[ad_1]

- Ethereum’s worth appreciated by greater than 2.5% within the final 24 hours

- Most metrics and market indicators appeared bullish on ETH’s charts

As market sentiment modified over the previous couple of hours, Ethereum [ETH] benefited from the identical as its each day chart turned inexperienced. Nevertheless, the newest uptick may simply be the start of a large rally, particularly for the reason that king of altcoins’ worth is now transferring inside a bullish sample.

Ethereum’s bullish transfer

The final 7 days weren’t within the traders’ greatest pursuits as ETH’s worth dropped by over 5%. Nevertheless, because the market development modified, ETH additionally managed to push its worth up by greater than 2.5% in 24 hours. In accordance with CoinMarketCap, on the time of writing, ETH was buying and selling at $2,988.30 with a market capitalization of over $358 billion.

Curiously, issues may get even higher for ETH within the coming days. World of Charts, a well-liked crypto-analyst, just lately shared a tweet highlighting that the ETH/BTC pair was transferring inside a falling edge sample. A profitable breakout from the sample may end in ETH hitting new highs within the coming months.

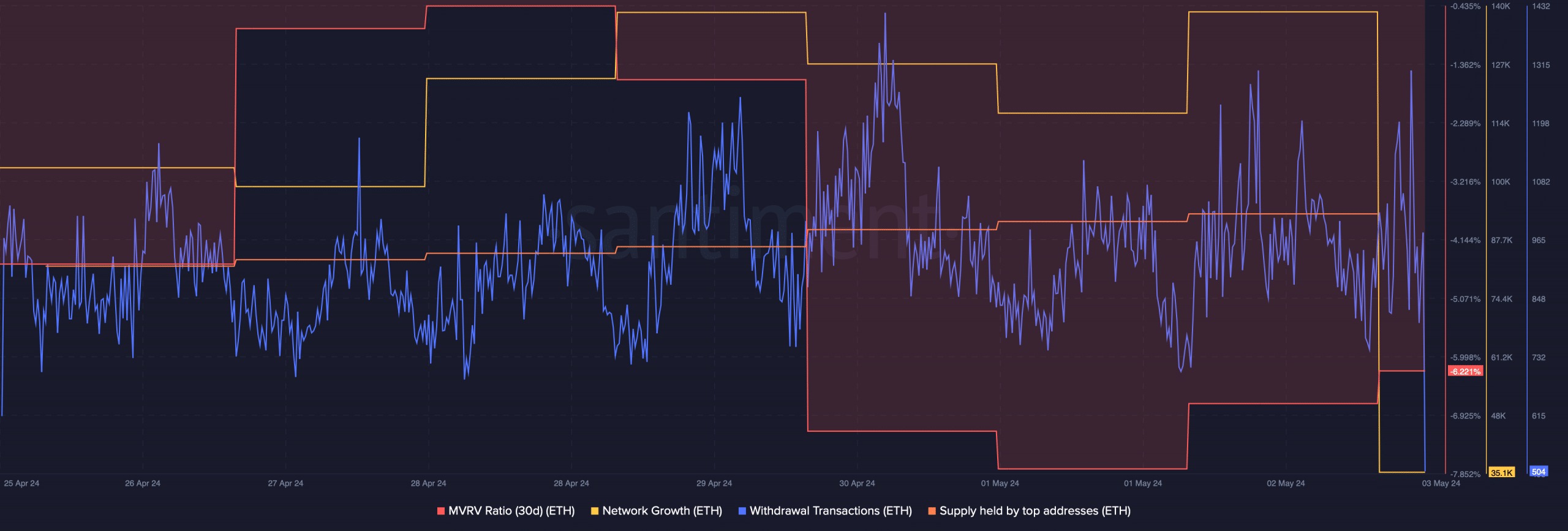

Subsequently, AMBCrypto checked ETH’s metrics to see whether or not it could handle a breakout. Our evaluation of Santiment’s information revealed that ETH’s community development hiked over the previous couple of days. Merely put, extra addresses had been created to switch the token as its energetic withdrawal charge climbed final week.

Moreover, Ethereum’s provide held by high addresses additionally rose barely, suggesting that purchasing stress on the token was excessive.

Quite the opposite, its MVRV ratio remained low. At press time, ETH’s MVRV ratio had a price of -6.22%.

