[ad_1]

Aave Labs has unveiled its 2030 strategic roadmap, which incorporates a number of key initiatives reminiscent of Aave V4, a brand new visible identification, and expanded defi performance.

On Might 1, the DeFi lending platform launched a governance proposal dubbed “Temp Verify” to solicit group touch upon updating its protocol.

On the coronary heart of the plan is the discharge of Aave V4, which might considerably enhance the protocol’s consumer interface and increase its performance throughout many blockchain networks.

The newest model of Aave boasts an improved operational fluidity due to the inclusion of a Cross-Chain Liquidity Layer (CCLL) that allows seamless asset transfers throughout supported chains.

Aave additionally introduced plans to combine Actual World Property (RWAs) with its native stablecoin, GHO, in partnership with ChainLink. The algorithmic stablecoin, launched in July 2023, has a market valuation of $49 million, making it a minor participant in comparison with opponents such as Tether (USDT) and USD Coin (USDC).

Strategies pertaining to GHO encompass enhancements to the liquidation engine, together with “comfortable” liquidations and variable liquidation incentives, in addition to improved GHO integration, together with interest-earning choices.

An emergency redemption mechanism for GHO depegging eventualities was additionally proposed as a part of the main improve.

The plan outlines a three-year growth timeline. Aave Labs intends to attach with the group frequently, together with suggestions classes and annual critiques, to make sure that the mission’s progress is consistent with group expectations and altering market circumstances.

Aave Labs has additionally advocated a transfer from a retroactive to a proactive funding mannequin primarily based on open budgeting and group approval previous to the mission’s starting. The deliberate finances includes 15 million GHO and 25,000 stkAAVE for analysis, growth, and safety audits within the first yr.

Revamped visible identification

Aave has additionally proposed updating its visible identification to higher mirror its strategic future targets and improve model recognition within the defi trade. The brand new design strives to convey a contemporary, distinct picture that’s in keeping with Aave’s creative method.

Aave Labs welcomed broad participation from builders and group members in attaining its targets, emphasizing that the protocol’s governance will stay decentralized. Contributors are inspired to take part actively in discussions and growth processes, thereby shaping the protocol’s future.

Following group suggestions, Aave Labs intends to revise and embrace it within the official Aave Governance Framework earlier than closing approval. The documentation for this mission is supplied below the CC0 license, permitting for open collaboration and in depth contributions.

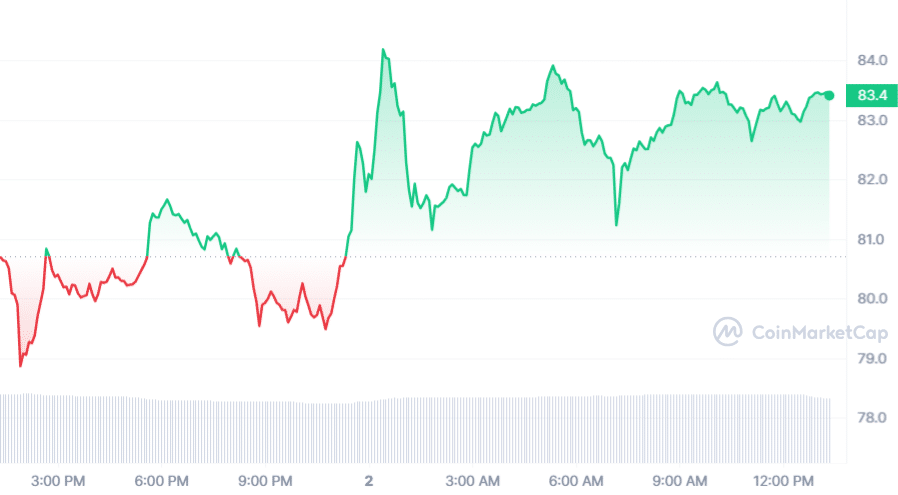

On the time of writing, AAVE was buying and selling at $83.41, up 3.4% within the final 24 hours, per knowledge by CoinMarketCap. Nonetheless, the token dropped 8% within the earlier week as a result of current decline within the world crypto market.

[ad_2]

Source link