[ad_1]

Yesterday, when Coinbase confronted outage, the inventory worth stage dropped from $205 to $195, inflicting a downfall of roughly 5%.

Coinbase has discovered itself on the middle of a number of controversies these days. An enormous $1 billion Bitcoin withdrawal, a big outage affecting customers, and a glitch erasing $100 billion in Bitcoin wealth.

The Billion-Greenback Exodus

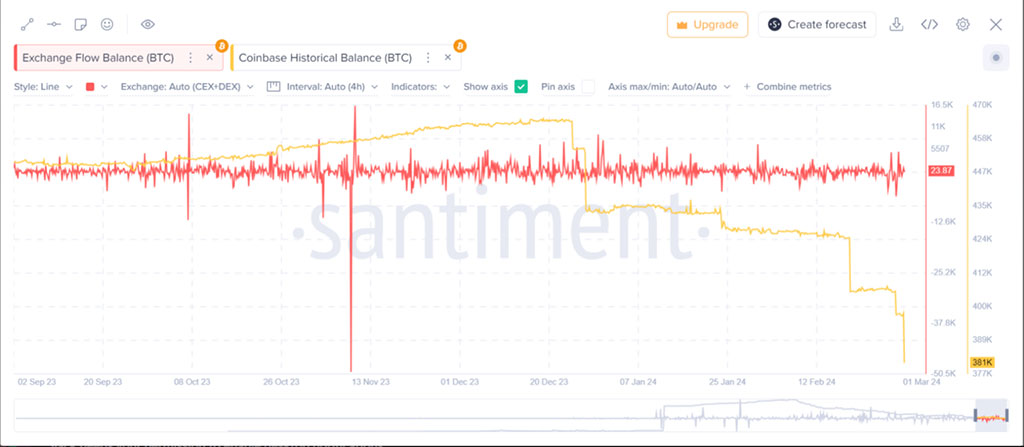

Photograph: Santiment

Just lately, Coinbase skilled a large outflow of Bitcoin, with roughly 16,000 BTC, valued at roughly $1 billion, being withdrawn in a single transaction. This occasion marked some of the important withdrawals the platform has ever witnessed. Confirmations from numerous analytics platforms, together with Santiment, Arkham Intelligence, and Coinglass, validated the large drop in Coinbase’s Bitcoin holdings.

This withdrawal occurred amidst a Bitcoin bull run, with the cryptocurrency’s worth hovering properly above $60,000, indicating a attainable shift in investor sentiment or a strategic transfer by a big participant out there.

Outage amidst a Surge

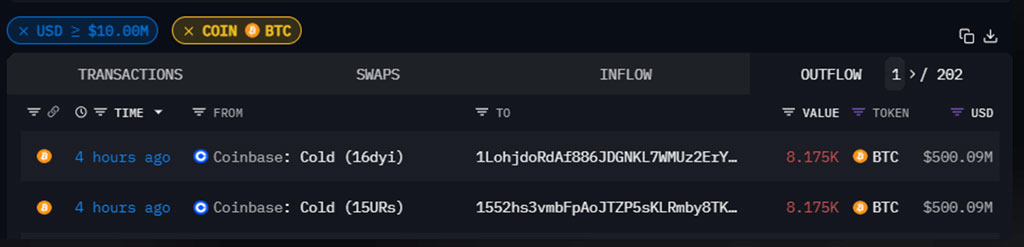

Compounding the drama, Coinbase suffered a big outage that left some customers unable to entry their accounts, witnessing zero balances, and dealing with points with shopping for or promoting. The outage, attributed to an unprecedented surge in visitors as Bitcoin climbed above the $63,000 mark, highlighted the platform’s vulnerabilities. Brian Armstrong, Coinbase’s co-founder and CEO, admitted the platform was examined past its limits, with visitors surges exceeding ten instances the anticipated quantity.

Photograph: Brian Armstrong / X

The $100 Billion Glitch

Photograph: TradingView

Including to the turmoil, a glitch on Coinbase worn out an estimated $100 billion in Bitcoin wealth in underneath 60 minutes. The glitch led to a panic amongst merchants as they noticed their balances drop to zero, inflicting Bitcoin’s worth to plummet from $64,300 to $59,461. Though Coinbase assured its customers that their property had been secure and the account stability show points had been restored, the speedy loss in market cap and the non permanent prevention of Bitcoin from breaking its 2021 all-time excessive left an enduring influence on investor confidence.

Affect on Coinbase (COIN) Inventory

Photograph: TradingView

This chart depicts the 15-minute worth motion for Coinbase Global Inc (NASDAQ: COIN) on March 1st, with information factors on the shut of every 15-minute interval. The chart contains 4 Exponential Transferring Averages (EMAs) with durations of 20 (crimson line), 50 (orange line), 100 (blue line), and 200 (brown line). These EMAs function indicators of short-, medium-, and long-term developments and potential help or resistance ranges.

Yesterday, when the change confronted outage, the inventory worth stage dropped from $205 to $195, inflicting a downfall of roughly 5%. On the time of the final information level, 08:45 UTC+5:30, the inventory was buying and selling at $202.71, barely down by 0.29%. The inventory opened the session above the 200 EMA, indicating a bullish sign. Nevertheless, all through the buying and selling interval, the inventory worth oscillated across the EMAs, suggesting an absence of clear directional momentum, as mirrored by the crossover of the 20 and 50 EMAs.

The Relative Energy Index (RSI), which measures the magnitude of latest worth adjustments to guage overbought or oversold circumstances, is at 51.46. This worth is near the mid-line of fifty, suggesting that the inventory is neither overbought nor oversold within the concise time period.

The general buying and selling sample exhibits some volatility with a number of crosses over the EMA traces. Nonetheless, the proximity of the inventory worth to the EMAs suggests a consolidating market. The RSI is close to 50 reinforces this view, indicating that merchants could be awaiting additional alerts earlier than committing to a transparent bullish, or bearish stance.

[ad_2]

Source link