[ad_1]

- Regardless of excessive unrealized losses, a whale was seen accumulating ETH

- ETH provide held by addresses that don’t belong to exchanges elevated in latest weeks

Ethereum’s [ETH] worth corrected sharply throughout the early buying and selling hours in Asia on Friday because of escalating tensions between Israel and Iran. Although it recovered to be valued at over $3,000 at press time, the second-largest cryptocurrency has largely been within the crimson over the previous week. In truth, it misplaced greater than 12% of its valuation, in accordance with CoinMarketCap.

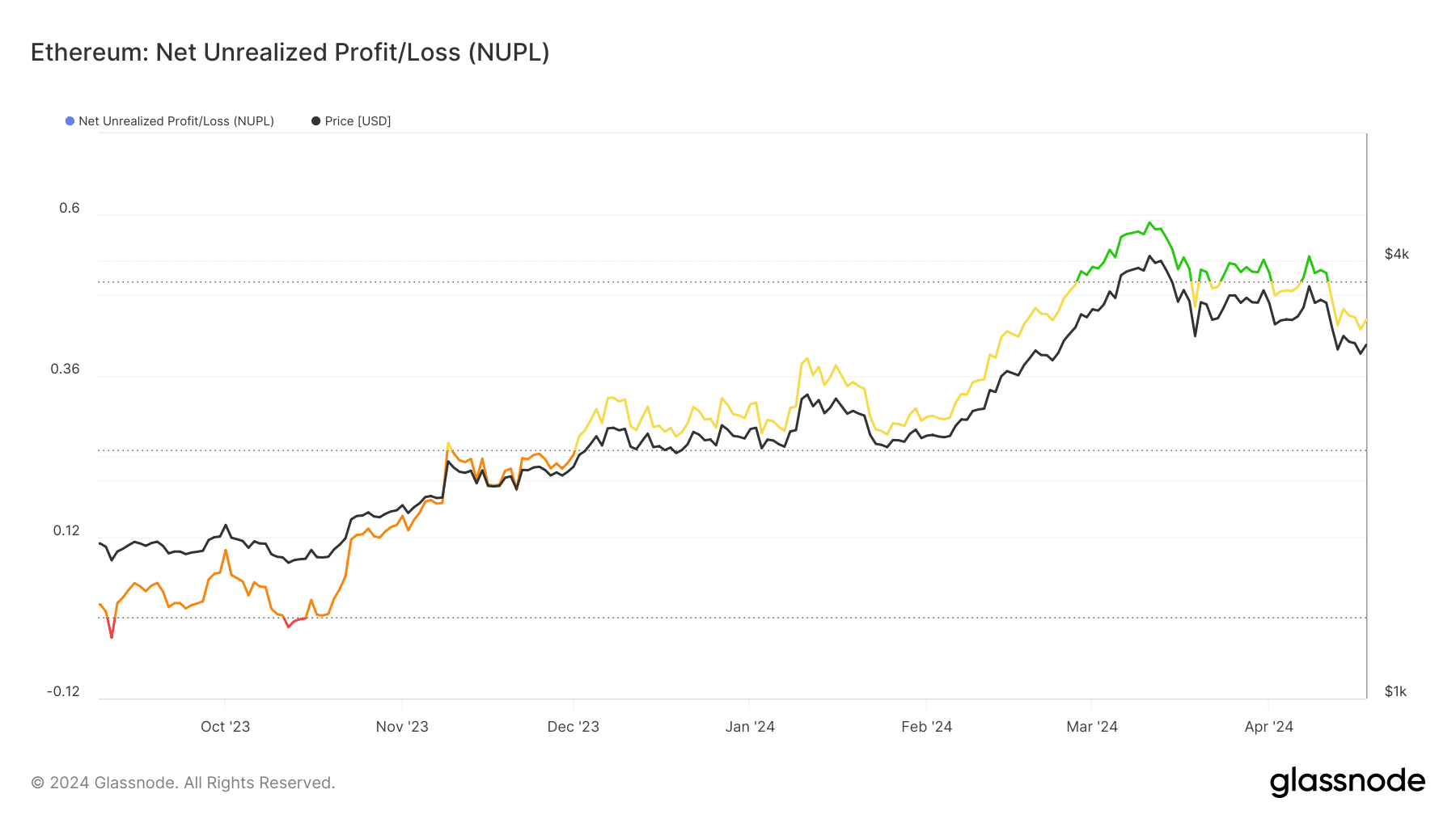

ETH’s profitability drops

The droop contributed to the online unrealized income of the community declining. AMBCrypto examined the identical utilizing Glassnode’s knowledge and located that the variety of ETH holders in revenue got here down sharply.

