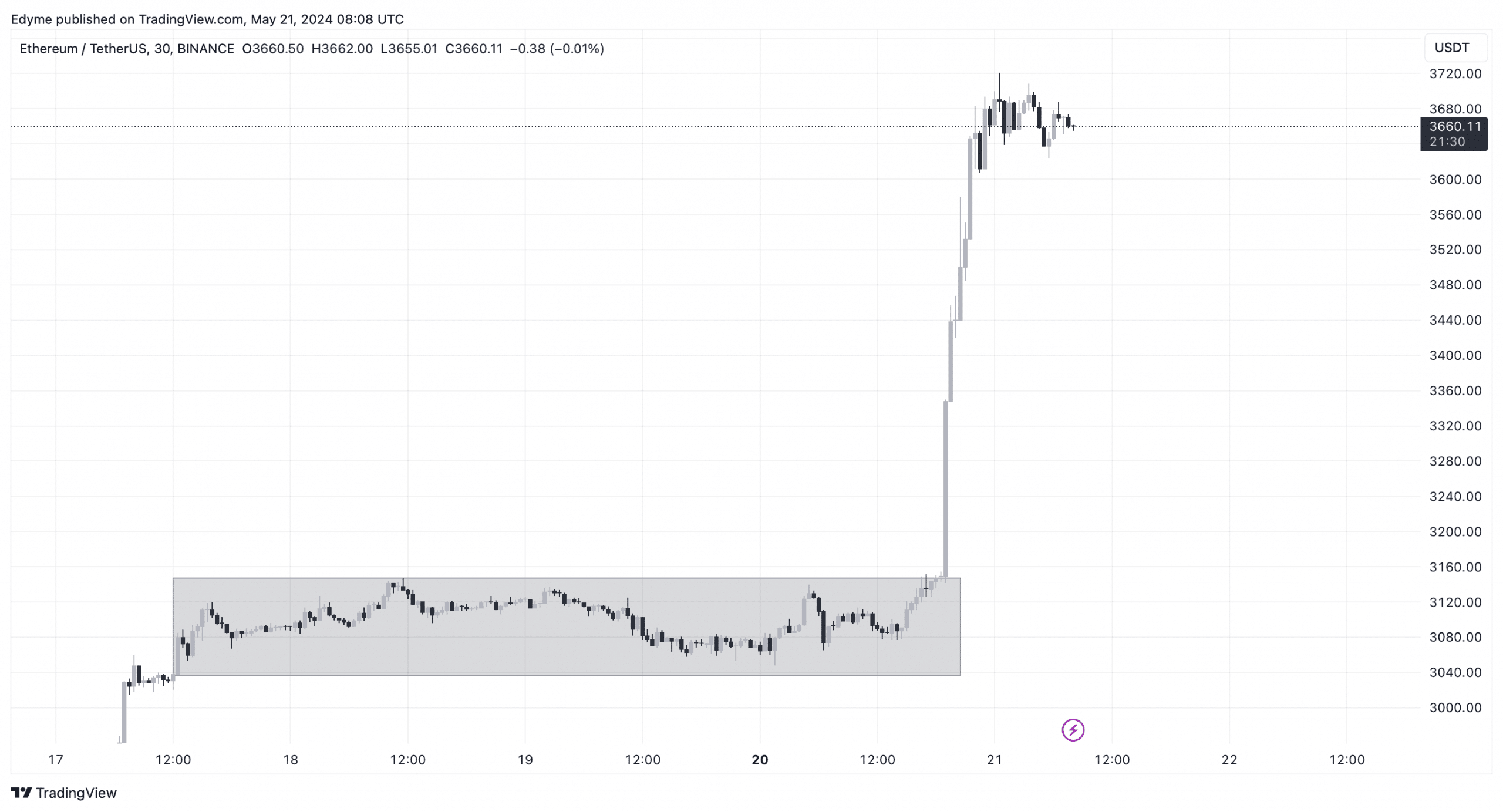

Taking a look at Ethereum’s value chart, the asset seems poised for additional positive factors.

Is your portfolio inexperienced? Verify the Ethereum Profit Calculator

It has just lately damaged via a consolidation zone to the upside, a technical sample that means patrons are firmly in management.

This breakout, mixed with constructive regulatory developments and sturdy market metrics, units the stage for potential continued upward motion in ETH’s value.

[ad_2]

Source link