[ad_1]

- Investments value $30 million had been allotted to Ethereum merchandise.

- Bitcoin registered outflows, however ETH’s value would possibly drop.

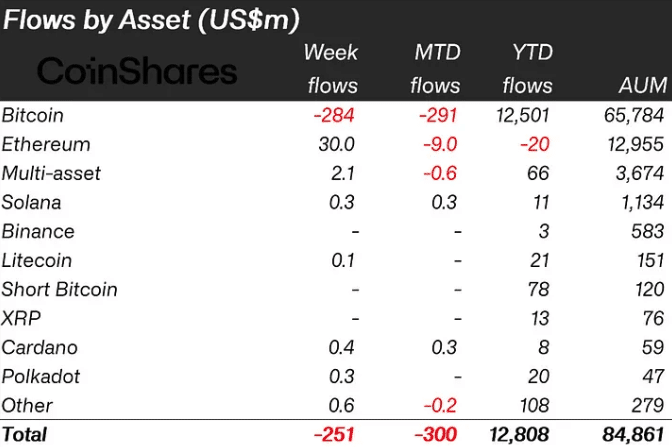

For the fourth consecutive week, digital asset funding merchandise recorded extra outflows than inflows. Coinshares, the main asset supervisor, made this identified in a submit dated the seventh of Could.

In whole, the outflows had been value $251 million with Bitcoin [BTC] accounting for $284 million. Nevertheless, Ethereum [ETH] was capable of cut back that quantity after it registered inflows value $30 million.

ETH comes out from the shadows

This was the primary time in seven weeks that Ethereum had inflows. Nevertheless, AMBCrypto noticed that the launch of Bitcoin and Ethereum spot ETFs in Hong Kong final week was liable for the rise.

CoinShares additionally agreed, highlighting that,

“The brilliant spot final week was the profitable launch of spot-based Bitcoin and Ethereum ETFs in Hong Kong, which noticed US$307m inflows within the first week of buying and selling.”

Another excuse may very well be linked to the anticipated determination of the U.S. whether or not to approve the Ethereum ETF purposes or not.

In earlier articles, AMBCrypto had reported how some consultants expressed skepticism in regards to the approvals.

Nevertheless, there have been just a few who displayed optimism that the submitting would get the inexperienced mild. Within the week earlier than the final, we had mentioned how Litecoin [LTC] and Chainlink [LINK] led the inflows.

However final week, these altcoins couldn’t discover favor within the eyes of traders. For Ethereum, an approval might save ETH from its miserable section.

Alternatively, rejection might set off one other wave of correction for the cryptocurrency. At press time, ETH modified fingers at $3,067.

The coast just isn’t clear

Moreover, there have been predictions that the worth would possibly slide again. If validated, a decline to $2,800 might occur, because it did just a few weeks again.

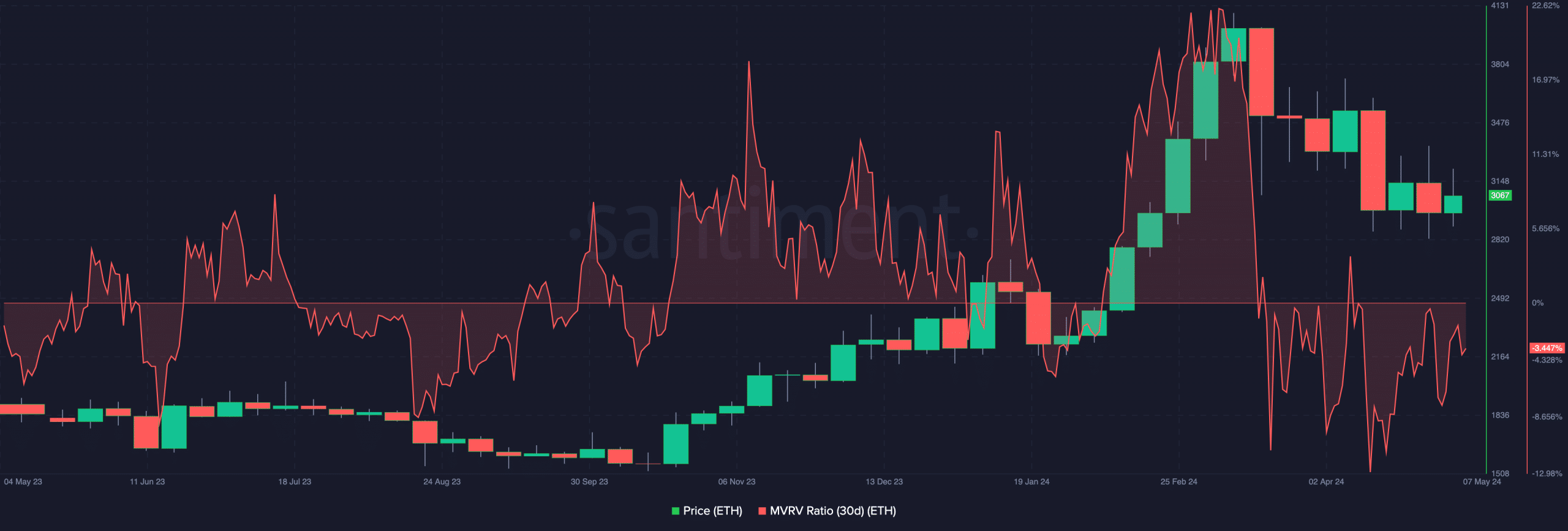

Nonetheless, there are some merchants whose goal is a return above $4,000. To establish the potential of those forecasts, we seemed on the Market Worth to Realized Worth (MVRV) ratio.

The MVRV ratio measures the profitability status of holders. With this metric, one can inform if a cryptocurrency is undervalued, at truthful worth, or overvalued.

At press time, Ethereum’s 30-day MVRV ratio was -3.447%. Which means holders would generate a median of a -3% loss if all of them determine to promote on the present worth.

However most wouldn’t do that. Nevertheless, this won’t be a great accumulation level, regardless of the adverse studying. Traditionally, nice shopping for alternatives seem when the metric is between -7% and -18%.

Subsequently, these maintaining a tally of ETH, and ready for good entries, would possibly want to attend a bit longer.

Is your portfolio inexperienced? Try the ETH Profit Calculator

Whatever the entry area, ETH would wish an intense degree of shopping for strain to start out rewarding the positions.

For now, it’s unsure when that can occur. Nevertheless, market individuals are hopeful that Ethereum’s time to shine won’t be distant.

[ad_2]

Source link