[ad_1]

- Peter Schiff opined that Bitcoin’s worth may not acquire from the occasion.

- Regardless of its excessive worth, an vital metric revealed that purchasing BTC would possibly stay worthwhile.

Outspoken Bitcoin [BTC] skeptic Peter Schiff has come out with one other prediction, saying that the coin’s provide wouldn’t be minimize in half by the halving.

Schiff posted this on X (previously Twitter) on the twelfth of March, highlighting his causes.

In keeping with him, 90% of the whole Bitcoin provide already exists. Subsequently, the one factor left to chop is the provision development, not Bitcoin’s.

Schiff’s speculation doesn’t maintain water

If we had been to go by the economist’s opinion, then it may very well be troublesome for the worth of BTC to expertise exponential growth after the halving.

This was not the primary time that Schiff had criticized the coin. However regardless of his vocal skepticism, Bitcoin has continued to defy his forecast.

This yr, the value of the coin has elevated by an unbelievable 64.90% whereas tapping new all-time highs.

Concerning the halving which might most certainly occur in April, miners will get 3.125 BTC as reward. Traditionally, Bitcoin’s worth has surged to superb heights after the halving.

However this time, it has been completely different because the coin hit a brand new excessive earlier than the occasion.

Nevertheless, that doesn’t take away the opportunity of additional development. For example, the primary halving in 2021 noticed BTC leap to $126 from 12. The 2016 and 2020 halving additionally created astronomical values for the coin.

For AMBCrypto, opinion and historical past alone don’t transfer markets. Subsequently, we thought of it essential to judge the state of Bitcoin on-chain.

