[ad_1]

- ETH’s worth fell briefly, with the altcoin valued at $3470 on 9 April

- Decline in worth fueled an uptick in lengthy liquidations

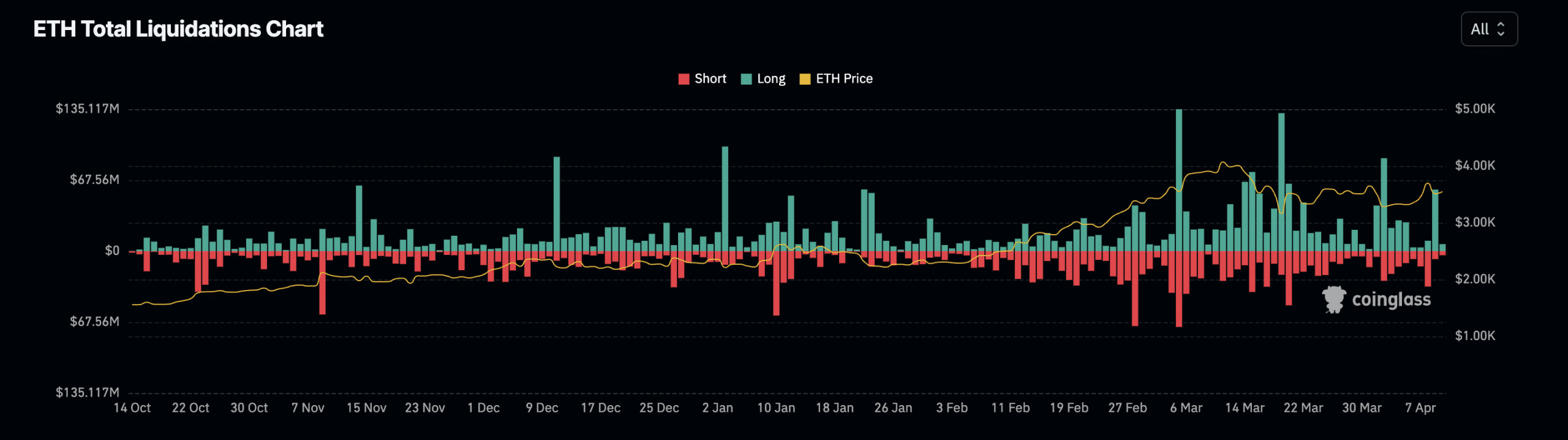

Ethereum’s [ETH] lengthy liquidations closed the buying and selling session on 9 April at a weekly excessive of $59 million, in accordance with Coinglass information. This occurred regardless of the current volatility within the altcoin’s worth. The truth is, in accordance with CoinMarketCap, ETH was buying and selling at slightly below $3550 at press time.

Liquidations occur in an asset’s derivatives market when a dealer’s place is forcefully closed on account of inadequate funds to take care of it. Lengthy liquidations happen when the worth of an asset abruptly drops, and merchants who’ve open positions in favor of a worth rally are pressured to exit their positions.

In ETH’s case, it recorded a spike in lengthy liquidations on 9 April as a result of fall in its worth in the course of the intraday buying and selling session. For its half, the altcoin briefly exchanged palms under $3500, earlier than regaining to shut the day at $3505.

Quickly after, Futures market members who had positioned bets in favor of a worth rally had been plunged into losses when ETH’s worth fell to a low of $3470. Then again, brief liquidations totalled $7 million, AMBCrypto discovered.

Bulls’ try to displace the bears

Whereas it fell just a little over the past 24 hours, ETH’s worth rally over the previous week mirrors the overall uptrend throughout the cryptocurrency market over that interval. The truth is, the worldwide cryptocurrency market capitalization has risen by 4% within the final seven days alone.

