[ad_1]

Famed dealer Peter Brandt has thrown a wrench into the gears of Bitcoin’s celebratory parade. In a current evaluation titled “Does historical past make a case that Bitcoin has topped?”, Brandt throws chilly water on the concept of a limitless value surge, suggesting the cryptocurrency could be nearing the summit of its present bull run.

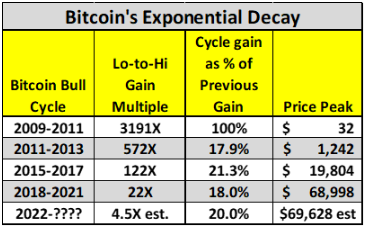

Bitcoin And The Exponential Dampener

Brandt’s analysis hinges on the idea of “exponential decay.” He dissects Bitcoin’s historical past, figuring out 4 distinct bull cycles, with the present one being the fifth. Right here’s the place issues get attention-grabbing: Brandt observes a regarding development – every successive cycle has exhibited a diminishing stage of exponential progress. In less complicated phrases, the value beneficial properties haven’t been as explosive as in earlier cycles.

This “exponential dampener” paints a doubtlessly bearish image. By making use of this development to the present cycle, Brandt arrives at a sobering prediction – a peak value of round $72,723, a determine the highest crypto already achieved in current buying and selling.

Whereas acknowledging the historic value boosts related to halving occasions (predetermined reductions in new Bitcoin creation), Brandt emphasizes the plain power of exponential decay. This, he argues, suggests a 25% likelihood that Bitcoin might need already hit its zenith for this cycle.

Brace For Affect? Potential Worth Retracements On The Horizon

If Brandt’s evaluation holds true, cypto buyers could be in for a bumpy trip. The veteran dealer anticipates potential value retracements, with Bitcoin doubtlessly plummeting to the mid-$30,000 vary, and even revisiting the 2021 lows.

A Lengthy-Time period Play? The Bullish Case For A Correction

Drawing parallels to historic value patterns noticed within the gold market, Brandt argues {that a} correction might pave the way in which for long-term bullishness. He views comparable chart patterns in gold as cases the place corrections have been adopted by renewed progress surges.

By analogy, a value correction in Bitcoin might act as a springboard for a future bull run, hunting down short-term speculators and attracting long-term buyers in search of a decrease entry level.

So, Ought to You Panic Promote Your Bitcoin?

Not essentially. Brandt’s evaluation affords a priceless perspective, however it’s only one piece of the puzzle. The cryptocurrency market thrives on volatility, and unexpected occasions can considerably affect value actions.

Buyers ought to think about this evaluation alongside different market indicators, conducting their very own analysis earlier than making any funding selections. Bear in mind, the cryptocurrency market rewards persistence and a robust abdomen for volatility. As Brandt himself acknowledges, “The information communicate for itself,” however the future stays unwritten, and it’s anybody’s judgment if Bitcoin has reached its peak, or if a wholesome correction is on the horizon.

Featured picture from Pexels, chart from TradingView

[ad_2]

Source link