Ethereum’s weekly goal

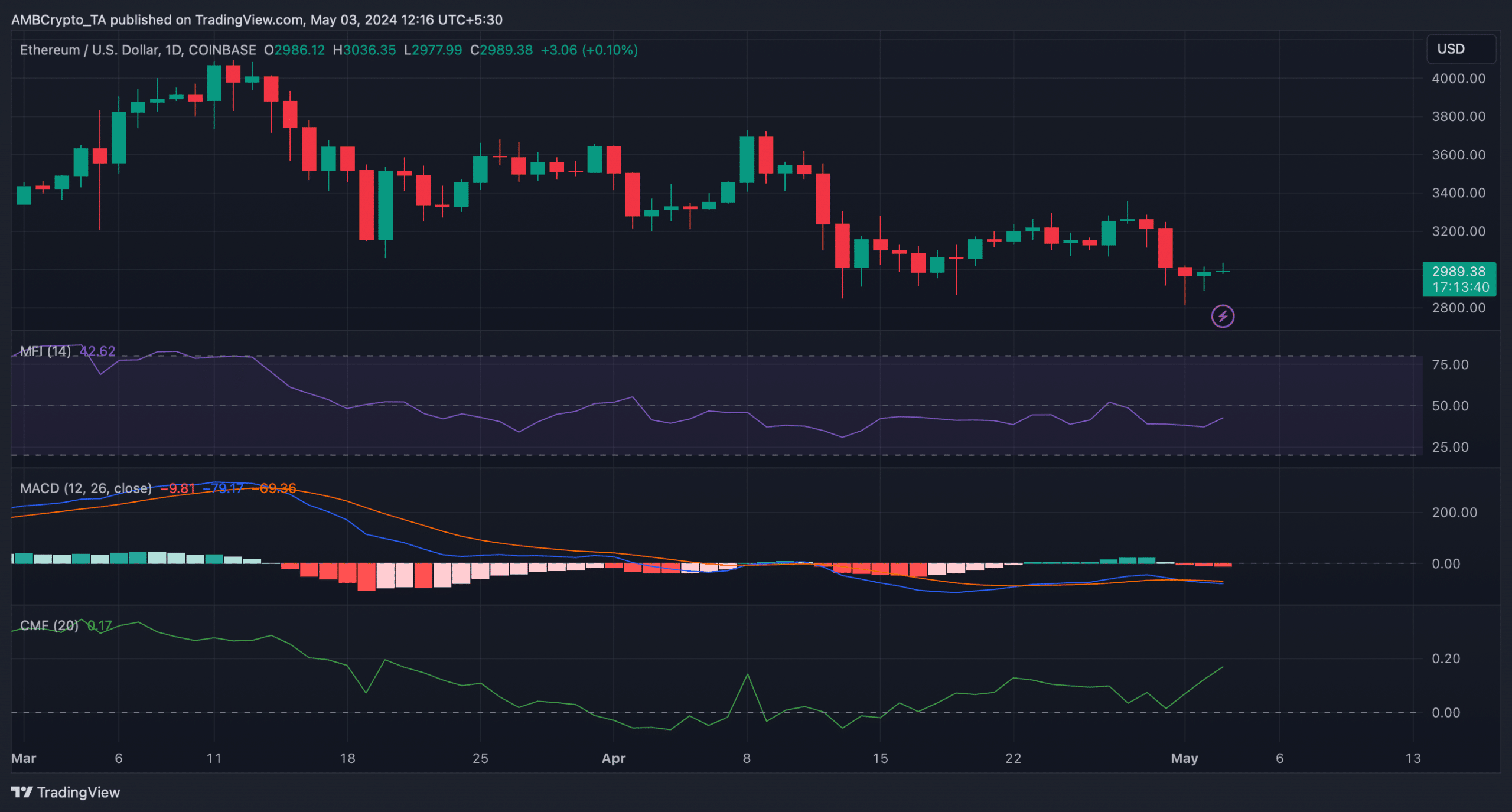

Since most metrics appeared bullish, AMBCrypto then checked ETH’s each day chart to see whether or not an additional uptrend was inevitable.

We discovered that ETH’s Chaikin Cash Move (CMF) registered a pointy uptick from the impartial degree. The Cash Move Index (MFI) additionally went north. Each of those indicators counsel that the probabilities of a sustained bull rally are excessive.

However, the MACD supported the sellers because it flashed a bearish crossover on the charts.

We then analyzed Hyblock Capital’s information to seek out out the attainable targets ETH may hit this week if the bull rally lasts. To ensure that ETH to maintain the rally, will probably be essential for the token to go above $3,100, as liquidations would rise sharply.

Learn Ethereum’s [ETH] Price Prediction 2024-25

A hike in liquidations may end in a worth correction. A profitable breakout above that degree may enable ETH to climb to $3,300 by the tip of this week if every thing falls into place.

[ad_2]

Source link