[ad_1]

India is at the moment in a vital section within the international crypto market, aiming to stability innovation and security. Impressed by different nations, it’s specializing in find out how to regulate digital digital property (VDAs). A ‘HODL’ technique could possibly be adopted, emphasizing accountable regulation to encourage development and innovation within the sector.

The worldwide run to manage cryptocurrency property offers India with a novel alternative to guide this house. By implementing a complete regulatory framework, India can place itself as a world chief in accountable cryptocurrency asset use.

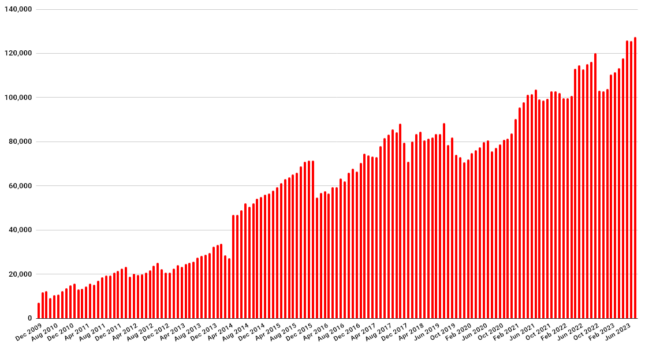

India’s VDA and Web3 panorama is stuffed with potential. With international developments, India ought to seize the chance. In line with the ‘India’s Web3 Panorama 2023’ report by Hashed Emergent and companions, India has over 1,000 startups and 12% of worldwide Web3 builders, making it one of many largest ecosystems worldwide.

Lately, on the G20 Summit, India demonstrated its management by advocating for international regulatory requirements. The nation is looking for collaborative efforts to handle the worldwide nature of crypto property and deal with their broader monetary implications.

The nation is carefully observing profitable regulatory fashions just like the EU’s MiCA and the UK’s deliberate crypto laws, paving the way in which for a well-defined home framework.

The EU is gearing up for the implementation of the Markets in Crypto-assets (MiCA) regulation, set to come back into impact this yr.

The Dubai Worldwide Monetary Centre (DIFC), a distinguished international monetary hub, has not too long ago launched the world’s first Digital Belongings Legislation. Positioned because the main monetary middle within the Center East, Africa, and South Asia (MEASA) area, this transfer underlines its dedication to embracing digital finance.

In the meantime, the UK authorities is making waves with its ambition to turn out to be a world chief in Web3 because it plans to manage crypto property by formal laws in 2024.

Firstly of 2024, when the US SEC gave the green light to 11 ETFs, making it simpler for buyers to faucet into Bitcoin instantly by regulated channels.

Following the announcement, Bitcoin soared previous the $70,000 mark for the primary time, signaling a surge of curiosity and confidence within the cryptocurrency.

This resolution not solely offers buyers with a well-recognized and controlled solution to entry Bitcoin but in addition highlights the rising integration of digital property into mainstream finance.

Additionally Learn: Indian Authority Bust ‘E-Nugget’ App Scam with Binance

[ad_2]

Source link