[ad_1]

Solana recorded about $15B in DEX quantity up to now seven days, translating to a +153% weekly change.

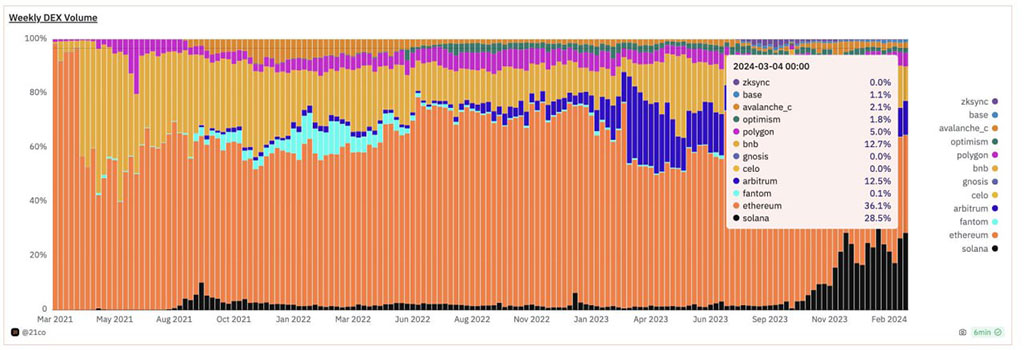

Solana’s (SOL) nickname, “Ethereum Killer”, is coming nearer to actuality, particularly on the DEX (decentralized alternate) quantity surge. On the weekly chart, Solana commanded 28.5% of complete DEX volumes, as Ethereum (ETH) dominated at 36.1%. BNB Chain and Arbitrum adopted intently at round 12%.

Photograph: Dune Analytics

Solana has recorded spectacular development in DEX volumes as extra initiatives set store on the community. A yr in the past, the community accounted for 1.1% of the DEX market share in comparison with Ethereum’s +50% dominance, as famous by Tom Wan, an on-chain information and analysis strategist at 21Co (21Shares father or mother firm).

Solana’s Spectacular Development in DEX Quantity

Solana immediately owns 28.5% of the whole DEX Quantity whereas Ethereum owns 36.1%

1 Yr in the past, Solana solely had 1.1% marketshare and Ethereum had 50%-70%

Main DEXs on Solana like @orca_so, @RaydiumProtocol and @MeteoraAG additionally grown quite a bit in… pic.twitter.com/HEZFEce9gv— Tom Wan (@tomwanhh) March 6, 2024

Solana-based DEXs like Jupiter (JUP) have been a smash hit since its debut, attracting huge site visitors. Different high DEXs on Solana embody Orca, Raydium, and Phoenix, every driving +$1.5B buying and selling volumes up to now seven days, per DefiLlama information.

Solana recorded about $15B in DEX quantity up to now seven days, translating to a +153% weekly change. The highest DEXs surged triple digits based mostly on modifications in weekly volumes.

Photograph: DeFiLlama

Over the identical interval, Ethereum DEX quantity hit $20.7B, translating to round +55% weekly change. Prime DEXs on Ethereum, like Uniswap and Curve Finance, posted spectacular outcomes. However the weekly change for its main DEXs was double digits per DefiLlama data. This meant Solana’s weekly DEX quantity surged 3X in comparison with Ethereum’s.

How Solana’s DEX Development Impacts the Market

Put otherwise, Solana’s traction elevated within the DEX area and appears to have eaten a part of Ethereum’s market share. The community was developed to handle Ethereum’s scalability and pace points.

Solana’s decrease charges and quicker transactions have attracted extra customers and initiatives. The traction can be a magnet for extra traders.

Nevertheless, the surge in quantity on Solana tends to have an effect on it too. As an illustration, on March 6, the Binance Trade opted for intermittent suspension of withdrawals on Solana, citing a spike in transaction volumes on the community.

Within the meantime, Ethereum is gearing towards vital upgrades to handle scalability, pace, and price points. It stays to be seen if the upgrades will give it extra leverage on the DEX quantity in opposition to Solana.

[ad_2]

Source link