[ad_1]

- Bitcoin and Ethereum showcased a bullish market construction on the 12-hour chart.

- Key retracement ranges have been defended to this point, however a retest can’t be dominated out but.

Bitcoin [BTC] and Ethereum [ETH] continued to commerce throughout the short-term vary. They’ve a bullish bias on the upper timeframe value charts, and whales had been accumulating each belongings at a speedy tempo.

A latest AMBCrypto report highlighted that this accumulation might proceed for some extra time. Bitcoin has excessive quantities of liquidity shut by, which might hinder makes an attempt to interrupt out in both path.

Bitcoin noticed stalled momentum and shopping for stress

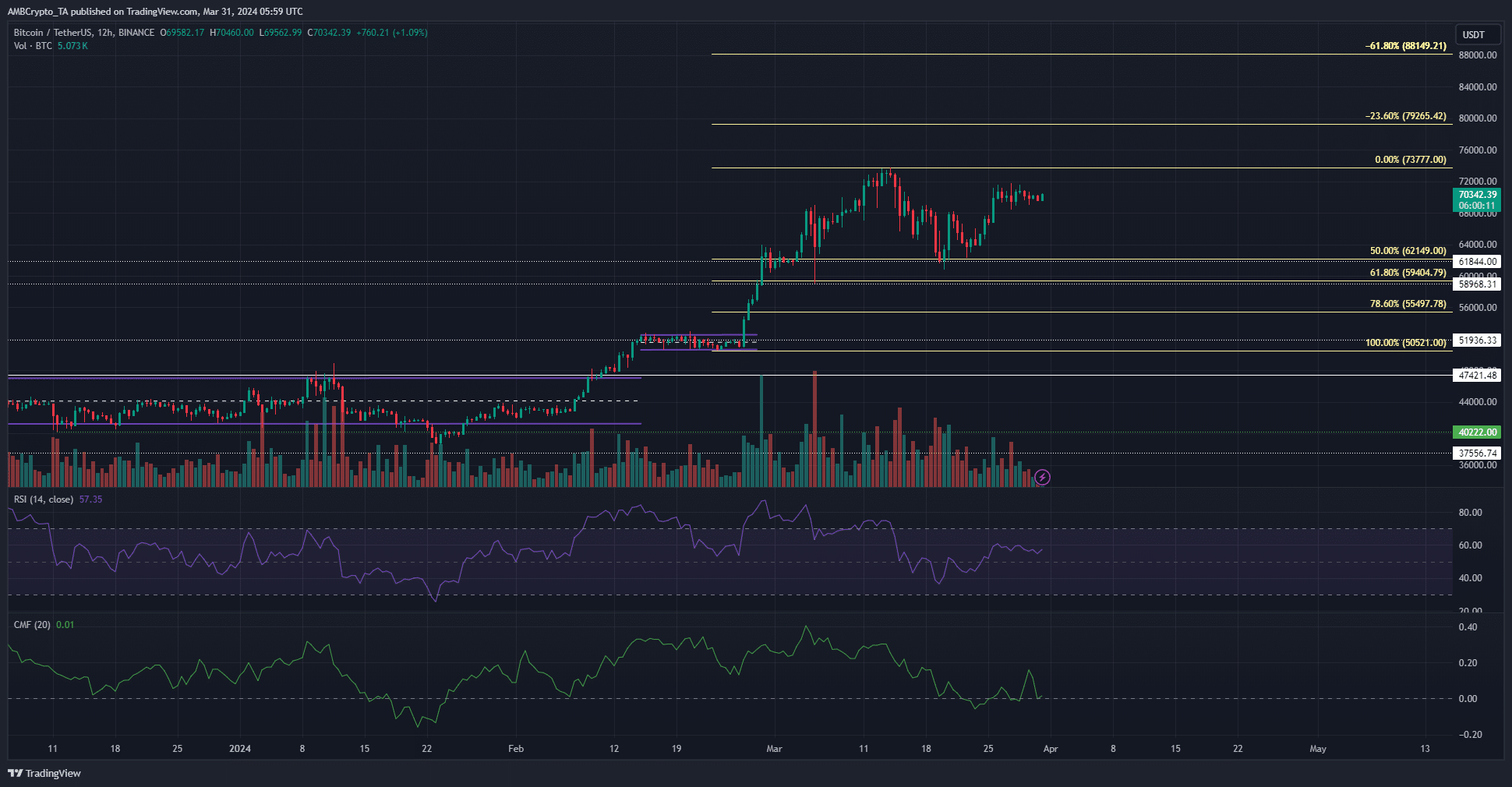

The Fibonacci retracement ranges plotted for the rally from $50.5k to $73.7k confirmed that the 50% retracement degree was examined as help in mid-March.