When confronted with such dangers to their portfolios, a number of individuals begin to capitulate, leading to panic promoting. Nevertheless, the actions of 1 explicit whale investor piqued the curiosity of the market.

Unfazed whale goes on shopping for spree

In keeping with on-chain monitoring platform Spot On Chain, a “big” whale is accumulating ETH regardless of being in unrealized loss. The danger-tolerant investor snapped 41,358 ETH over the previous 5 days, valued at round $128 million at prevailing costs.

Total, the whale is now in possession of a whopping 117,268 ETH cash, which if offered would lead to losses of roughly $20 million.

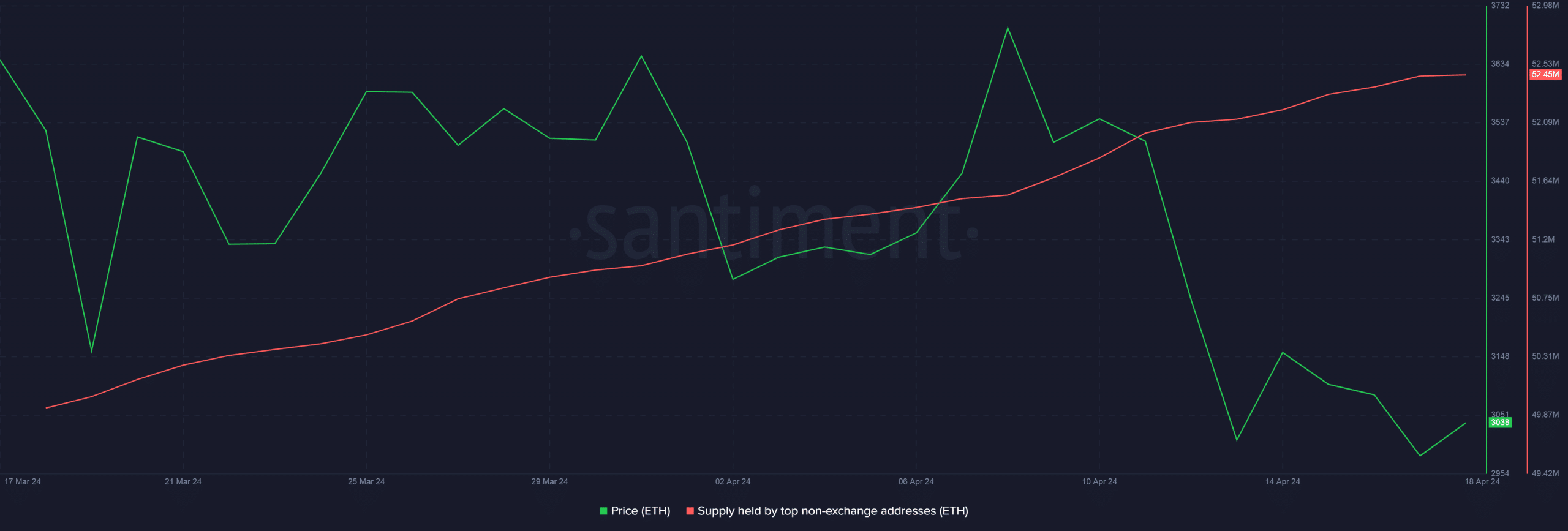

The buildup sample, nevertheless, was not restricted to the aforementioned whale. AMBCrypto dug additional utilizing Santiment knowledge and seen a gradual rise in ETH provide held by addresses that don’t belong to exchanges.

These HODLing tendencies are an indication of confidence in ETH’s worth over the long-term. These addresses is perhaps anticipating ETH to rebound and rebound properly.

Is your portfolio inexperienced? Try the ETH Profit Calculator

What to anticipate subsequent?

On the time of writing, Ethereum’s market was in a impartial state, as per the newest readings from Ethereum Fear and Greed Index. This signified a balanced market sentiment and not using a sturdy bias in the direction of shopping for and promoting.

Bitcoin’s [BTC] halving is anticipated to create ripples throughout the broader market, together with ETH. Following the final halving in 2020, ETH’s trajectory mirrored BTC’s, and each main property hit new highs the next yr.

[ad_2]

Source link