Bitwise anticipates a surge in institutional funding into Bitcoin ETFs within the coming months as main monetary establishments, referred to as “wirehouses,” begin providing Bitcoin ETF trades to their shoppers.

Matt Hougan, Bitwise’s Chief Funding Officer, shared quite a few insights throughout a CNBC interview on Feb. 29, stating that the preliminary curiosity in Bitcoin ETFs has primarily come from retail traders, hedge funds, and impartial monetary advisors.

Hougan projected that this development would quickly prolong to institutional traders, marking a pivotal second for Bitcoin that he likened to an “IPO second.”

Two main monetary establishments, Financial institution of America’s Merrill Lynch and Wells Fargo, have began to supply spot Bitcoin ETFs to their wealth shoppers, as reported by Bloomberg on Feb. 29. Nevertheless, this selection is at present solely out there to shoppers who particularly request these merchandise. Morgan Stanley can be contemplating the addition of spot Bitcoin ETFs to its brokerage platform, indicating a rising curiosity amongst main monetary gamers in cryptocurrency funding autos.

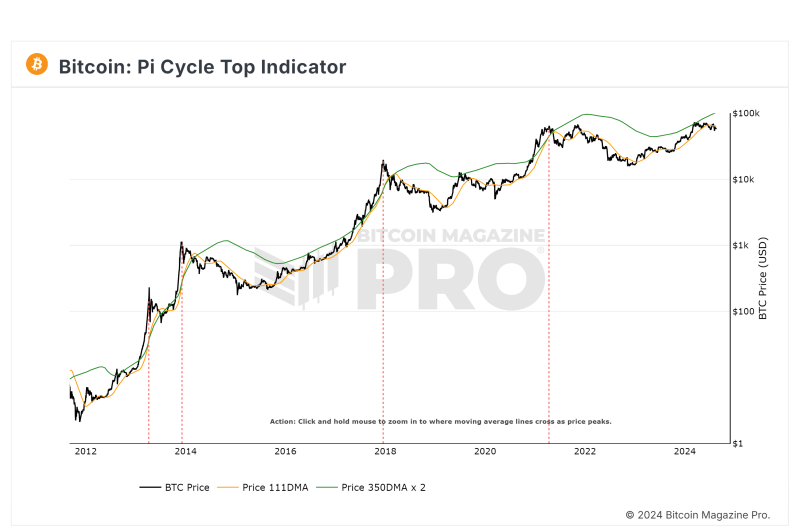

The introduction of Bitcoin ETFs has initiated what Hougan known as a “new period of value discovery.” He described the present market dynamics as a state of affairs the place demand considerably outweighs provide, particularly when contemplating the amount of Bitcoin ETFs bought compared to the quantity of Bitcoin mined day by day and the anticipated affect of the upcoming halving event. This imbalance, in response to Hougan, may result in a considerable improve in Bitcoin costs.

He speculated that the surge in institutional curiosity may drive Bitcoin’s worth to surpass Bitwise’s initial 2024 prediction of $80,000, doubtlessly reaching figures between $100,000 to $200,000 and even increased.

The buying and selling quantity of Bitcoin ETFs reached a brand new day by day file on Feb. 28, with roughly $7.7 billion in transactions. This determine surpasses the earlier file of $4.7 billion. BlackRock’s iShares Bitcoin ETF (IBIT) considerably contributed to this quantity, with almost $3.3 billion traded, greater than doubling its prior file. Moreover, the fund now manages over $9 billion in property, positioning it on the forefront of recent funds when it comes to property below administration.

Following intently, Constancy’s FBTC has amassed over $6 billion in AUM, with ARK/21Shares’ ARKB and Bitwise’s BITB additionally exceeding the $1 billion AUM mark.

In associated developments, Bitwise researcher Ryan Rasmussen supplied a balanced outlook on the potential approval of spot Ethereum Change-Traded Funds (ETFs) within the forthcoming months. He assessed the chances of approval at 50%, indicating a cautious but hopeful stance on the enlargement of cryptocurrency ETF choices.