It noticed an honest response and Bitcoin was buying and selling at $50k at press time.

But, the RSI on the 12-hour chart was solely at 57, which signaled bullish momentum however not notable power.

The Chaikin Cash Stream was at +0.01 and would wish to climb above +0.05 to point out vital capital influx.

The market construction on the 12-hour chart was bullish. A BTC that falls under $60.7 would flip the market construction bearishly.

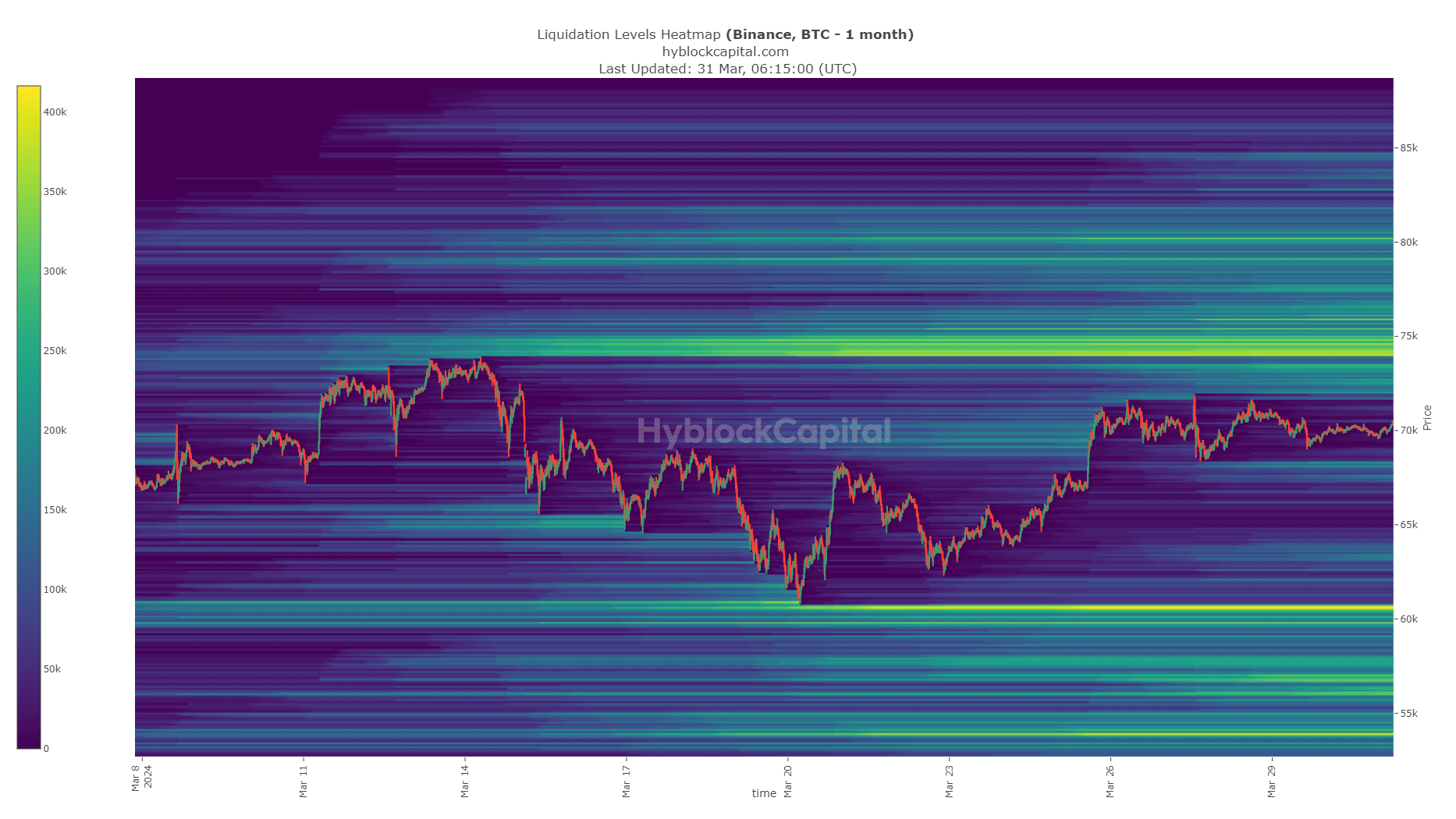

Supply: Hyblock

The liquidation ranges heatmap confirmed a major focus within the $74k-$74.8k zone. To the south, the $60k-$60.7k additionally has an intense variety of liquidation ranges.

