[ad_1]

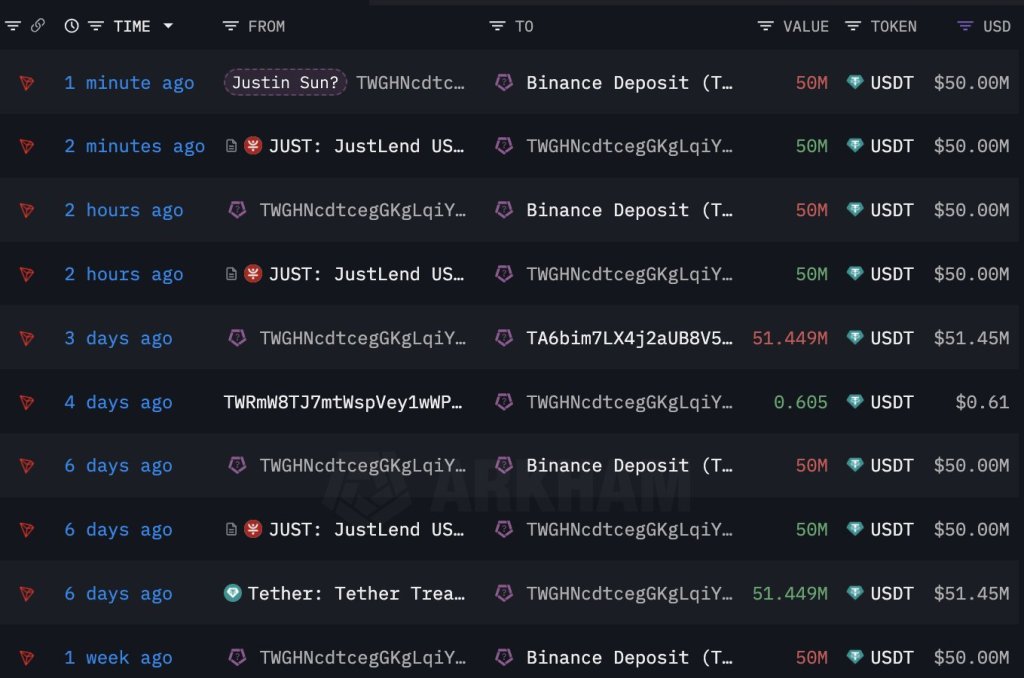

Justin Solar, the co-founder of Tron–a sensible contracting platform for deploying decentralized functions (dapps), is as soon as once more transferring and shuffling hundreds of thousands of {dollars}. Based on Lookonchain data on February 29, Solar reportedly transferred 100 million USDT to Binance, days after transferring enormous sums earlier this week.

Justin Solar Holds Tens of millions Of ETH: Will The Co-founder Purchase Extra?

From February 12 to 24, a pockets related to Solar acquired 168,369 ETH for a median worth of $2,894. This buy, valued at roughly $580.5 million, at present holds an unrealized revenue of round $95 million. Profitability might enhance contemplating the sharp demand for crypto, particularly high cash like Bitcoin and Ethereum, in current days.

The Ethereum worth chart exhibits that ETH has been on a transparent uptrend, rising from round $2,200 in early February to over $3,450 when writing. At this tempo, and contemplating the institutional curiosity in potent crypto property, together with ETH, the chances of the second most useful coin stretching positive aspects shall be extremely probably.

As Bitcoin inches nearer to $70,000, the likelihood of Ethereum additionally monitoring increased towards its all-time excessive of round $5,000 shall be elevated.

Since ETH already owns an enormous stash of cash, there’s hypothesis that the co-founder will double down, shopping for much more cash. The crypto group will proceed watching the deal with till this occurs and there’s strong on-chain knowledge to help the acquisition.

Spot Ethereum ETFs And The Dencun Improve Are Key Updates

To this point, optimism is excessive, particularly among the many broader altcoin group. As Bitcoin races to register new all-time highs pumped by institutional billions, eyes shall be on america Securities and Trade Fee (SEC). There are a number of functions for a spot Ethereum exchange-traded fund (ETF).

The company has not supplied a definitive timeline for approving or rejecting the spinoff product. There’s regulatory uncertainty across the standing of ETH, a major headwind which may delay and even stop the well timed authorization of this product.

Nonetheless, the group is wanting ahead to the following communication in Could. If the spot Ethereum ETF is a go, the coin will probably rally to new all-time highs, following Bitcoin.

Nevertheless, earlier than then, eyes are on the anticipated implementation of Dencun. The improve addresses challenges dealing with Ethereum, together with scalability. By Dencun, Ethereum builders hope to put the bottom for additional throughput enhancements within the coming years.

With increased throughput, transaction charges drop, overly enhancing consumer expertise. This improve may go a great distance in cementing Ethereum’s position in crypto, wading off stiff competitors from Solana and others, together with the BNB Chain.

Function picture from DALLE, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site completely at your personal danger.

[ad_2]

Source link