[ad_1]

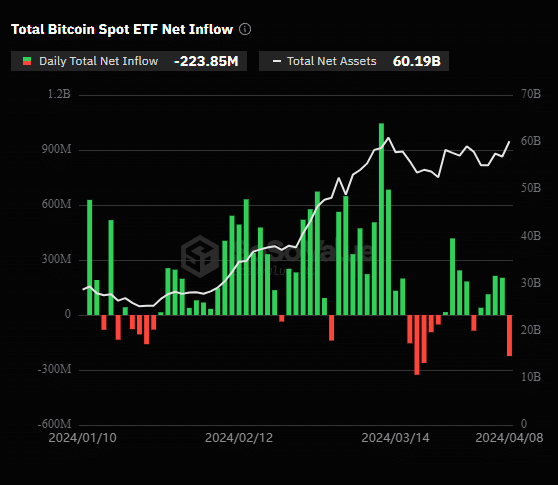

Bitcoin ETFs noticed a internet outflow of $223 million on Monday after 4 consecutive days of internet influx.

In response to SoSo Value, Monday was essentially the most vital outflow for Bitcoin ETFs in over two weeks. Final week, BTC ETFs noticed 4 days of consecutive inflows totaling practically $570 million, driving Bitcoin’s value to $72,000.

Nevertheless, Monday’s outflow brought on BTC’s every day buying and selling quantity to say no by 6%, forcing the value to retrace to $69,000.

Bitwise’s ETF noticed essentially the most vital single-day internet influx at $40.3 million. Nevertheless, practically $303 million was withdrawn from Grayscale’s ETF, GBTC.

For the reason that SEC accepted ETFs in January, Bitcoin’s market actions have pushed primarily the web asset influx into these devices. Institutional funds will seemingly proceed to play a bigger position within the token’s market efficiency, because the London Inventory Trade can also be making ready to launch Bitcoin ETNs subsequent month.

With the halving approaching, analysts are divided on how the BTC market will carry out within the quick time period. Trade specialists like Anthony Scaramucci and Mark Plamer emphasised that the market is in an early bullish cycle, persevering with after the halving, driving the most important cryptocurrency to over $150,000.

Nevertheless, not all buyers share the identical sentiment. Earlier at this time, a survey launched by Deutsche Financial institution confirmed that 30% of its buyers see Bitcoin dipping beneath $20,000 by the tip of this yr.

[ad_2]

Source link