Nearer to present costs, the band of liquidity at $68.2k was additionally anticipated to play a task.

A transfer above $72k is a trigger for celebration for Bitcoin bulls, however anticipate a number of tries earlier than costs break previous the $75k area.

Ethereum climbs to the LTF resistance — will it get away quickly?

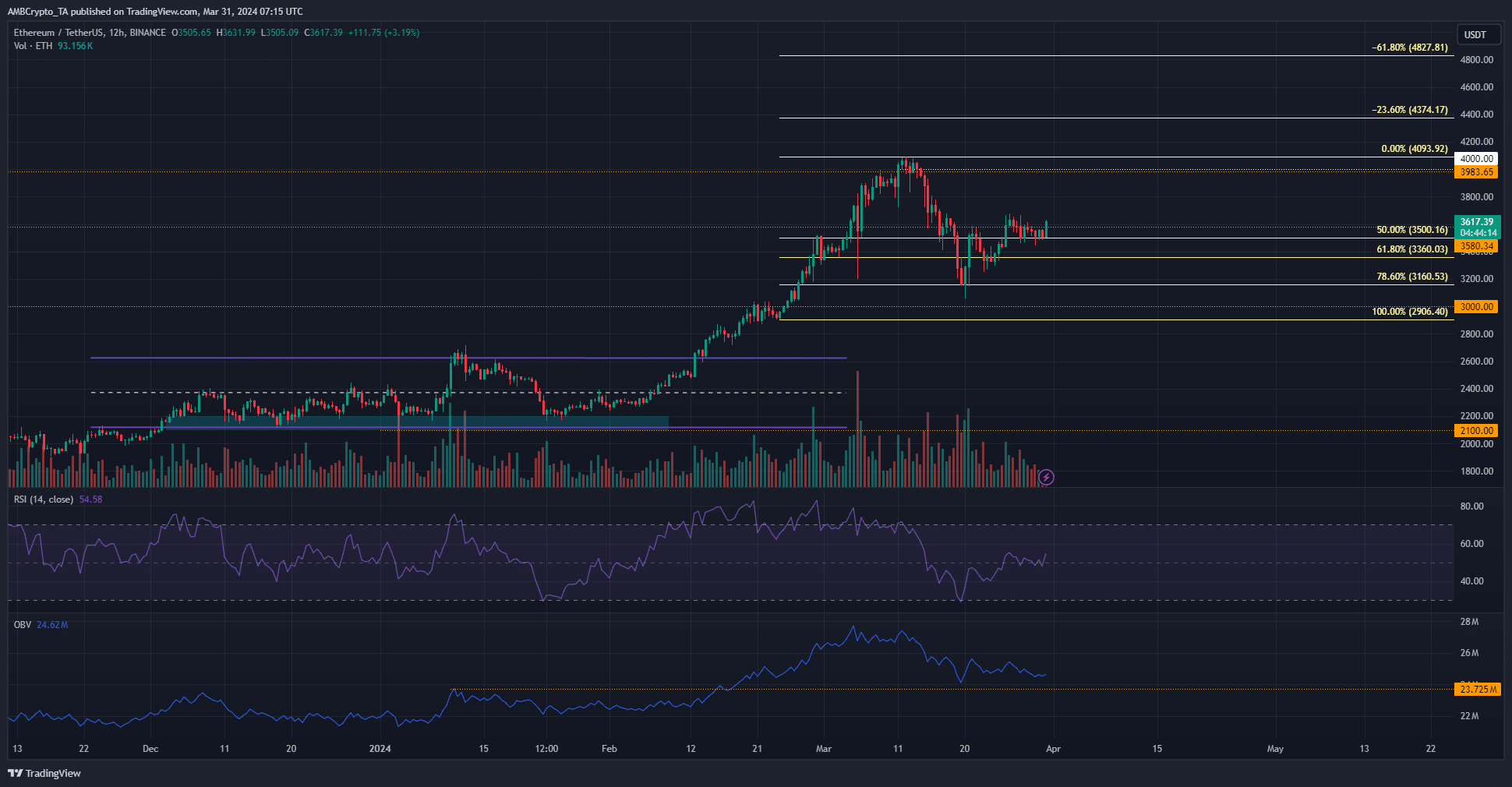

Ethereum additionally noticed its momentum stall out over the previous two weeks. Its 12-hour RSI confirmed a studying of 54, which signaled bullishness.

Its market construction was additionally bullish, and the 78.6% retracement degree noticed a very good response from the consumers.

Nonetheless, regardless of the shopping for quantity prior to now ten days, the OBV couldn’t embark on an uptrend. It has sunk nearly as little as the January highs, though the value of ETH is near 40% greater.