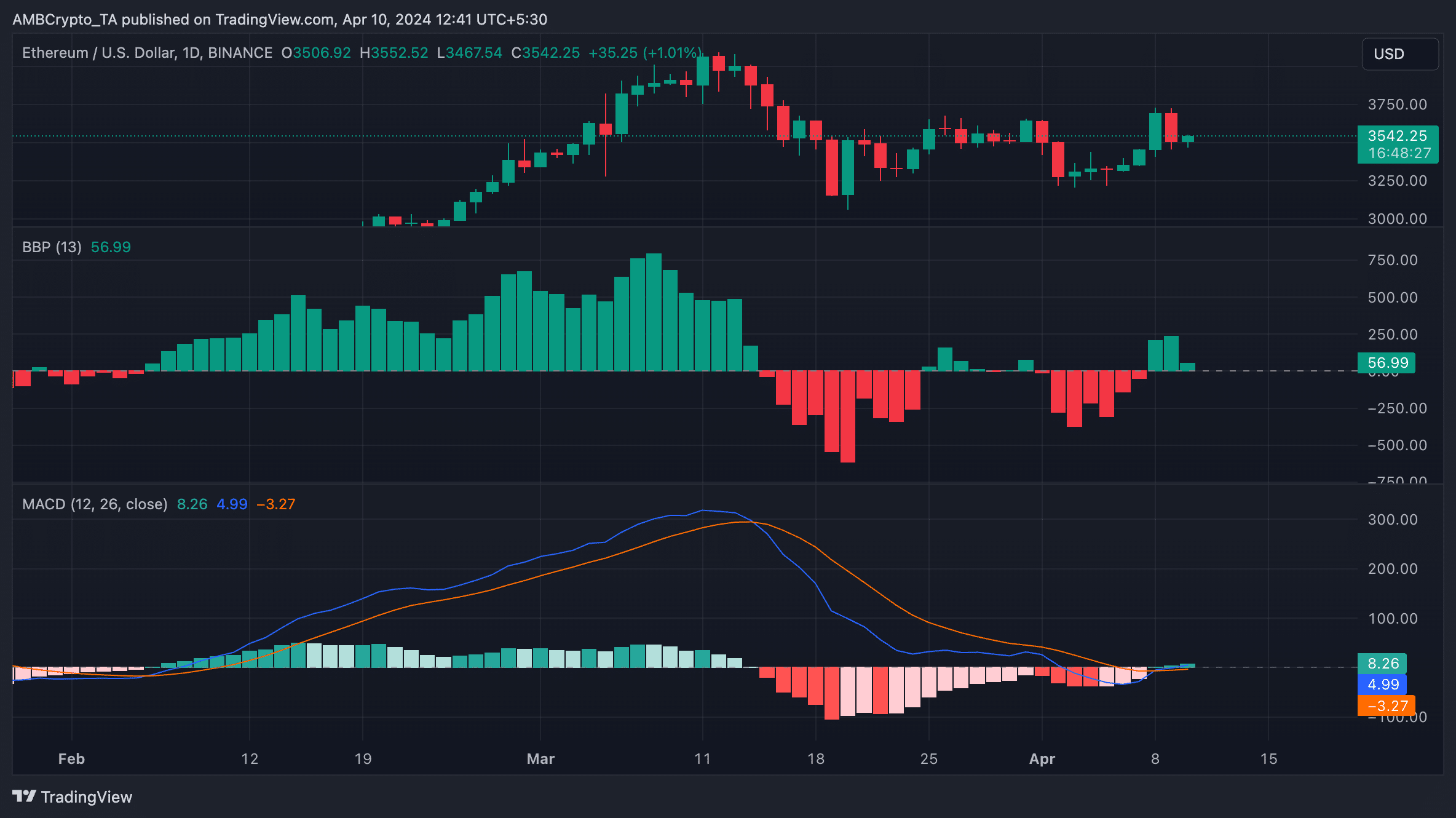

An evaluation of ETH’s efficiency on the 1-day chart underlined a re-emergence of bullish sentiments.

Learn Ethereum (ETH) Price Prediction 2024-25

For instance, readings from the coin’s Elder-Ray Index revealed that the indicator has returned solely optimistic values since 8 April. This indicator measures the connection between the power of consumers and sellers available in the market. When its worth is optimistic, it signifies that bullish momentum is dominant available in the market.

Moreover, on 8 April, ETH’s MACD line (blue) crossed above the Sign line (orange) to be positioned above zero, at press time.

This sort of intersection is taken into account a bullish sign as a result of it signifies that the altcoin’s shorter-term shifting common is gaining momentum. This, relative to the longer-term shifting common. Merchants interpret it as an indication to enter and exit brief positions.

[ad_2]

Source link