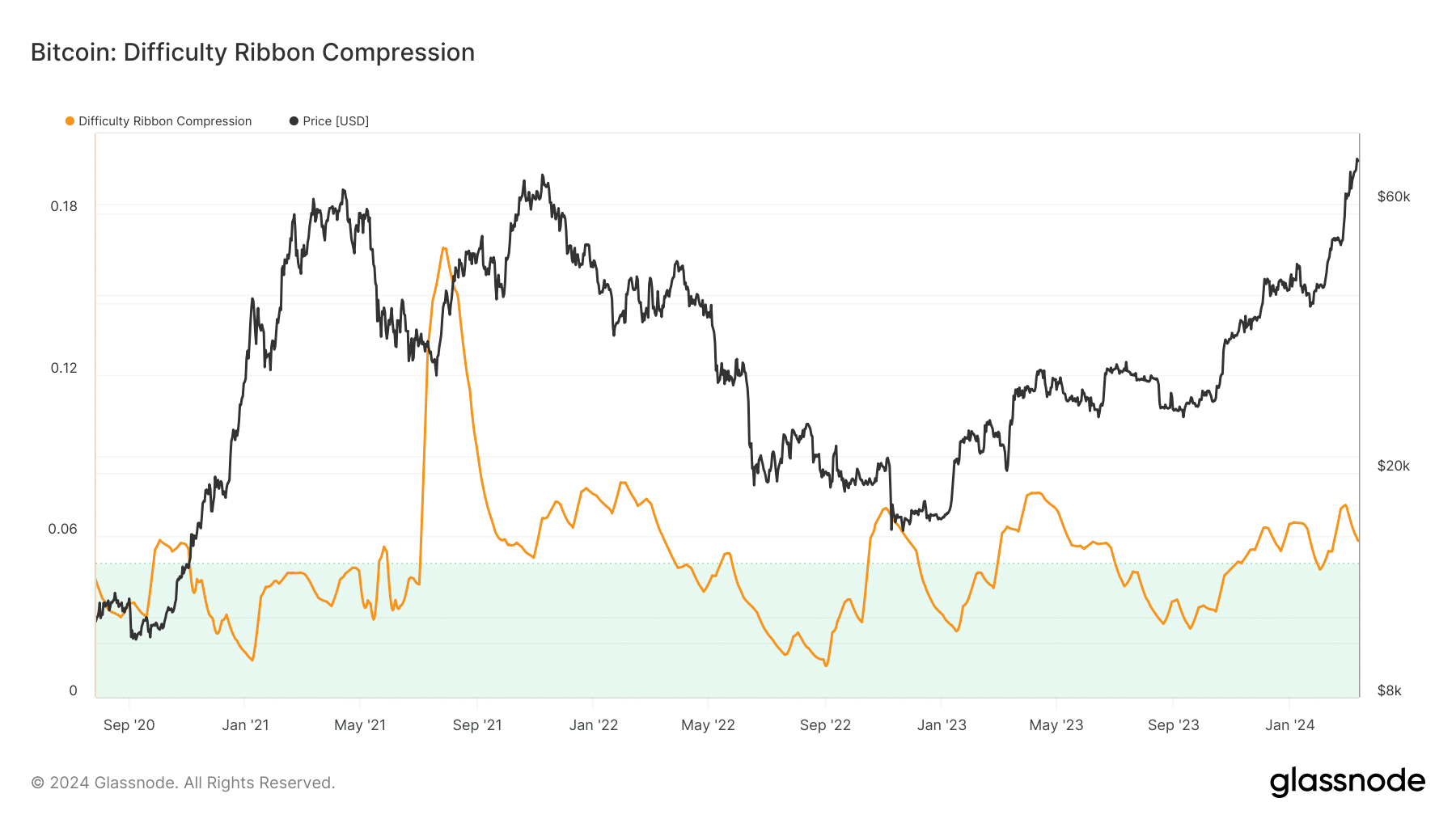

One metric we checked out was the Issue Ribbon Compression.

For these uninitiated, the Issue Ribbon Compression quantifies zones of excessive and low compression which may also help in spotting shopping for and promoting alternatives.

With a compression threshold of 0.05, the metric advised that Bitcoin at $72,864 stays a very good shopping for alternative.

If this metric had been to flash a promote sign, then the studying would have been between $0.10 and $0.16 prefer it was in This fall 2021.

Inflation declines, hype returns

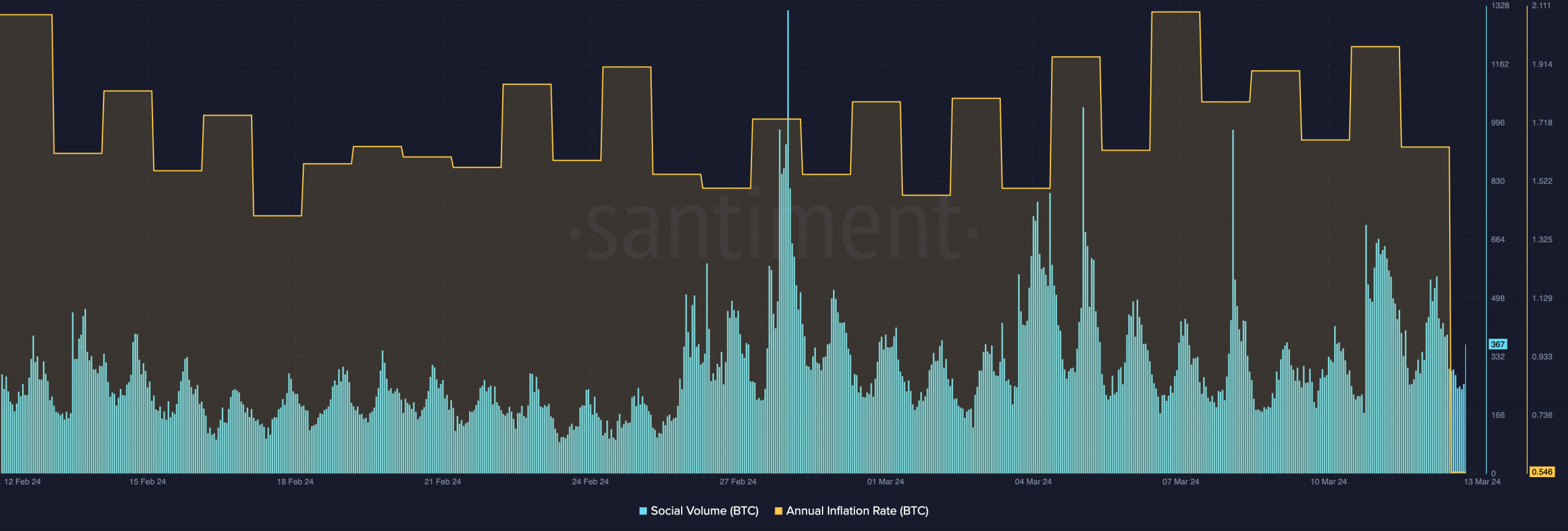

One other metric we checked out was the annual inflation price. In keeping with information from Santiment, AMBCrypto observed that Bitcoin’s annual inflation price had dropped to 0.54.

If the inflation price continues to drop because the halving approaches, features for Bitcoin would possibly speed up inside months. Moreover, consideration within the coin’s path has been rising, as proven by the social quantity.

At a studying of 367, the surge in social quantity implies that mentions of the coin throughout completely different social channels have elevated.

If this metric continues to extend, then demand for BTC may also observe.

How a lot are 1,10,100 BTCs worth today?

Ought to this be the case, Schiff’s opinion would possibly maintain no water and the value of Bitcoin might rise within the six-figure path.

Nevertheless, merchants must be watchful about their optimism as a correction might occur within the course of.

[ad_2]

Source link