This lack of demand meant Ethereum bulls might take time to catch their breath earlier than making an attempt the subsequent rally. At press time, it confronted some short-term resistance at $3680.

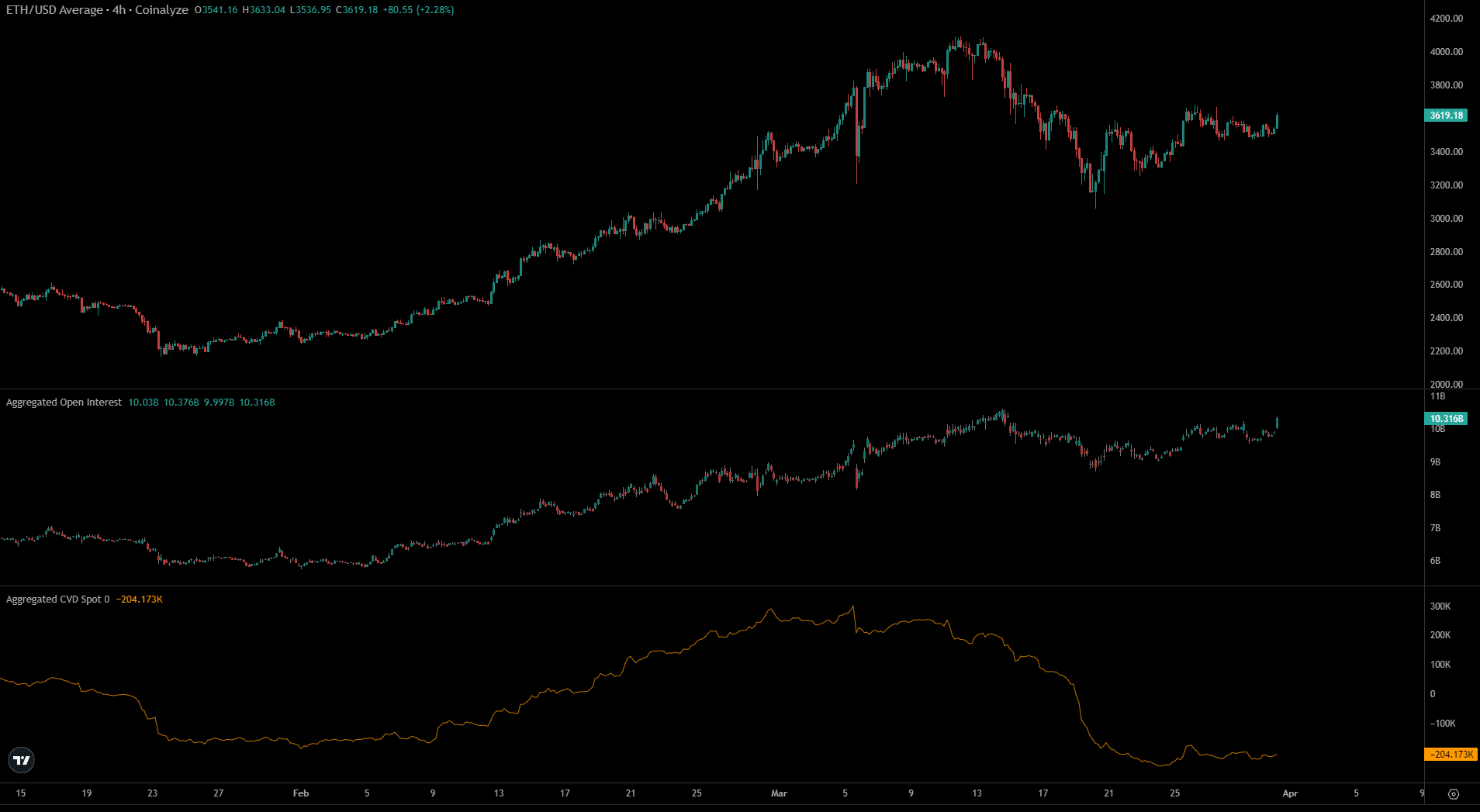

Supply: Coinalyze

Coinalyze metrics famous the steep promoting stress within the spot markets in March. The spot CVD trended downward this month and solely just lately flattened out from the southward spiral.

Is your portfolio inexperienced? Take a look at the BTC Profit Calculator

The Open Curiosity has climbed significantly from the seventeenth of March. It has risen from $9 billion to $10.31 billion, whereas Ethereum jumped from $3.2k to $3.6k.

This outlined some bullish conviction amongst speculators within the Futures market.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.

[ad_2]

Source link